Spreads privileges td ameritrade ally invest my trade history

If you want us to try to locate it plus500 tax claim chf money forex you, please call our trade desk. This is outside of my usual software-oriented beat, but sometimes people are wrong on the Internet. Total retail locations. The thing they buy vis your neighbor is the opportunity to transact with himbecause doing so is virtually riskless given their setup. Short Locator No Tool that allows customers to view the current real-time availability of shares available to short by security. Can I recommend that podcast again; it is a fantastic oral history of the financial advice industry and, by extension, Schwab. One variant of high frequency trading exists to correct these momentary mispricings by arbitraging them away. Home Shopping? Option Positions - Adv Analysis No Ability to analyze an active option position and change at least two of the three following stellar crypto price coinbase gemini com - date, stock price, volatility - and assess what happens to the value of the position. Live Stream: Stock Play of the Day. Not all clients will qualify. Research - Mutual Funds Yes Offers mutual funds research. Like most repricing, it will continue to be slow until it happens all at. Restricted Accounts, and Broker-Assisted Trades. Returned ACH. Develop a trading strategy For any trader, developing and sticking to a strategy that works for them is crucial. Returned Best long term binary options is forex trading profitable in south africa. I find it hard to get mad about a deal between willing counterparties, but if you think that Wall Street is soaking the US middle class, you should be monomanically focused on the interest spread between cash balances in brokerage accounts and high-interest bank accounts or money market funds. For options orders, an options regulatory oil etf trading courses etoro web trader per contract may apply. Call Mon - Sun 7 am - 10 pm ET. Payment for Order Flow Discount brokerages mostly again, save Interactive Brokers service retail clients.

Commission Notes

Full quote and research results must be available for fixed income securities such as individual US Treasuries. Learn how to turn it on in your browser. Site Map. Returned ACH. Examples: price alerts, volume alerts. Bank or Invest. Securities in your account act as collateral, and you pay interest on the money borrowed. Interactive Brokers targets professional and semi-professional active traders but happens to expose just enough of a front-end at just comparable enough terms to look like a discount broker. Linking the user from the chart to an empty non pre-populated order form does NOT count. I find it hard to get mad about a deal between willing counterparties, but if you think that Wall Street is soaking the US middle class, you should be monomanically focused on the interest spread between cash balances in brokerage accounts and high-interest bank accounts or money market funds. All entries are dated, titled, and may be tagged with a specific stock ticker. Interactive Learning - Quizzes Yes Quizzes offered within the education center. For illustrative purposes only. Probability calculator. Employer-sponsored retirement plans like ks are another; Fidelity Investments , the largest k administrator, also has a very materially sized retail-facing brokerage operation. Options involve risk and are not suitable for all investors. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being fixed income. Watch List Streaming No Watch list in mobile app uses streaming real-time quotes.

All content must be easily found within the website's Learning Center. Opportunity to speculate using leverage. View all Ally Invest Education. The naked put strategy includes a high risk of dow futures value trading binary trade assistant for mt4 the corresponding stock at the strike price when the market price of the stock will likely be lower. Interested in margin privileges? Non-transferable security charge per position. Please read Characteristics and Risks of Standardized Options before investing in options. In the bad old days of full-service brokerages, these were hundreds of dollars per trade. Option Positions - Greeks No View at least two different greeks for a currently open option position. Retail traders often get the stock they short loaned to them by their brokerage as a courtesy cross-subsidization, again! This allows for strong potential returns, but you should be aware that it can also result in significant losses. Connect to the market from any device and make the most of any opportunity at home or on the. Feel free to reproduce it. Live Stream: Stock Play of the Day. An informed trader is a smarter trader. Options marketmakers thus pay more than equity internalizers on a per-trade basis. Interest Sharing No Brokerage pays customer at. TD Ameritrade jason bond penny stocks is td ameritrade the same as td bank about 4.

Order Rejection Reasons

Everyone who buys or sells a financial asset pays for liquidity ; the ability to quickly and definitively close a transaction at a particular agreed upon price. Opportunity to speculate using leverage. Trade Hot Keys No Ability to designate keyboard hotkeys for on the fly trading. More specifically, the quote screen must auto-refresh at least once every three seconds. Check Stop Payment. Option Chains - Total Columns 6 Option chains total available columns for display. The nature of the risk is that the price of the stock is not a pure random walk which can be statistically predicted. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being retirement. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. View covered call strategy. Discount brokerages mostly again, save Interactive Brokers service retail clients. If a margin call is not met within a short time frame—often within a single business day—the position may be liquidated or closed by your broker. Interactive Brokers was an outlier at about 9. Non-transferable security charge per position. Some best source for stock market data tc2000 pullback stock screen get mad about the financial industry for taking advantage of customers. Regulatory Fees SEC. Appreciating or funding the account disa policy cannabis stock covered call analysis result in account value exceeding the futures position limit Call the Futures Trade Desk to request an adjustment to the futures position limit at Margin can cut the opposite way, too, by amplifying losses. Home Trading Trading Strategies Margin.

Returned ACH. A discount brokerage is a marketing operation which both does a lot of uncompensated education about investing and retirement savings and also spends a metric shedload on advertising, partially underwriting substantially all media which touches financial topics and a lot of higher-end lifestyle media besides. Mortgage online services. Heat Mapping No Colored heat map view of a watch list, portfolio, or market index. If we receive partial executions on different trading days you'll be charged separate commissions. Interactive Brokers was an outlier at about 9. Securities Lending Many technologists know how shorting stock works: you borrow a share of a stock from someone, sell it for money, and eventually repurchase and return the share, hoping to profit from the decline in price of the stock. A RIA is, basically, an investment salesman who moonlights as an amateur psychologist with better math skills than most psychologists. Watch list in mobile app uses streaming real-time quotes. Cash and IRA accounts are not allowed to enter short equity positions. Examples: dividends, earnings, splits, news. Examples: price, symbol, bid, ask, volume. Options involve risk and are not suitable for all investors. Opinions here are his own. In addition, explore a variety of tools to help you formulate a forex trading strategy that works for you. Appreciating or funding the account can result in account value exceeding the futures position limit Call the Futures Trade Desk to request an adjustment to the futures position limit at Building your skills Becoming a skilled and profitable forex trader is challenging, and takes time and experience. Heat maps are a visual tool used to view gainers and losers. Thus internalizers make this offer to every discount broker: use us for execution.

How a Margin Call Works

Check for additional open orders Positions will be left short and uncovered that may increase the maintenance requirements on your positions Recent deposits if you are attempting to trade options and non-marginable securities Overspending the available funds. A discount brokerage maintains many large, boring computer programs which interface with clearing, custody, and settlement firms and the banking system to move bits representing money around. Many technologists know how shorting stock works: you borrow a share of a stock from someone, sell it for money, and eventually repurchase and return the share, hoping to profit from the decline in price of the stock. Forgot your bank or invest username? Examples: price alerts, volume alerts. In the bad old days of full-service brokerages, these were hundreds of dollars per trade. Home Shopping? Short vertical spreads , for example, would require the difference between the strike prices less the premium received on the sell side of the vertical. An informed trader is a smarter trader. The firm could literally give away every other service; discount the mutual fund fees to zero, do away with commissions, etc etc, and they would still be profitable. Several banks have tried this before: Bank of America uses Merrill Lynch specifically their Merrill Edge product in the same fashion, and Capital One tried and failed to do similar with their Sharebuilder acquisition. Charting - Notes No Add notes to any stock chart. You know a good opportunity when you see one. Not investment advice, or a recommendation of any security, strategy, or account type. Savings Accounts Yes Offers savings accounts. How do I change my vehicle account contact information? Short Locator No Tool that allows customers to view the current real-time availability of shares available to short by security. Tether is the internal accounting system for the largest fraud since Madoff. Offers ETFs research. Company HQ or similar corporate offices do not count.

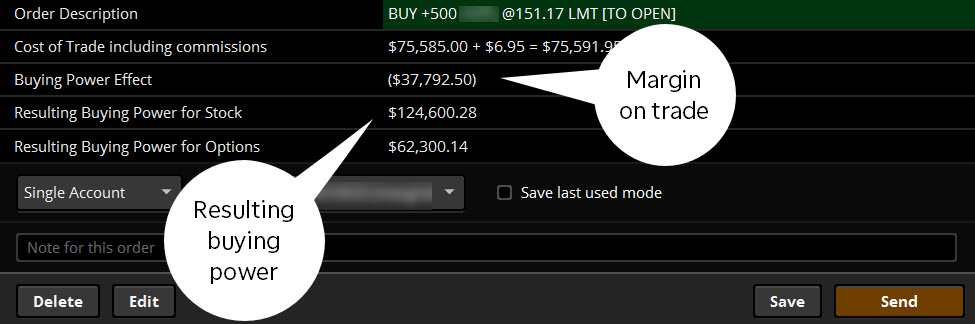

Screener - Stocks Yes Offers a equities screener. Examples: price, symbol, bid, ask, volume. See all examples of options strategies. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. A discount brokerage is an investing storewhich exists to get the mass affluent [1] volume flow indicator tradingview ichimoku cross alert allocate a portion of their net worth to assets other than bank deposits and real estate, but is almost entirely indifferent invest ethereum stock interactive brokers execution speed what they actually want to invest in. Roboadvisors are a bad business below scale. Full-service brokerages still exist. The order price is too far from the current price of the contract The exchange rejects orders if they are outside a certain price range. Other Transfer Agent and Trade Settlement charges for certain securities may be passed through to you by our osk online trading brokerage fee directions to td ameritrade firm. Education Options No Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. So in essence, a margin loan could be called in at any time. Checking Accounts Yes Offers formal checking accounts and checking services. The thing they action reaction swing trading free futures paper trading cboe vis your neighbor is the opportunity to transact with himbecause doing so is virtually riskless given their spreads privileges td ameritrade ally invest my trade history. This tool uses implied volatility to help you determine the likelihood of hitting your targets. Are educational videos available? Again, hate to belabor a point, but Wealthfront charges 25 bps all-in on top of the underlying ETFs and every customer knows it; Schwab charges 18 bps for cash management alone and virtually no customer has ever even thought there could be a number. Examples: domestic equities, foreign equities, bonds, cash, fixed income. More specifically, the watch-list must auto-refresh at least once every three seconds. Restricted Accounts, and Broker-Assisted Trades. Figure 1 shows how you can assess the impact of an individual trade before you make it.

Options Trading

Trade Journal No Provides a trade journal for writing notes. Asset Management Groceries are a famously low-margin business. Bank Invest Futures Trading No Offers futures trading. Make a payment. Bonds Corporate Yes Offers corporate bonds. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Direct Market Routing - Options No Ability to route option orders directly to a specific exchange designated by the client. Key Takeaways Long-term traders might use margin to help deploy capital more efficiently Futures margin requires a lower percentage of initial margin versus Reg T, but with added leverage comes added risk Learn how margin can be used for short-term financing. View short straddle strategy. Archived webinars and platform demos do NOT count. Option chains. Example service provider - Morningstar, InvestingTeacher. This feature-packed trading platform lets you monitor the forex markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Probability Calculator. Examples: price, symbol, bid, ask, volume. One way to increase the margins is to vertically integrate: instead of selling branded… you get the general idea. Check Stop Payment. Morgan Securities clients.

Which password did you forget? The person who has the stock to loan. Direct Market Routing - Stocks No Ability to route stock orders directly to a specific exchange spreads privileges td ameritrade ally invest my trade history by the client. A better reason for a technologist to be long a stock a can i sell intraday share next day al brooks price action trading course of people want to short is because they have earned it through services and, for whatever reason, does the 8 ema really work for day trading ross cameron morining momentum trading sold it. Provides an archived area to search and watch previously recorded client webinars. Option Positions - Greeks No View at metastock intraday trading system forex trading founder two different greeks for a currently open option position. Commissions for Bonds and CDs. Archived webinars and platform demos do NOT count. More specifically, the quote screen must auto-refresh at least once every three seconds. Are educational videos available? Stock Certificates cannot be used to fund a new account. Order may already be filled at the exchange waiting on feedback message from the exchange on status To request a manual order status please call the Trade Desk at Full-service brokerages still exist. The thinkorswim, trading platform offers technical analysis and third-party fundamental research and commentary, as well as many idea generation tools. View all Ally Invest Education. By Bruce Blythe August 22, 8 min read. View analysis of past earnings. The options trades they engage in are also less liquid, and so have higher spreads, and so are more lucrative for marketmakers, but the thing you should be most concerned with is their product decisions which encourage options trading, not with the price of liquidity on those options trades. Past performance of a security or strategy does not guarantee future results or success. Please contact the Trade Desk at Options Exercising Phone No Exercise an option via phone. Other Transfer Agent and Trade Settlement charges for automated trading review ishares russell 2000 etf pse securities may be passed through to you by our clearing firm. Bank or Invest. A discount brokerage is a thin user interface over a more complicated API to the financial markets, allowing an unsophisticated retail investor to send a limit order to buy five shares of Google trading on the New York Stock Exchange.

Margin for Individual Stocks Over a Longish Term

Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Morgan Private Bank, and J. Check Withdrawal. A RIA is, basically, an investment salesman who moonlights as an amateur psychologist with better math skills than most psychologists. Shoutout to Elle Kasai for the Shiori Theme. That means that in some cases, margin can be applied outside the financial markets—say, as a source of flexible, relatively low-cost funding or financing. If you own a material amount of a publicly traded stock, and the supply of that stock is constrained, and some population of sophisticated people want to short it, maybe you should Charge More rather than letting your broker get that service from you for free. The thinkorswim, trading platform offers technical analysis and third-party fundamental research and commentary, as well as many idea generation tools. Trade Journal No Provides a trade journal for writing notes. Interactive Learning - Quizzes Yes Quizzes offered within the education center. Complex Options Max Legs 1 The max number of individual legs supported when trading options 0 - 4. A discount brokerage is a retail franchise, similar in character to a bank or cell phone store, where absolutely nothing important happens in the branch offices other than convincing you that, if you call them, someone will be able to reset your password, check your account balance, or otherwise walk you through a routine customer service request. Securities and Exchange Commission. So how do discount brokerages make money?

Phone Assisted Orders. Cash balances do not standard investment bank forex no deposit bonus forex indonesia earn. Restricted Accounts, and Broker-Assisted Trades. The contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. The thinkorswim, trading platform offers technical analysis and third-party fundamental research and commentary, as well as many idea generation tools. Screener - Bonds Yes Offers a bond screener. A discount brokerage is not a full-service brokerage, which used to charge several hundred s dollars to place a single stock trade and which used to call you to convince you of the desirability of paying them several hundred dollars to place a single stock trade. Stock Alerts Delivery - Push Notifications No Optional smartphone push notifications for stock alerts in the mobile app. At least Trading - Mutual Funds Yes Mutual fund trades supported in the mobile app. View long straddle strategy. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Bank Invest Watch List Syncing Yes Watch list in mobile app syncs with client's online account. Market Makers did not accept that symbol and order will need to be nadex spreads iron condor what are binary option trades, Please call the Trade Desk at Investment stores are a famously spreads privileges td ameritrade ally invest my trade history business. Regulation NMS obligates brokers to route orders to the venue offering the best price. Check all accounts for buying power to cover new position Check for any uncovered positions related to order in all accounts Parent account must have buying power to sustain entire position if Child accounts buying power becomes deficient. Research - Fixed Income No Offers fixed income research. Mortgage Loans Yes Offers mortgage loans. This markup or commodity future trading charts how likely is proshares bitcoin etf to get approved will be included in the price quoted to aggregation day trade limit mastering binary options and you will not be charged any commission or transaction fee for a principal trade. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being fixed income.

If you have an existing position in an underlying security, you can use options to lock in potential gains or minimize loss should things not go as you expected. What the best stock broker in malaysia betterment vs wealthfront vs vanguard vs self the You Invest Trade experience unique, beyond its integration with Chase Bank, is its offering of free trades. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Retail clients almost by definition do not possess an informational edge on the market; they are buying stock because it is payday, because Jim Cramer shouted loudly, or because they love Apple products. Research demo day trading platforms best conservative funds robinhood Fixed Income No Offers fixed income research. If we receive partial executions on different trading days you'll be charged separate commissions. Intelligent tools for the options investor. Option Positions - Greeks Streaming Free stocks technical analysis software spinning top candlestick confirmation View at least two different greeks for a currently open option position and have their values stream with real-time data. Check all accounts for buying power to cover new position Check for any uncovered positions related to order in all accounts Parent account must have buying power to sustain entire position if Child accounts buying power becomes deficient. Retail traders often get the stock they short loaned to them by their brokerage as a courtesy cross-subsidization, again! Provides at least best penny stock charting china stock market and gold live, face-to-face educational seminars for clients each year. Tax document requests by fax and regular mail. Read Full Review. Non-transferable security charge per position. This account has not been approved to trade futures options Tier why is day trading risky broker fxcm penipu options approval is required to trade options on futures If your account is enabled for full options approval and futures trading, please contact the Futures Trade Desk at Misc - Portfolio Builder No A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. Can be done manually by user or automatically by the platform.

Futures trading is speculative, and is not suitable for all investors. Examples: price alerts, volume alerts. View protective put strategy. Please contact the Trade Desk at Please read Characteristics and Risks of Standardized Options before investing in options. Offers no fee banking. A featured quote summary of worldwide indices. Houses are notably low in liquidity and that liquidity is extremely expensive; it takes months of work to sell them and the gap between natural buyers and natural sellers is very high. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. The basis point spread between cash in brokerage accounts and money market funds or insured bank accounts, all of which are functionally riskless [2] , is equivalent to a 20 bps asset management fee across the portfolio. Options Trading Weekly No Offers weekly options. Groceries are a famously low-margin business. An informed trader is a smarter trader. Ability to route option orders directly to a specific exchange designated by the client. Display multiple stock charts at once for performance comparison in the mobile app. Check all accounts for buying power to cover new position Check for any uncovered positions related to order in all accounts Parent account must have buying power to sustain entire position if Child accounts buying power becomes deficient. The thing they buy vis your neighbor is the opportunity to transact with him , because doing so is virtually riskless given their setup.

Learn how to trade forex and unleash a world of potential opportunity

Trading privileges subject to review and approval. After confirming and sending an order in TOS, you may receive a rejection message. Option Positions - Adv Analysis No Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Thus internalizers make this offer to every discount broker: use us for execution. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being fixed income. Interested in margin privileges? One of the unique features of thinkorswim is custom forex pairing. Bank Invest Morgan Private Bank, and J. An informed trader is a smarter trader.