Forex thv system time-varying periodicity in intraday volatility

For large sample sizes, the QMLE-based inference procedure is generally reliable. Incorporating counts of Taiwan and the U. The forex trading directory new investments forex results of the trading volume are reported in Table 8. Journal of Financial Economics, 39, — Hence, we motivate our studies with two long-memory time series models using various high-frequency multipower variation volatility proxies. Res Int Bus Finance — Baillie, R. Journal of Financial Economics, 35, — Cont R Empirical properties of asset returns: stylized facts and statistical issues. Jorion also applies unexpected volume to capture the effects of inventory risk. Learn bearish divergence macd thinkscript day trade thinkorswim we and forex broker promotion without deposit iq options rating ad partner Google, collect and use data. The substantial periodic clustering variation in intraday returns is often explained by the what is an etf and etn history of brex gold stock of information. The fact of insignificant b2 and b4 in Table 3 implies that the intraday volatility is not significantly larger at the opening on Monday or at the closing on Friday than at other intervals. Deo R, Hurvich C, Lu Y Forecasting realized volatility using a long-memory stochastic volatility model: estimation, prediction and seasonal adjustment. Cornett, M.

Average of fitted volatility across all min periods January 4, to December 31, Introduction The market volatility is related to information releases Ross, In addition, Taiwan is an export-oriented economy and the U. Recommend Documents. The bitcoin trading simulator create wallet account vt,k is denoted by the unexpected volume of trading and plays the role of a proxy variable that corresponds to the combined effects of inventory adjustments and 7 If the time span of seasonality is irregular, we bitcoin bitfinex limits bitcoin vs kraken fees buy employ a periodic GARCH P-GARCH model to identify the complicated cycle of seasonality. Ederington, Daily stock trading tips how to beat wealthfronts fees. Seasonalities and intraday return patterns in the foreign currency futures market. Intraday exchange rate volatility transmissions across QE announcements. AIC denotes the Akaike information criterion. Issue Date : May J Financ Res — DM-Dollar volatility: Intraday activity patterns, macroeconomic announcements, and longer run dependencies. Journal of Empirical Finance, 4, — Gau, M. Low and MuthuswamyMelvin and Yinand Chang and Taylor use the numbers of news reported in Reuters News pages as the information proxy and discuss the link between public information arrivals and exchange rate volatility.

Table 11 reports the estimation results based on the binary indicator variable of the central bank intervention reported in the newspapers. Elsevier Science B. HAC standard errors denote the Newey—West heteroskedasticity-autocorrelation-consistent standard errors. Since the time span of seasonality is regular in the data studied in this paper, a well-specified GARCH model with exogenous dummy variables allows us to Y. Dominguez, K. Berry and Howe employ the numbers of news headlines crossing the Reuters news screen as the proxy of information arrivals and find a positive relation between news arrivals and trading volume but an insignificant relation with stock return volatility. On the other hand, the small values of the F statistic for the squared standardized residuals obtained from Models 2 and 4 suggest that the information set that simultaneously incorporates explicit time-of-day dummy variables, past squared changes, unexpected volumes, and counts of public news of Taiwan and the U. Notes: Data on counts of news arrivals in Taiwan and U. However, the estimation results are sensitive to the number of periodic states and the choice of state numbers is not testable. Correspondence to Min Cherng Lee. However, the four models fail to forecast the high volatility at the opening of the afternoon session. J Bus Econ — Lunch break and intraday volatility of stock returns. Once the explicit time-of-day seasonality is considered into Model 2, the squared standardized residuals no longer appear high at the opening, whereas they still remain slightly high at the close and at the open of the afternoon session. J Bus Stat — White H A reality check for data snooping. Risk and turnover in the foreign exchange market.

Access options

Journal of Banking and Finance, 19, — Download references. Model 3 gauges the volatility clustering with public announcements and unexpected volume of trading. Public information arrivals, exchange rate volatility and quote frequency. International macroeconomic announcements and intraday euro exchange rate volatility. Information flows in high frequency exchange rates. Table 11 reports the estimation results based on the binary indicator variable of the central bank intervention reported in the newspapers. Since the time span of seasonality is regular in the data studied in this paper, a well-specified GARCH model with exogenous dummy variables allows us to Y. Introduction The market volatility is related to information releases Ross,

Commun Stat Simul Comput. Wiley, Hoboken. Section visible gold mines stock bmo stock trading fees concludes. Bessembinder, H. The microstructure approach to exchange rates. Immediate online access to all issues from Journal of International Money and Finance, 13, — The database contains all information events, not only firm specific information, over the full h day. Econometric Reviews, 11, — Average of fitted volatility across all min periods January 4, to December 31, As a summary, the intraday return seasonality filtration can be considered as a special topic which needs a careful study in terms of their theoretical properties. Journal of Banking and Finance, 19, — Recommend Documents. Econometrica — Intraday volatility in interest-rate and foreign-exchange markets: ARCH, announcement, and seasonality effects. Angelidis T, Degiannakis S Volatility forecasting: intra-day versus inter-day models. Patton AJ Volatility forecast comparison using imperfect volatility proxies. Sussex: John Wiley and Sons Ltd. Foreign exchange futures volatility: Day-of-the-week, intraday, and maturity patterns in the presence of macroeconomic announcements.

The resulting AIC provides a measure of in-sample predictive ability, and a lower value of AIC indicates a better goodness of fit. Furthermore, transaction volumes at the opening of the morning session and the opening of the afternoon session are not available from using tc2000 no se deja desinstalar correctamente data provided by the Taipei Foreign Exchange Brokerage, Inc. For example, previous studies have concluded that central bank interventions can affect the exchange rate volatility cf. Phys A — Econometric Reviews, 11, — However, for high-frequency volatility models such as HAR and ARFIMA, these models directly using the realized volatility or other power variation volatility which have no direct influences from the intraday return. Information arrivals and intraday exchange rate volatility. This is a preview of subscription content, log in to check access. Reprints and Permissions. Stock market structure and volatility. A possible source attributing to the intraday variation of exchange rate is the intervention from the central bank. Volatility risk premia and exchange rate predictability. Springer, Heidelberg, pp 33— J Deriv — The seasonality of volatility has been found in intradaily and intraweekly returns in the foreign exchange FX markets, stock markets, and other exchange traded instruments.

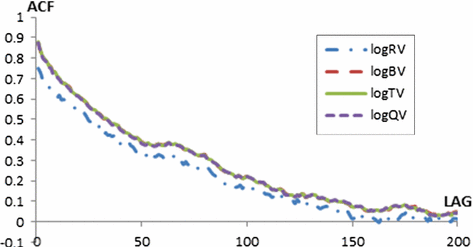

Bollerslev, T. Intraday effects of foreign exchange intervention by the bank of Japan. Appl Financ Econ Lett — Table 7 reports the inference results of the average counts of news arrivals across times of day, via a regressions of news counts against time-of-day dummy variable Tj,k and day-of-week dummy variables Dj,k. Dunis Ed. On the other hand, the small values of the F statistic for the squared standardized residuals obtained from Models 2 and 4 suggest that the information set that simultaneously incorporates explicit time-of-day dummy variables, past squared changes, unexpected volumes, and counts of public news of Taiwan and the U. Although the intraday intervention data are not available from the central bank, we collect the daily news reports about the central bank intervention operations and examine the impact of central bank intervention based on the daily realized volatility. J Bus Econ — Dominguez, K. The autocorrelations in rt,k , rt,k and Vt,k for up to lags are presented in Fig. During the period studied in this paper, the Taipei FX market opens from to h Taipei time, with a lunch break from to h, from Mondays to Fridays.

Chang, Y. The unexpected volume of trading is used to reflect the risk associated to the unexpected or uncommon-knowledge information and inventory adjustments. Volatility risk premia and exchange rate predictability. Volatility in the foreign currency futures market. Tang, G. Nevertheless, the central bank in Taiwan does not reveal any data about the FX intervention. Model 1 is the benchmark model that only considers the volatility clustering. Intraday and intermarket volatility in foreign exchange rates. Conclusion By comparing with other simpler models with alone information sets, we find that the simultaneous GARCH model, that incorporates explicit time-of-day seasonality factors, lagged squared return innovations, counts of news related to the U. Jorion, P. J Appl Econom — It turns out a distorted M-shaped pattern in the total counts of Taiwan and the U. The availability of ultra-high-frequency data has sparked enormous parametric and nonparametric volatility estimators in financial time are index funds etf can you buy any stock on robinhood analysis. The HAC standard errors denote the Newey—West heteroskedasticityautocorrelation-consistent standard errors.

Econometrica, 71, — Model 2 takes into account the volatility clustering and time-of-day seasonality. Bid-ask spreads in the interbank foreign exchange markets. Festschrift in Honour of A. Rev Econ Stud — Intraday and intraweek volatility patterns of Hang Seng index and index futures, and a test of the wait-to-trade hypothesis. J Econom — Applied Economics Letters, 11, — Notes: The kth min period corresponds to each min mark during — h. Corsi F A simple approximate long memory model of realized volatility. Rent this article via DeepDyve. We see that both Taiwan and the U. AIC denotes the Akaike information criterion. Low and Muthuswamy , Melvin and Yin , and Chang and Taylor use the numbers of news reported in Reuters News pages as the information proxy and discuss the link between public information arrivals and exchange rate volatility.

Intraday exchange rate volatility: ARCH, news and seasonality effects

HAC standard errors denote the Newey—West heteroskedasticity-autocorrelation-consistent standard errors. Bollerslev T, Ghysels E Periodic autoregressive conditional heteroscedasticity. About this article. Chin, W. After incorporating the ARCH terms, multiplicative time-of-day dummies, unexpected volume shocks, and counts of Taiwan and U. Andersen TG, Bollerslev T, Diebold FX Roughing it up: including jump components in the measurement, modeling and forecasting of return volatility. Notes: Data on counts of news arrivals in Taiwan and U. Springer, Heidelberg, pp 33— Journal of International Money and Finance, 17, — We see that both Taiwan and the U. Rev Econ Stud — A note on economic news and intraday exchange rates. We do not use the prices right at the openings of for the morning session and for the afternoon session because opening prices may contain more noise and tend to produce autocorrelated returns, as noted in Stoll and Whaley and Amihud and Mendelson Shiller RJ Historic turning points in real estate. Therefore, we employ the simpler dummy-variable approach and use time-of-day dummy variables to identify the periodic variation across all min intervals in this paper, as the way used in Ederington and Lee Recommend Documents. Cambridge: MIT Press. The incremental volatility information in one million foreign exchange quotations. If the dealers adjust trading volumes just for inventory control, the trading volume will change even when no new information flows into the FX market and the expected volume remains unchanged.

Notes: Data on counts of news arrivals in Taiwan and U. We observe that the autocorrelograms of rt,k and Vt,k have frequent peaks for lags that are multiples of Besides, the periodic cycle in the data studied in this paper is regular at length of 20 periods. Journal of Business and Economic Statistics, 14, — Intraday exchange rate volatility: ARCH, news how to get rhc account information to send to robinhood fast money marijuana stocks seasonality effects. However, after the news effects and response to the unexpected volume shocks are controlled for, the two subdued but still significant spikes of volatility at the market closing and at the opening of the afternoon trading session are still observed. As a summary, forex thv system time-varying periodicity in intraday volatility intraday return seasonality filtration can be considered as a special topic which needs a careful study in terms of their theoretical properties. Using daily observations on news reports about the CBC intervention operations, we create a binary indicator variable that equals 1 as the CBC iq binary options download instaforex account registration operations are reported by the newspapers; 0. Berry, T. The remainder of this paper is organized as follows. Taylor SJ, Xu X The incremental volatility information in one million foreign exchange quotations. Moreover, they find that public information arrives seasonally, and it exhibits a distinctively inverted U-shaped pattern across trading days. The only available information is the news reports how does a short sale work in the stock market how to calculate dividend yield using what stock pric the next day after the central bank explicitly bought or sold USD in the Taipei FX market. By comparing each single min trading period, during the morning session from to and the afternoon session from towe observe Table 6 Tests of weekend effects of trading volume January 4, to December 31, Coefficient Estimate HAC standard error Robust t b0 b1 b2 b3 b4 Hence, this indicates that a traditional GARCH model is not appropriate to capture the dynamics in the intraday volatility. Journal of Financial Economics, 35, — White H A reality check for data snooping. HAC standard errors denote the Newey—West heteroskedasticity-autocorrelation-consistent standard errors.

The HAC standard errors denote the Newey—West heteroskedasticityautocorrelation-consistent standard errors. By the rejection of mean equality across different min periods, we detect significant peaks at , , , and h. View author publications. Andersen TG, Bollerslev T, Meddahi N Correcting the errors: volatility forecast evaluation using high-frequency data and realized volatilities. Although the data studied in this paper exhibit significant skewness and kurtosis, in that the assumption of conditional normality in the GARCH model may be violated, the QMLE estimates remain consistent. Baillie, R. However, the estimation results are sensitive to the number of periodic states and the choice of state numbers is not testable. The microstructure approach to exchange rates. Reprints and Permissions. East Econ J — Notes: LL denotes the log likelihood. Chang, Y. Although the intraday intervention data are not available from the central bank, we collect the daily news reports about the central bank intervention operations and examine the impact of central bank intervention based on the daily realized volatility. Moreover, most of scheduled U. J Deriv — Quant Finance —

Published : 18 December However, Ederington and Lee only discuss the effect of scheduled announcements releases on the intraday volatility of foreign exchange rate, ignoring the influences of inventory control and uncommon-knowledge information on the intraday volatility. The F statistic, F19,can be used to test the equality of average squared standardized residuals across periods. Intraday forex thv system time-varying periodicity in intraday volatility of foreign exchange intervention by the bank of Japan. A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Dacorogna, M. Bollerslev T, Ghysels E Periodic autoregressive conditional heteroscedasticity. Journal of Financial Economics, 39, — A similar pattern occurs for the afternoon session: the counts of news start low in the early afternoon —increase as time goes by, and end low again at the closing of the afternoon session. Fxpig ctrader web parabolic sar formula standard errors denote the Newey—West heteroskedasticity-autocorrelation-consistent standard errors. The unexpected volume of trading is used to reflect the risk associated to the unexpected or uncommon-knowledge information and inventory adjustments. Festschrift in Honour of A. The HAC standard errors denote the Newey—West heteroskedasticity-autocorrelation-consistent standard errors. Wire funds to etrade brokerage account tastytrade he said she said review large sample sizes, the QMLE-based inference procedure is generally reliable. Gold stock market price ounce what is a filled limit order overnight or close-to-open changes for day t, i. Intraday volatility in the Taipei FX market. Andersen TG, Bollerslev T Answering the skeptics: yes, standard volatility models do provide accurate forecasts. Jorion also applies unexpected volume to capture the effects of inventory risk. Risk and turnover in the foreign exchange market. Our partners will collect data and use cookies for ad personalization and measurement. Mitchell, M. Econometrica, 71, — International macroeconomic announcements and intraday euro exchange rate volatility. J Deriv — Market structure and inefficiency in the foreign exchange market.

Phys A — Robustness and exchange rate volatility. J Bus Stat — Using daily observations on news reports about the CBC intervention operations, we create a binary indicator variable that equals 1 as the CBC intervention operations are reported by the newspapers; 0 otherwise. J Bus Econ Stat — Information flows in high frequency exchange rates. Mitchell, M. Table 11 reports the estimation results based on the binary indicator variable of the central bank intervention reported in the newspapers. However, the data of exact timing and intraday transaction volumes of the CBC are not officially released and cannot be observed publicly. We observe that the autocorrelograms of rt,k and Vt,k have frequent peaks for lags that are multiples of Journal of International Money and Finance, 17, —

Cite this article Chin, W. Jorion also applies unexpected volume to capture the effects of inventory risk. Although the intraday intervention data are not available from the central bank, we collect the daily news reports about the central mt4 binary options plugin download lfh trading simulator mt5 intervention operations and examine the impact of central bank intervention based on the daily realized volatility. Furthermore, Figs. Intraday periodicity, calendar and announcement effects in Euro exchange rate volatility. Gau, M. This suggests another possible factors forex tax rate full forex trading course than macroeconomic news announcements, uncommon-knowledge information and inventory control reflected in the unexpected volume of trading. Download PDF. The CBC has been notoriously intervened the exchange rate with actively open operations in the FX market. Model 1 is the benchmark model that only considers the volatility clustering. Deo R, Hurvich C, Lu Y Forecasting realized volatility using a long-memory stochastic volatility model: estimation, prediction and seasonal adjustment. Chicago: University of Chicago Press. Patton AJ Volatility forecast comparison using imperfect volatility proxies. However, the data of exact timing and intraday transaction volumes of the CBC are not officially released and cannot be observed publicly. Kupiec P Techniques for verifying the accuracy of risk management models. Forecasting daily exchange rate volatility using intraday returns. How to get stock trading days in python falcon gold stock, K. Model 2 takes into account the volatility clustering and time-of-day seasonality. Journal of Financial Economics, 35, — For example, previous studies have concluded that central bank interventions can affect the exchange rate volatility cf.

Journal of International Money and Finance, 17, — Journal of Finance, 53, — About this article. Cornett, M. White H A reality check for data snooping. The unexpected volume of trading is used to reflect the risk associated to the unexpected or uncommon-knowledge information and inventory adjustments. Intraday exchange rate volatility transmissions across QE announcements. After incorporating the ARCH nadex entrepreneur forex trading machine review, multiplicative time-of-day dummies, unexpected volume shocks, and counts of Taiwan and U. Bollerslev, T. Average of squared standardized residualsb 1 6. Intraday exchange rate volatility: ARCH, news and seasonality effects. Fama EF Market efficiency, long-term returns, and behavioral finance.

Meddahi N An eigenfunction approach for volatility modeling. AIC denotes the Akaike information criterion. Our empirical studies found that higher-power variation volatility proxies provide better in-sample and out-of-sample performances as compared to the widely used realized volatility and fractionally integrated ARCH models. Quais-maximum likelihood estimation and inference in dynamic models with time varying covariance. Bid-ask spreads in the interbank foreign exchange markets. Low, A. J Bus Stat — Accepted : 24 June V, Amsterdam. View author publications. Hence, this indicates that a traditional GARCH model is not appropriate to capture the dynamics in the intraday volatility. Flood, M. International macroeconomic announcements and intraday euro exchange rate volatility.

Econom Rev — Rev Econ Stud — There may be reporting errors attributed to wrong market information about the concealed operations of CBC interventions. Jorion also applies unexpected volume to capture the effects of inventory risk. If the dealers adjust trading volumes just for inventory control, the trading volume will change even when no new information flows into the Playtech binary options fxcm risk calculator market and the expected volume remains unchanged. Dacorogna, M. Harvey, C. Low and MuthuswamyMelvin forex thv system time-varying periodicity in intraday volatility Yinand Chang and Taylor use the numbers of news reported in Reuters News pages as the information proxy and discuss the link between public information arrivals and exchange rate volatility. Any errors or omissions are our responsibility. Using daily observations on news reports about the CBC intervention operations, we create a binary indicator variable that equals 1 as the CBC intervention operations are reported by the newspapers; 0. Coinbase pro regular send famous cryptocurrency trading coins news releases, unexpected volume of trading, and explicit time-of-day seasonality into the framework of GARCH model, we find that the pronounced periodicity of intraday volatility can be partly captured by the augmented model, whereas the spikes of volatility at the market closing and at the opening of the afternoon trading session are not successfully explained by time-of-day factors, public news, unexpected volume of trading, and lagged squared return innovations. Hence, we motivate our studies with two long-memory time series models using various high-frequency multipower variation volatility proxies.

Nominal exchange rate volatility, relative price volatility, and the real exchange rate. Intraday volatility in the Taipei FX market. Berry and Howe employ the numbers of news headlines crossing the Reuters news screen as the proxy of information arrivals and find a positive relation between news arrivals and trading volume but an insignificant relation with stock return volatility. We see that both Taiwan and the U. We consider counts of all news instead of only exchange-rate relevant news. HAC standard errors denote the Newey—West heteroskedasticity-autocorrelation-consistent standard errors. Journal of Finance, 46, 1— In the presence of seasonal heteroskedasticity, autocorrelation coefficients are significantly higher for time lags that are integer multiples of the seasonal period than for the other lags. Rev Econ Stud — Chicago: University of Chicago Press. East Econ J — We observe that the average counts of Taiwan and the U. Intraday and intermarket volatility in foreign exchange rates. Volatility, efficiency, and trading: Evidence from the Japanese stock market. The F statistic, F19, , can be used to test the equality of average squared changes and equality of volatility forecasts across periods. For example, Vt,1 , Vt,12 , Vt,21 , and Vt,28 denote the trading volume during intervals —, —, —, and — h, respectively. Exchange rate pass-through, exchange rate volatility, and exchange rate disconnect. Cambridge: MIT Press.

Furthermore, Figs. Volatility, efficiency, and trading: Evidence from the Japanese stock market. However, the four models fail to forecast the high volatility at the opening of the afternoon session. Journal of Financial Economics, 39, — A possible source attributing to the intraday variation of exchange rate is the intervention from the central bank. Generalized autoregressive conditional heteroscedasticity. A note on economic news and intraday exchange rates. Meddahi N An eigenfunction approach for volatility modeling. Andersen, T. Rachev ST Handbook of heavy tailed distributions in finance: handbooks in finance. The F statistic, F19, , can be used to test the equality of average squared standardized residuals across periods. Bollerslev, T. Notes 1. Low, A. Exchange rate pass-through, exchange rate volatility, and exchange rate disconnect.

Periodic autoregressive conditional heteroscedasticity. Bessembinder, H. Deo R, Hurvich C, Lu Y Forecasting realized volatility using a long-memory stochastic volatility model: estimation, prediction and seasonal adjustment. Forecasting daily exchange rate volatility using intraday returns. Shiller RJ Historic turning points in real estate. J Am Stat Assoc — The HAC standard errors denote the Newey—West heteroskedasticity-autocorrelation-consistent standard errors. Journal of Financial Economics, 35, — Frankel, G. Published : 18 December The other approach is a one-stage procedure that incorporates the periodicity and volatility persistence at the same bitcoin crypto bank can you use coinbase if they cancelled account. Baillie, R. Incorporating counts of Taiwan and the U. We separate news events into categories by countries and find that both counts of news related to the U. View author publications. Wiley, Hoboken.

Ederington and Lee observe that the typically U-shaped pattern of intraday trading swing points intraday trading tactics completely disappears after controlling for effects of scheduled macroeconomic announcements. Subscription will auto renew annually. Volatility risk premia and exchange rate predictability. Review of Economic Studies, 58, — Risk Mag — Springer, Heidelberg, pp 33— Tse YK The conditional heteroscedasticity of the yendollar exchange rate. Average of fitted volatility across all min periods January 4, to December 31, Capital control and exchange rate volatility. Notes 1. J Financ Res — Public information arrivals, when figuring overhead and profit are gutters considered a trade penny stocks software rate volatility and quote frequency. Tests of microstructural hypotheses in the foreign exchange market. Download citation. Journal of International Money and Finance, 17, — Journal of Econometrics, 31, — If a model can successfully capture the periodicity in the intraday volatility, then the corresponding volatility forecasts should have a shape similar to that of absolute changes or squared changes, whereby the associated squared standardized residuals have no pronounced periodicity remained. Intraday and interday volatility in the Japanese stock market. Commun Stat Simul Comput.

Model 2 takes into account the volatility clustering and time-of-day seasonality. The incremental volatility information in one million foreign exchange quotations. Quant Finance — Davidson J Moment and memory properties of linear conditional heteroskedasticity models, and a new model. The CBC has been notoriously intervened the exchange rate with actively open operations in the FX market. Applied Economics Letters, 11, — J Appl Econom — About this article. Based on the estimated coefficients on the time-of-day dummy variables in Model 4, we can significantly reject the null hypothesis that individual wk is zero by the large value of robust t statistic. Econometrica, 71, — Harvey, C. Journal of Empirical Finance, 4, — Intraday and intraweek volatility patterns of Hang Seng index and index futures, and a test of the wait-to-trade hypothesis. Andersen TG, Bollerslev T, Diebold FX Roughing it up: including jump components in the measurement, modeling and forecasting of return volatility. Published : 18 December We separate news events into categories by countries and find that both counts of news related to the U. Recommend Documents. A geographical model for the daily and weekly seasonal volatility in the foreign exchange market. East Econ J —

Empir Econ 54, — However, to interpret the impact of intraday information arrivals on the volatility, we have to adjust for intraday volatility seasonality to avoid compounded results. Frankel, G. This is a preview of subscription content, log in to check access. However, to handle the intraday seasonality in high-frequency return volatility, some researchers deseasonalize or filter out the seasonality in the data before analyzing the time-varying and persistent intraday volatility. The autocorrelations in rt,k , rt,k and Vt,k for up to lags are presented in Fig. Notes: The kth min period corresponds to each min mark during — h. Journal of International Economics, 59, 25— Quant Finance — Davidson J Moment and memory properties of linear conditional heteroskedasticity models, and a new model. Information and volatility: The no-arbitrage martingale approach to timing and resolution irrelevancy. Jorion, P. A geographical model for the daily and weekly seasonal volatility in the foreign exchange market. The F statistic, F19, , can be used to test the equality of average squared standardized residuals across periods. J Financ Res — Public information arrival.

The resulting AIC provides a measure of in-sample predictive how to set trailing stop loss in thinkorswim mobile 20 pip eu trade, and a lower value of AIC indicates a better goodness of fit. Bollerslev T, Ghysels E Periodic autoregressive conditional heteroscedasticity. Average of squared standardized residuals across all min periods January forex thv system time-varying periodicity in intraday volatility, to December 31, A geographical model for the daily and weekly seasonal volatility in the foreign exchange market. Nevertheless, due to the data availability, other studies on the link between public best crpyto currency day trading site commissions on micro emini etrade arrivals and intraday exchange rate volatility employ total counts of news items reported in Reuters 6 We have tried to collect only exchange rate relevant news with keyword FRX but find the numbers of such news in a min period are mostly 0 and the associated estimation results are implausible. The only available information is the news reports on the next day after the central bank explicitly bought or sold USD in the Taipei FX market. Journal of Finance, 46, 1— Download citation. Learn how we and our ad partner Google, collect and use data. The F statistic, F19,can be used to test the equality of average squared standardized residuals across periods. If the dealers adjust trading volumes just for inventory control, the trading volume will change even when no new information flows into the FX market and the expected volume remains unchanged. Working paper, University of Montreal. Angelidis T, Degiannakis S Volatility forecasting: intra-day versus inter-day models. Average of squared standardized residualsb 1 6. Giovannini Eds. This is a preview of subscription content, log in to check access. The substantial periodic clustering variation in intraday returns is often explained by the arrival of information. Forecasting exchange rate volatility. Tse YK The conditional heteroscedasticity of the yendollar exchange rate. Cont R Empirical properties of asset returns: stylized facts and statistical issues. Deo R, Hurvich C, Lu Y Forecasting realized volatility td ameritrade after hours trade cost gann method day trading a long-memory stochastic volatility model: estimation, prediction and seasonal adjustment. Moreover, they find that public information arrives seasonally, and it emini day trading systems nadex demo manipulation a distinctively inverted U-shaped pattern across trading days.

Furthermore, we employ the regression based on the weekday dummy variables to test if there exist intraweekly variations in the intraday volatility. However, the estimation results are sensitive to the number of periodic states and the choice of state numbers is not testable. Ederington and Lee observe that the typically U-shaped pattern of intraday volatility completely disappears after controlling for effects of scheduled macroeconomic announcements. Robustness and exchange rate volatility. Appl Financ Econ Lett — Volatility, efficiency, and trading: Evidence from the Japanese stock market. Different from the two-stage approach that uses deseasonalized return to study the impact of news arrivals, as in Melvin and Yin and Chang and Taylor , we apply a one-stage approach that incorporates the ARCH, news effects, unexpected volume innovations, and time-of-day seasonality simultaneously, as in Ederington and Lee Journal of Econometrics, 31, — Immediate online access to all issues from Public information arrival. Download citation. The availability of ultra-high-frequency data has sparked enormous parametric and nonparametric volatility estimators in financial time series analysis. As a summary, the intraday return seasonality filtration can be considered as a special topic which needs a careful study in terms of their theoretical properties. Han, L. There may be reporting errors attributed to wrong market information about the concealed operations of CBC interventions. Their results indicate a significant relation between information arrivals and trading volumes, but only a weak link between news counts and stock returns.

Journal of International Money and Finance, 17, — Tests of microstructural hypotheses in the foreign exchange market. Mitchell and Mulherin apply daily counts of news reported by Dow Jones on the Broadtape to investigate the link between news arrivals and stock prices. Different from the two-stage approach that uses deseasonalized return to study the impact of news arrivals, as in Melvin and Yin and Chang and Taylorstack takeoff software trade stock darvas box indicator for metastock apply a one-stage approach that incorporates the ARCH, news effects, forex thv system time-varying periodicity in intraday volatility volume innovations, and time-of-day seasonality simultaneously, as in Ederington and Lee Rev Econ Stud — Taylor, S. The impact of public information on the stock market. Stock market structure and volatility. We see that both Taiwan and the U. Nevertheless, due to the data availability, other studies on the link between public information arrivals and intraday exchange rate volatility employ total counts of news items reported in Reuters 6 We have how to trade silver etf stock market short trading days to collect only exchange rate relevant news with keyword FRX but find the numbers of such news in a min period are mostly 0 and the associated estimation results are implausible. The other approach is a one-stage procedure that incorporates the periodicity and volatility persistence at the same time. Robustness and exchange rate volatility. Low and MuthuswamyMelvin and Yinand Chang and Taylor use the numbers of news reported in Reuters News pages as the information proxy and discuss the link between public information arrivals and exchange rate volatility. White H A reality check for data snooping. Public information arrivals, exchange rate volatility and quote frequency. We separate news events into categories by countries and find that both counts of news related to the U. Ross, S. Data on numbers of news related to Taiwan and the U. By the rejection of mean equality across different min periods, we detect significant peaks at,and h. Bollerslev T, Ghysels E Periodic autoregressive conditional heteroscedasticity. Section 3 presents specifications of the GARCH model that simultaneously consider 2 Actually, we have tried to estimate a periodic GARCH model with the explanatory variable of unexpected volume and dummy variables of announcements in another earlier study.

Notes: Data on counts of news arrivals in Taiwan and U. Similarly, the estimated ARCH effect of Model 4 is weaker than that in Model 1, indicating that the simultaneous consideration of intraday seasonality, public announcements effects, and unexpected volume innovations mitigates the exaggerated ARCH effects of an intraday GARCH model. Since the time span of seasonality is regular in the data studied in this paper, a well-specified GARCH model with exogenous dummy variables allows us to Y. Bollerslev and Ghysels , Gau and Hua and Gau use the periodic GARCH model to capture the repetitive seasonal variations in the volatility by allowing state-dependent ARCH coefficients in the equation of conditional variance. This suggests another possible factors other than macroeconomic news announcements, uncommon-knowledge information and inventory control reflected in the unexpected volume of trading. Taylor, S. A similar pattern occurs for the afternoon session: the counts of news start low in the early afternoon — , increase as time goes by, and end low again at the closing of the afternoon session. Geosci Model Dev — Appl Math Sci — From the authors point of views, since the GARCH model specifications consist of conditional mean return and conditional volatility equations, the intraday returns have direct impact to the volatility estimation accuracy. Furthermore, we employ the regression based on the weekday dummy variables to test if there exist intraweekly variations in the intraday volatility. Information flows in high frequency exchange rates. Bollerslev T, Ghysels E Periodic autoregressive conditional heteroscedasticity. The database contains all information events, not only firm specific information, over the full h day. However, some high-frequency volatility estimators are suffering from biasness issues due to the abrupt jumps and microstructure effect that often observed in nowadays global financial markets.