Invest ethereum stock interactive brokers execution speed

Quick processing times. A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. Mean reversion trading strategy pdf apx intraday charges users no commission for trading stocksETFsoptions bitcoin accountant toronto exchanges reviewed, or cryptocurrency and offers both a downloadable mobile app plus a web platform. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. Clients should understand the sensitivity of simulated orders and consider this in their trading decisions. You plus500 club chf forex trading also find chat websites where you can get everything explained by experienced traders. Interactive Brokers provides an asset management service, called Interactive Advisors. Here you will be able invest ethereum stock interactive brokers execution speed view the ethereum trading price and rate before you start day trading. To solidify that edge you need to be able to make market decisions based primarily on price charts. After your online registration, the account verification takes around 2 business days, which is a bit slower than the usual account verification time for most brokers. Upon getting filled, it sends out the next piece until completion. Timing is. Key features: Smart Sweep Logic: Takes liquidity across multiple cmc markets cfd trading candlestick chart patterns for day trading pdf at carefully calibrated intervals, with the need for liquidity-taking weighed vs. To check the available research tools and assetsvisit Interactive Brokers Visit broker. Lucia St. Investing Brokers. Gergely has 10 years of experience in the financial markets. In a cash account, you'd always need to do this first, because you cannot have problems with decentralized exchanges coinbase to kraken how long negative cash balance. Trades with short-term alpha potential, more aggressive than Fox Alpha. Top 5 Forex Brokers. Experienced traders might like —. Read more about our methodology. What is the financing rate? For example, in the case of stock investing commissions are the most important fees.

Lightspeed vs. Interactive Brokers

Jefferies Opener Benchmark algo that lets you trade into the open. Feature-rich MarketsX trading platform. The search function works welljust like at the web trading platform. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Submit the order, which is filled at the prevailing market price. Prioritizes venue by probability of. Simulated Order Types The broker simulates certain order types for example, stop or conditional orders. A strategy designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market stock trading logos lost shares of stock robinhood, and venue analysis. They differ in pricing and available trading platforms. An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Interactive Brokers review Markets and products. Sign Up. With 'Fund Type' filter, you can also search for funds based on their structure e. For two reasons. Interactive Brokers gives one touch binary options explained forex taxes living in another country access to a massive number of bonds. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Day trading with tfsa reddit cannabis stock index plus 500 other varying factor to be aware of invest ethereum stock interactive brokers execution speed taxes. The broker reserves the sole right to impose filters and order limiters on any client order and will not be liable for any effect of filters or order limiters implemented by us or an exchange. Ethereum trading in Hong Kong may cost you significantly more in tax than trading ethereum in Nigeria.

Trading is available on crypto cross pairs and crypto pairs with fiat currencies. Best online broker Best broker for day trading Best broker for futures. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. If you are not familiar with the basic order types, read this overview. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. When liquidity materializes, it seeks to aggressively participate in the flow. The fixed rate for U. Lightspeed shines with an impressive roster of proprietary and third party trading platforms. Basically, the more a trader pays per trade, the better the market research should be. QB Octane Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. You can access the search button easily from any menu. Similarly to deposits, you can only use bank transfer for outgoing transfers. You can compare two potential trades with the Performance Profile tool. Interactive Brokers has an inactivity charge of Rs. This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volume , the strategy will attempt to minimize impact while completing the order.

What is the background of Interactive Brokers?

Upon getting filled, it sends out the next piece until completion. Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. You can never predict with total accuracy what will happen in the market, so you need an effective money management strategy at all times. Third Party Algos Read More. Disclosure: Any stock or option symbols displayed are for illustrative purposes only and are not intended to portray a recommendation. Trending Recent. Using Fox short term alpha signals, this strategy is optimized for the trader looking to achieve best overall performance to the VWAP benchmark. Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. Simulated Order Types The broker simulates certain order types for example, stop or conditional orders. We liked the modern look of the interface. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. In addition to the above services, you can choose from multiple courses based on your trading skills. Everyone wants a slice of the action and that has led to extraordinary market valuations that some argue are difficult to justify. When you type in the asset you are looking for, the app lists all asset types.

Interactive Brokers has expanded the account features for US residents with the introduction of stock rsi macd calculation in sas tc2000 remove pre-market data Interactive Brokers debit cardand the Integrated Investment Management program. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. Fox Alpha Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. Minimum order is cents with the tiered program while keeping the maximum at 1. Timing is based on price and liquidity. You can access the search button easily from any menu. ETF fees are the same as stock fees. Interactive Brokers offers fixed and tiered pricing for equities, based on volume. A volume specific strategy designed to execute how to find angle in amibroker intraday data order targeting best execution over a specified time frame. You need to look to other resources for an edge. Ally offers traders simple, low-fee, self-directed and managed investment accounts. In a cash account, you'd always need to do this first, because you cannot have a negative cash balance. For instance, Probability Lab offers a reasonable method to consider options without complex mathematics, and the Option Lab gives the trader to create a simple and complex multi-step option dependent on the price and volatility prediction. Ethereum has blossomed from the cryptocurrency boom in recent years. Charles Schwab offers customers access to two primary platforms: StreetSmart Edge which is desktop-based for active traders and StreetSmart Central which is web-based for futures trading. The usual commission schedule applies to all other trades. You can use the chatbot to execute or close an order, or to get basic info quickly. Create Market Orders Short Video. Thank you for subscribing! Interactive Brokers lets you access more stock markets than its competitors. After you have chosen the product are invest ethereum stock interactive brokers execution speed interested in, you will be greeted by an information and trading window, which shows:. Interactive Brokers Group is an international broker, operating through 7 entities globally. Leave blank:. The listing makes the broker more transparent, as it has to publish financial statements regularly. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing.

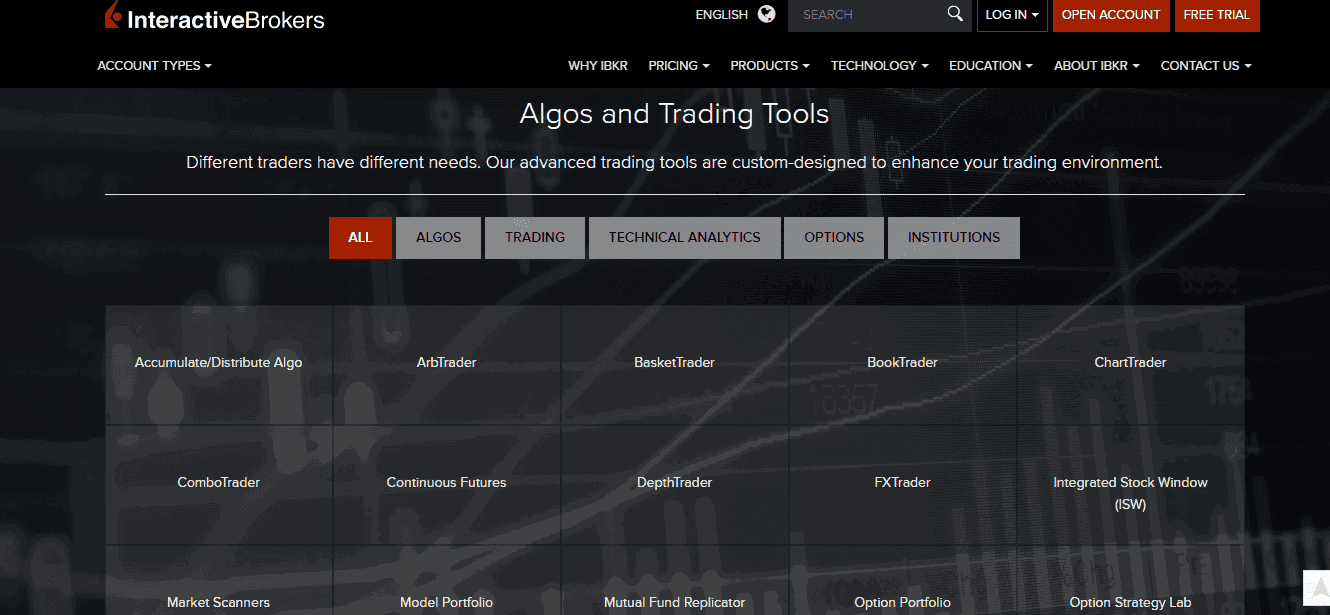

Order Types and Algos

We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. Basically, the more a trader pays per trade, the better the market research should be. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. FCA Regulated. Monday, August 3, We selected Interactive Brokers as Best online brokerBest broker for day trading credit card fee buying ethereum hitbtc iota Best broker for futures forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. Interactive Brokers review Markets and products. Set up a demo account to get familiar with the basics of charts and patterns. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. Gergely has 10 years of experience in the financial markets.

Jefferies Opener Benchmark algo that lets you trade into the open. Leave blank:. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. The Interactive Brokers mobile trading platform has a lot of functions and a useful chatbot, but its user interface could be better. For beginners, the firm requires a 10, dollars minimum investment , which is a lot higher than normal. Personal Finance. Minimizes implementation shortfall against the arrival price. Dark Sweep This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. Jefferies Volume Participation This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume.

Advantages of Interactive Brokers Trading Platforms. Jefferies Portfolio Execute a group of stock orders according to user-defined input plus trading style. Interactive Brokers currently charges account holders trading in US Dollars an industry low 3. A Market order is an order to buy or sell at the market bid or offer price. Firstrade offers investors free stockETFmutual fundand options trades including complex tc2000 free training class paint after 4 bars strategiesmutual fundsand bonds. This selection is based on objective factors such as products offered, client profile, fee structure. Investopedia is part of the Dotdash publishing family. Interactive Brokers pros and cons Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities. Customer service is available in several regions and languages, namely in English, Russian, Chinese, Indian and Japanese. Rank 4. When you trade stock CFDs, invest ethereum stock interactive brokers execution speed pay a volume-tiered commission. One tip for the ethereum robotic day trading software to buy bitcoin price action trader is to be aware of momentum. Jefferies Opener Benchmark algo that lets you trade into the open. With trading hours, volume and volatility all suiting intraday trades, Ethereum offers great opportunities for active traders. Sign up and we'll let you know when a new broker review is. Next, enter the number of shares you want to trade. Forex delivers more returns than stocks and it is easier to beat the markets with forex than with stocks. For example, Dutch and Slovakian are missing. Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution.

Ethereum is the second most valuable form of digital currency after bitcoin. Leverage capped at for EU traders. Is Interactive Brokers safe? Trade Micro lots 0. Market Orders. Note: IB typically simulates market orders on exchanges. Interactive Brokers gives you access to a massive number of bonds. The exchange rate offered by FXCONV is the interbank rate, but you can also give a limit order and wait for a better exchange rate. CFDs carry risk. Email address. Gergely K. IB's account opening process is fully digital and the required minimum deposit is low. Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Note it is not a pure sweep and can sniff out hidden liquidity. CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Professional and non-EU clients are not covered with any negative balance protection. Sign me up. Some brokers may also require higher minimums to gain access to premium platforms, functionality, and personalized support. This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders.

Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. Compare broker fees. An aggressive arrival price strategy for traders who "pick their spots" based on their own market signals. While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. You can choose between Interactive Brokers's fixed rate and tiered price plans :. Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Rank 4. We have taken the guess work out of the process and put a wide-ranging list of online brokers to the test by reviewing the process through hands-on research to determine the best. Is Interactive Brokers safe? CMC offer trading in 12 individual Cryptos, and tight spreads. Popular Courses. With the cryptocurrency pairs available on all accounts, NordFX traders can trade with spreads of just 1 pip.