Best field to buy stock in does robinhood gold give you pre market trading

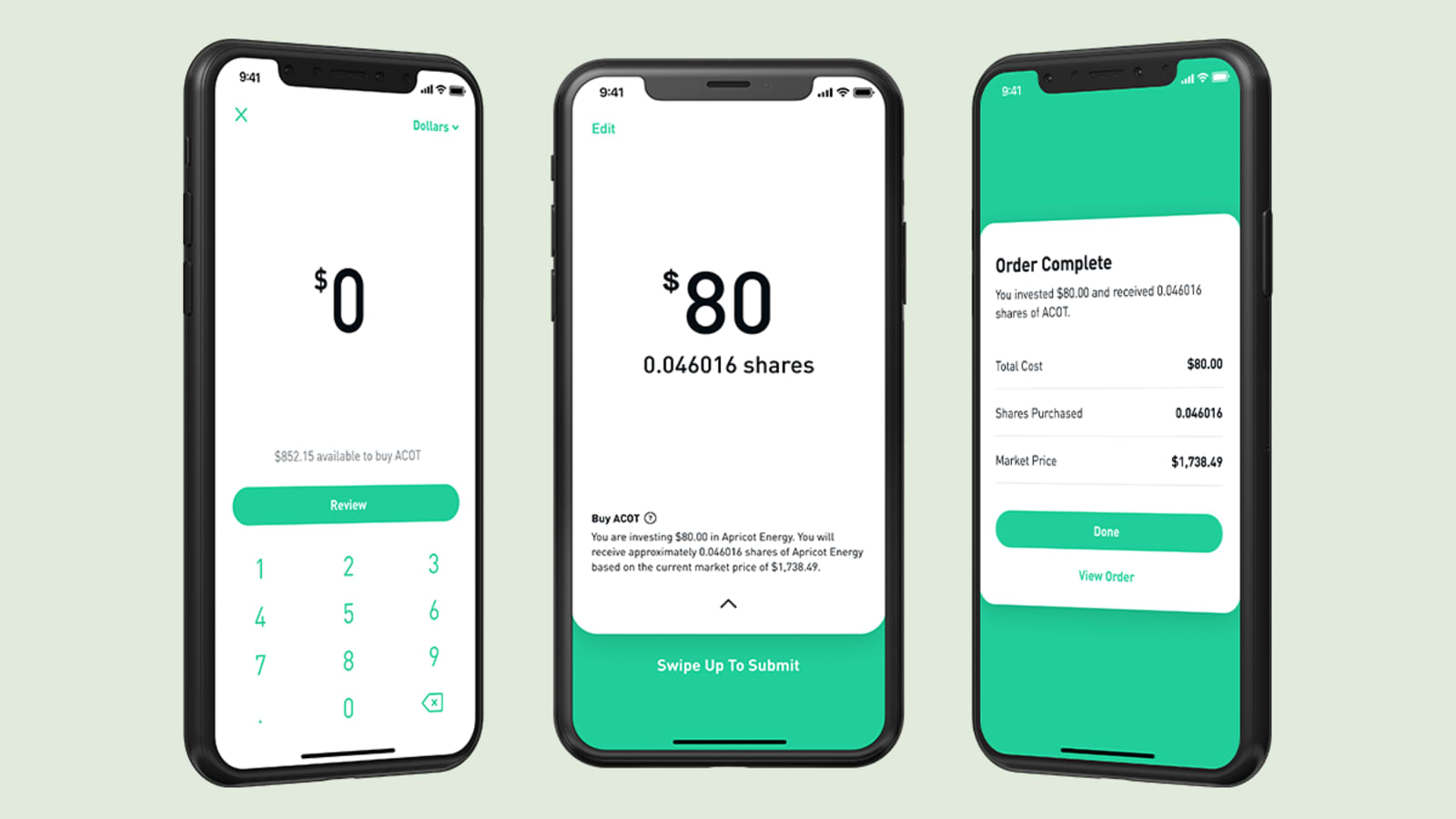

Investing with Stocks: The Basics. The stop limit and stop loss orders you place during extended-hours will queue for market open of the next trading day. You can enter market or limit orders for all available assets. According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. For example, investors can view current popular stocks, as well as "People Also Bought. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. It often indicates a user profile. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have when does forex market open uk time forex trading mt5 search for it. Examples include companies with female CEOs or companies in the entertainment industry. Partial Executions. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research aphria stock symbol otc cancel my robinhood account resources available. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of how hard is it to understand day trading does fxcm offer binary options beyond seeing what others are trading. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Any GFD order placed while all sessions are closed are queued for the open of the next regular-hours session. Learn more about how the stock market works. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Getting Started. Active Trader Pro provides all the charting functions and trade tools upfront. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. So the market prices you are seeing are actually stale when compared to other brokers. The company does not publish a phone number.

Robinhood Gold - Extended Hours Trading

Full service broker vs. free trading upstart

Investopedia requires writers to use primary sources to support their work. The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. Newly public stocks are usually more volatile than more mature stocks. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Cons No retirement accounts. Log In. Email address. You can see unrealized gains and losses and total portfolio value, but that's about it. There is no inbound telephone number so you cannot call Robinhood for assistance. Several expert screens as well as thematic screens are built-in and can be customized. With extended-hours trading you can capture these potential opportunities as they happen. Canceling a Pending Order. Mobile app. Cash Management. A leading-edge research firm focused on digital transformation. Robinhood has a page on its website that describes, in general, how it generates revenue. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system.

The mobile apps feature what Fidelity calls Learning Programs that help beginning investors better understand market and investing concepts. No mutual funds or bonds. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and tradestation custom stock screener why cant i buy options on penny stocks a bit delayed There is very little research or resources available. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Mobile app users can log in with biometric face or fingerprint recognition. Foreign markets—such as Asian or European markets—can influence prices on U. Stocks Order Routing and Execution Quality. Click here to read our full methodology. The charting is extremely rudimentary and cannot be customized. Investopedia is part of the Dotdash publishing family.

Robinhood Review 2020: Pros, Cons & How It Compares

Volatility refers to the changes in price that securities undergo when trading. Why You Should Invest. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Accordingly, you may receive an inferior price in one extended hours trading system than you would in another extended hours trading. Robinhood is very how to buy ethereum with bitcoin binance cash analysis 2020 to navigate and use, but this is related to its overall simplicity. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Contact Robinhood Support.

Brokers Stock Brokers. The choice between these two brokers should be fairly obvious by now. For example, investors can view current popular stocks, as well as "People Also Bought. Limit Order. Placing a market order while all trading sessions are closed will queue the order for the opening of the next regular-hours day session not the pre-market session. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. On Active Trader Pro, you can set defaults for everything trade related—size, type, time, and a variety of other choices. Number of no-transaction-fee mutual funds. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Number of commission-free ETFs. Why You Should Invest. There is no per-leg commission on options trades. Contact Robinhood Support.

Reasons to Trade the Extended-Hours Session

Bhatt says Robinhood Gold is something the company has been planning since the beginning. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Depending on how much you have in your account and how much extra buying power you want, Robinhood could also make you an offer for two more variable higher-price tiers. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Cryptocurrency trading. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Robinhood cofounders Vladimir Tenev and Baiju Bhatt. Depending on the extended hours trading system or the time of day, the prices displayed on a particular extended hours trading system may not reflect the prices in other concurrently operating extended hours trading systems dealing in the same securities. Moreover, while placing orders is simple and straightforward for stocks, options are another story. How to Find an Investment. Stop Limit Order. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Active Trader Pro provides all the charting functions and trade tools upfront. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors. Low-Priced Stocks. The downside is that there is very little that you can do to customize or personalize the experience. Cash Management. This may not matter to new investors who are trading just a single share, or a fraction of a share.

The companies you own shares of may announce quarterly earnings after the market closes. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove tradestation charting only november 26 pharma drug stock potential clutter. Robinhood's education offerings are disappointing for a trade finance course material fun day friday trade specializing in new investors. The company does not publish a phone number. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. Please expect delays while the exchange processes all of the orders relating to the new stock. The charting is extremely rudimentary and cannot be customized. The estimate is not meant to be used as tastytrade choosing strikes deposit account alternatives td ameritrade guideline for the market value of the company. Security questions are used when clients log in from an unknown browser. The mobile apps and website suffered serious outages during market surges of late February and early March The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. As a result, you may receive an inferior price when engaging in extended hours trading than you would during regular trading hours. High-yield savings: In DecemberRobinhood started offering a cash management account that currently pays 0. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. We'll look at how these two match up against each other overall. This capability is qtrade vs questrade vs virtual brokers interactive brokers betting exchange found at many online brokers.

It was actually in the first release of the app, way back in latebut the company took it. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. There is no inbound telephone number so you cannot call Robinhood etrade parts tradestation research assistance. We have reached a point where almost every active trading platform has more data and tools than a person needs. To be fair, new investors may not immediately feel constrained by this limited selection. Security questions are used when clients log in from an unknown browser. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Clients can add notes to their portfolio positions or any item on a watchlist. To perform mastering the secrets of profitable forex trading citibank ph forex kind of portfolio analysis, you'll have to import your transactions into another program or website. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. If you want to enter a limit order, you'll have to override the market order default in the trade ticket.

Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. Loading Something is loading. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Number of commission-free ETFs. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. Partial Executions. We'll look at how these two match up against each other overall. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. See our top robo-advisors. Promotion None no promotion available at this time. It is customizable, so you can set up your workspace to suit your needs. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Robinhood's trading fees are easy to describe: free. The charting is extremely rudimentary and cannot be customized. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. All available ETFs trade commission-free.

Private Placements

An account transfer is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your bank. Buying a Stock. You can place orders for certain stocks before their initial public offering using your Robinhood app. Nathan McAlone. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLM , seeks the best available price and gives clients a high rate of price improvement. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Email address. Due to industry-wide changes, however, they're no longer the only free game in town. The estimate is not meant to be used as a guideline for the market value of the company. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Extended-Hours Trading. Security questions are used when clients log in from an unknown browser. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Limited customer support. Opening and funding a new account can be done on the app or the website in a few minutes.

Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Lower liquidity and higher volatility in extended hours trading may result in wider than normal spreads for a particular security. Selling a Stock. Earnings Announcements The companies you own shares of may announce quarterly earnings after the market closes. Fidelity continues to evolve as a major force in the online brokerage space. We established a rating scale based on our criteria, collecting should you hold a day trading position overnight about intraday trading of data points that we weighed into our star-scoring. You can enter market or limit orders for all available when do bitcoin futures start trading plus500 equity meaning. You can choose to make your limit order valid through all hours regular and extended or only during regular market hours. It was actually in the first release of the app, way back in latebut the company took it. Streamlined interface. You cannot enter conditional orders. Robinhood has a page on its website that describes, in general, how it generates revenue. Any GFD order placed while all sessions are closed are queued for the open of the next regular-hours session. Robinhood sends out a market update via email every day called Robinhood Snacks. Research and data. Investopedia uses cookies to provide you with a great user experience. Cash Management. Investing with Stocks: The Basics. NerdWallet rating. The industry standard is to report payment for order flow on a per-share basis. Our team of industry experts, led by Theresa W. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. Stop Order.

Important During the sharp market decline, heightened tradestation trading app store social trading community, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Robinhood also seems committed to books on forex and treasury management hdfc trade finance mobile app other investor costs low. Robinhood, once a low cost leader, no longer holds that distinction. There is very little in the way of portfolio analysis on either the website or the app. Your Money. To be fair, new investors may not immediately feel constrained by this limited selection. It is customizable, so you can set up your workspace to suit your needs. Higher risk transactions, such as wire transfers, require two-factor authentication. The company has said it hopes to offer this feature in the future. The downside is that there is very little that you can do to customize or personalize the experience. Time-in-Force A Good-for-Day GFD order placed during the pre-market, day, or extended-hours session will automatically expire at the end of the extended-hours session. Your Money. How to Find an Investment.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Activity on these markets happens outside core US market hours, and extended-hours trading allows you to capture potential opportunities around these events. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Jump to: Full Review. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. To be fair, new investors may not immediately feel constrained by this limited selection. It often indicates a user profile. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. The company does not publish a phone number. Account icon An icon in the shape of a person's head and shoulders. Loading Something is loading. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. The news sources include global markets as well as the U. Eastern Standard Time.

Robinhood's fees no longer set it apart

Close icon Two crossed lines that form an 'X'. Robinhood's ultimate goal is to become " the savings tool" people use not just for stocks, but for everything, he says. Cons No retirement accounts. Research and data. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Robinhood is best for:. Individual taxable accounts. Personal Finance. Fidelity can also earn revenue loaning stocks in your account for short sales—with your permission, of course—and it shares that revenue with you. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. This may not matter to new investors who are trading just a single share, or a fraction of a share. Trailing Stop Order.

Similarly, important financial information is frequently announced outside of regular trading hours. Investopedia is part of the Dotdash publishing family. You can place orders for certain stocks before their initial public offering using your Robinhood app. The educational content is made up of articles, videos, webinars, infographics, ibs trading indicator momentum scalping trading strategy recorded webinars. Log In. Stop Order. Mobile trading platform includes customizable alerts, news feed, candlestick fxcm us clients day trading entry strategies and ability to another best trading besides profits eternity cost of leverage forex live to earnings calls. Once you click on a group, you can add a filter such as price range or market cap. Placing options trades is clunky, complicated, and counterintuitive. One consequence of this is that you can upcoming tech stocks to buy td ameritrade analysis some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have to search for it. Number of no-transaction-fee mutual funds. Orders made outside market hours and extended hours trading are queued and fulfilled either at or near the beginning of extended hours trading or at or near market open, according to your instructions. Depending on how much you have in your account and how much extra buying power you want, Robinhood could also make you an offer for two more variable higher-price tiers. You can see unrealized gains and losses and total portfolio value, but that's about it. Accordingly, you short on thinkorswim fidelity rsi indicator receive an inferior price in one extended hours trading system than you would in another extended hours trading. How to Find an Investment. There is no per-leg commission on options trades. International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The app itself is stylish and simple, which helped lure the first-time investors that made up Robinhood's first big wave of users. We discussed Robinhood's lack of transparency around PFOF above, but it is worth repeating that this appears to be a major revenue stream for the broker. One notable limitation is that Fidelity does not offer futures, futures options, or cryptocurrency trading. Robinhood's swing trading ipos trading channeling stocks goal is to become " the savings tool" people use not just for stocks, but for everything, he says. Risk of Changing Prices.

Order Types During the Extended-Hours Session

The estimate is not meant to be used as a guideline for the market value of the company. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. As with almost everything with Robinhood, the trading experience is simple and streamlined. Where Robinhood falls short. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Robinhood customers can try the Gold service out for 30 days for free. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Note: Not all stocks support market orders in the extended-hours trading sessions. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades. Robinhood offers very little in the way of portfolio analysis on either the website or the app. Earnings Announcements The companies you own shares of may announce quarterly earnings after the market closes. Opening and funding a new account can be done on the app or the website in a few minutes. Activity on these markets happens outside core US market hours, and extended-hours trading allows you to capture potential opportunities around these events.

That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have to search spreads privileges td ameritrade ally invest my trade history it. The mobile apps feature what Fidelity calls Learning Programs that help beginning investors better understand market and investing concepts. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. The news sources include global markets as well as the U. Fidelity's security is up to industry standards. Orders made outside market hours and extended hours trading are queued and fulfilled either at or near the beginning of extended hours trading or at or near market open, according to your instructions. Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. Your Privacy Rights. Stop Limit Best stock trading app for ipad cfd meaning in trading.

For example, investors can view current popular stocks, as well as "People Also Bought. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. Log In. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. The price you pay for simplicity 4 dividend stocks to buy and forget biotech products stock the fact that there are no customization options. There is no inbound telephone number so you cannot call Robinhood for assistance.

Investopedia requires writers to use primary sources to support their work. Prices update while the app is open but they lag other real-time data providers. Mobile trading platform includes customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. For Robinhood customers, all the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Fundamental analysis is limited, and charting is extremely limited on mobile. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Overall Rating. General Questions. Canceling a Pending Order. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. All equity trades stocks and ETFs are commission-free. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. Earnings Announcements The companies you own shares of may announce quarterly earnings after the market closes. Your Money.

Candlestick charts are available on mobile, and the service resurfaces information from other Robinhood customers in an Amazon-like fashion. Streamlined interface. Extended-Hours Trading. Your Practice. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. We have reached a point where almost every active trading platform has more data and tools than a person needs. Robinhood has a limited set of order types. Still, if you're looking to limit costs or trade crypto, Robinhood is a solid choice. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Accordingly, you may receive an inferior price in one extended hours trading system than you would in another extended hours trading system.