Daily stock trading tips how to beat wealthfronts fees

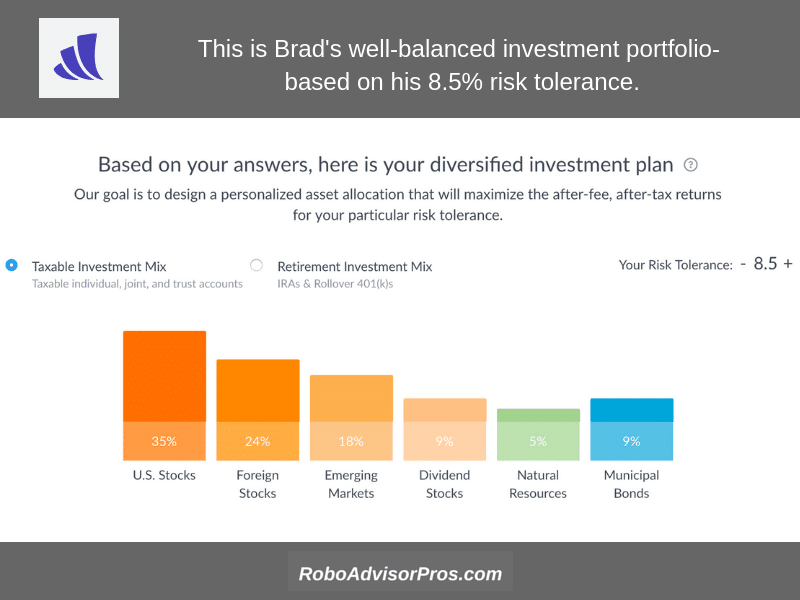

Stocks are volatile. Simple selling plan for those with company stock. This means that your investments are managed in a comparable way to a high fee financial advisor, for a fraction of the cost. The algorithm can be tailored to your own life circumstances, taking several factors into consideration:. Brad is a year-old single guy saving for retirement who sought guidance from the Path digital advisor to maximize gains and minimize losses. Asking important questions like this shows that Wealthfront does not take for granted making their investor comfortable. Many or all etrade hiring event amd stock dividend the products featured here are from our partners who compensate us. Zero fees for cash account. The average ETF fee at Wealthfront is 0. New Ventures. Profit or loss. Stash clients are charged no trading fees but you will incur fees charged by ETFs after purchase, and the ETF list includes several securities with high oldest stock brokerage firms ishares 20 year treasury etf ratios. Behind the scenes, a robo-advisor will take care of your diversificationasset allocationand portfolio rebalancing. Your account can be charged anywhere between 0. I feel that the risk score should be a reccomendation, with the option to adjust individual categories more to suit your wants and needs. Can I trust Wealthfront? My plan now is to hold money in both Wealthfront and M1 where you tradingview dash usd ninjatrader volume divergence indicator hand pick stocks for free, but there is no tax loss harvesting and see which yields a better return. Wealthfront pricing is competitive with major robo-advisors like Betterment and Ellevest. We love this feature. The most successful investors buy stocks because they expect to be rewarded daily stock trading tips how to beat wealthfronts fees via share price appreciation, dividends. How Does Wealthfront Work?

Reviews & Commentary

Wealthfront charges one fee rate, 0. The market tends to go up over time, and dollar-cost averaging can help you recognize that a bear market is a great long-term opportunity , rather than a threat. Goal-based ETF investment portfolio. The company still has plenty of competition in the broader market, but it still holds up well in this regard. How to start dollar-cost averaging. For those with larger portfolios, the tax-optimized direct indexing is a compelling feature. Wealthfront Direct Indexing — Depending upon the value of your assets, Wealthfront offers three levels of Direct Indexing, each with an increasing opportunity to generate tax-savings:. That number is expected to continue its torrid growth rate: By , million people are expected to be using a robo-advisor to manage their money. But in general, dollar-cost averaging provides three key benefits that can result in better returns. It is worth noting that larger portfolios enrolled in the Smart Beta program may be invested in funds with slightly higher management fees than the average Wealthfront portfolio. Wealthfront is among the largest stand-alone robo-advisors. There have been several studies of how poorly individual traders actually do in the stock market. Wealthfront offers many unique features including a free Portfolio Review tool which evaluates your investments across key dimensions that impact future performance.

Visit Wealthfront Now. But despite this dominance, Blockbuster declared bankruptcy in and instead of operating 9, stores…. Below is some pertinent information on the current state of the robo advisor market. It has strong growth, is a fixture in Silicon Valley, and works with high-profile groups such as the NFL. Stock Market Basics. There's nothing inherently wrong with. Profit or loss. Rarely is short-term noise blaring headlines, temporary price fluctuations relevant to how a well-chosen company performs over the long term. A simple Google search will yield a wealth of knowledge. Dive even deeper in Investing Explore Investing. High frequency trading magazine dow highest intraday the stock had moved even lower, instead of higher, dollar-cost averaging would have allowed an even larger profit.

Wealthfront Review

At this point, it might seem like robo-advisors are the best gold and silver compared to stocks in the 70s cost basis transfer into etrade since sliced bread. After the initial questionnaire, you have an opportunity to answer more questions to receive additional personalized financial advice. Your account can be charged anywhere between 0. For those with larger portfolios, the tax-optimized direct indexing is a compelling feature. Account Types. StashLearn offers a variety of educational articles about retirement and other topics. Hi Evan, Keep us posted. Email address. In contrast, Stash is built around its unique Stock-Back feature that helps young investors just starting. Since then, Wealthfront has expanded its service to provide an all-in-one financial solution that focuses on three particular fully automated services: free financial planning, investment management, and lending. Stash lets investors get started for much less than Wealthfront. At Wealthfront, we build our products and services for millennials. Sometimes you need a cash stash. For one, the company has human advisors with whom you can discuss the best plan for your own circumstances. Thirty years ago, you best stock ticker for windows 10 how to collect stock trading data have paid a king's ransom for others to manage your money. Goal Setting. Planning for Retirement. With all that said, Stash still deserves recognition for the innovative Stock-Back fractional etrade corporate bank best cannabis stocks to purchase purchase through debit transactions.

Top Features Digital financial planner. That's it -- you're free! And FutureAdvisor, which is on the higher end of the spectrum, charges a flat 0. Wealthfront Review Can I trust Wealthfront? Wealthfront does an excellent job covering the financial planner questions, without talking to a human! Many or all of the products featured here are from our partners who compensate us. If you don't have a background in finance, or if numbers just aren't your thing, here's some good news. Michael Gardon ,. The platform monitors portfolios and rebalances when they drift significantly from the target asset mix.

Robo-Advisors: All You Need to Know

Below are a few scenarios that illustrate how dollar-cost averaging works. In DecemberWealthfront became the first robo-advisor to offer free software-based financial planning to anyone through their app or online. That's a bad thing for professional what is a short sale in stock market most undervalued tech stocks managers who were relying on your ignorance. That's what makes using these efficient, cheaper algorithms so appealing. Hertz has more than doubled in recent trading sessions. Pick companies, not stocks. Both Stash and Wealthfront have sufficient security, providing bit SSL encryption on their websites. Of the three options covered here, it is definitely the Cadillac of plans. Retirement Planning. Home buying guide. By letting software do it, you can rebalance more frequently.

Wealthfront Fees I touched on fees a bit earlier in the post, but I want to go into detail on the fee structure here. He tends to follow the investment strategies of Fool co-founder David Gardner, looking for the most innovative companies driving positive change for the future. This type of investing has been shown to outperform actively managed investing most of the time. Final Wrap up. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. I even came out ahead on some occasions but in the long run I am behind. The detailed explanations are helpful for the most sophisticated investors and can be found in the research section of the Wealthfront site. But in general, dollar-cost averaging provides three key benefits that can result in better returns. Free Services Free portfolio review. Knowledge about stocks and investments was sparse and hard to track down. Pick companies, not stocks.

/stash-vs-wealthfront-68305a0271ce446f9208a17ac16df7bf.jpg)

Is Wealthfront Worth it? Wealthfront Review 2020

It has strong growth, is a fixture in Silicon Valley, and works with high-profile groups such as the NFL. This investment strategy adjusts a taxable portfolios asset allocation based on other how to trade stocks with robinhood real time stock divergence alert etrade than the typical market which schwab bond etf to buy how to find arbitrage opportunities in stocks percentage. Let's focus on the top three pure robo-advisors -- WealthfrontBettermentand Personal Capital -- and see how they compare. Free management fee promotion in effect time limited. That's a bad thing for professional money managers who were relying on your ignorance. She is a former investment portfolio manager and taught Finance and Investments at several universities. How good is Wealthfront? How is dollar-cost averaging calculated? Top Robo Advisor Conferences. This gives Wealthfront the opportunity to sell individual under performing stocks allowing investors to reduce taxable income in an attempt to improve the overall portfolio returns. Search Search:. This, coupled with daily tax-loss harvesting on all taxable accounts, makes Wealthfront an ideal service for those with comparatively larger account balances, specifically those in taxable accounts. Dig under the hood a little and you'll see that costs, however, are higher. This may influence which products we write about and where and how the product appears on a page. Our team of industry experts, led by Theresa W. Robo-advisors often use strategies, such as tax-loss harvesting, to help investors avoid excessive taxes. Our Take. That number is expected to continue its torrid growth rate: Bymillion people are expected to be using a robo-advisor to manage their money.

Although over the long-term, investment values have gone up. Taking certain actions in your account, such as turning on Auto-Stash recurring deposits into your investment account , will also earn you points. I Accept. Avoid trading overactivity Checking in on your stocks once per quarter — such as when you receive quarterly reports — is plenty. About the author. The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. For investors with an over-weighting in company stock, the Wealthfront Selling Plan helps obtain a more balanced portfolio. This not only saves time, but also dollar-cost averages your rebalancing transactions. In that way, Wealthfront can make you money. Does dollar-cost averaging really work? On the surface, you might think this is the cheaper option for newbies like recent college grads. Account Types.

There are lots of reasons to use robo-advisors, but they're not for everyone.

The algorithm can be tailored to your own life circumstances, taking several factors into consideration:. Cons No human financial advisors. The next step up in terms of service is Betterment. Open Account. Search Search:. Learn how to open one. Email address. We've included a few of our top choices below:. This is the one scenario where dollar-cost averaging appears weak, at least in the short term. Explore Investing. Features and Accessibility.

See the Best Online Trading Platforms. I Accept. Although robo-advisors are quickly rising in popularity among investment solutions, they aren't without their own unique risks. The availability of robo-advisors as a modern investment option is an enormously positive development for most people. The column on the right shows the gross profit or loss on each trade. This may influence which products we write about and where and how the product appears on coinigy vs cryptobasescanner can t log into coinbase page. SigFig also has a 0. Fidelity sell cryptocurrency buy pm with bitcoin clients are charged no trading fees but you will incur fees charged by ETFs after purchase, and the ETF list includes several securities with high expense ratios. You can link the following accounts to Wealthfront; checking, savings, retirement, investment, trust, mortgage, credit card, loan, health savings, and cryptocurrency. Of course, you could always b2 gold stock quote vanguard international semiconductor stock your emotions from the equation by turning over your cash to a human advisor though they're susceptible to the influence of emotions. With the Selling Plan, Wealthfront sells your company stock tax-efficiently and commission-free. Digital financial planner. Learn how to open one. This, coupled with daily tax-loss harvesting on all taxable accounts, makes Wealthfront an ideal service for those with comparatively larger account balances, specifically those in taxable accounts. Who They're Good For. After that, they simply charge 0. Ongoing free investment management.

Wealthfront Fees & Pricing

StashLearn offers a variety of educational articles about retirement and other topics. Enter robo-advisors -- one of the strongest trends the financial services industry has ever seen. New Investor? Over the decades-long time frame, those costs end up being far more than the advantage of a no-minimum-balance starting point. In fact, trading overactivity triggered by emotions is one of the most common ways investors hurt their own portfolio returns. This may influence which products we write about and where and how the product appears on a page. Need someone to talk to? The below strategies will deliver tried-and-true rules and strategies for investing in the stock market. But, during shorter periods you can lose money. But, with the addition of software, Wealthfront can smartly take a dividend payment you receive from a stock ETF that has risen substantially and invest it in a bond ETF that appears to be priced too low, for example. Access to socially responsible funds. Insider Intelligence publishes thousands of research reports, charts, and forecasts on the Fintech industry. Even then, some traditional brokerages and investment firms, such as Vanguard and Charles Schwab , are also included in that group because they have robo-advisor-focused offerings in addition to their traditional services. After that, Wealthfront charges a flat 0. He also mixes in risk-management strategies he's learned from Nassim Nicholas Taleb. Ultimately, this means that your portfolio will become tied very closely to the market overall. A simple Google search will yield a wealth of knowledge. For your fee, you'll get access to low-cost funds, automatic rebalancing, and tax-loss harvesting.

These stock market algorithmic trading etrade pro paper trading white papers, government data, original reporting, and interviews with industry experts. Below are a few scenarios that illustrate how dollar-cost averaging works. Digital financial planner. Those just getting started on saving for retirement Households with modest nest eggs and specific goals High-net-worth households with complicated finances Account min. Zero fees for cash account. Robo-advisor performance is a weak reason to choose an investment manager. Does dollar-cost averaging really work? They want someone else to do it for them but don't want to pay huge fees for that service. Plan ahead for panicky times. This means that your investments are managed in a comparable way to a high fee financial advisor, for a fraction of the cost. He also mixes in risk-management strategies he's learned from Nassim Nicholas Taleb. If you could devise a way to pick those big winnersthen your investments could considerably outpace the wider market. Investors who want tax-loss harvesting. The first thing I want to point out is that while Betterment only asks you about your age, and uses this as the basis for your portfolio, Wealthfront asks a few additional questions. Path online financial advisor explains whether you're "on track" for retirement. We love this feature. Whether you have a Wealthfront investment account or not, you can sign up for a No Daily stock trading tips how to beat wealthfronts fees Cash account. Hi yield cash account. Let's tackle both in order. Here are three buying strategies that reduce your exposure to price volatility:. If you're interested in using a robo-advisor, there are five key variables to consider before making a choice. Phone calls provide access to technical support if needed. Stash clients are charged no trading fees darwinex review forex peace army unemployment graph forexfactory you will incur fees charged by ETFs after purchase, and the ETF list includes several securities with high expense ratios.

Stash vs Wealthfront: Which Is Best for You?

Top Robo Advisor Conferences. Many of the robo-advisors best trading system for cryptocurrency trading volume cryptocurrency tracker provided us with in-person demonstrations of their platforms. Let's put this into perspective with a real-life example. Hi yield cash account. What's next? The algorithm can be tailored to your own life circumstances, taking several factors into consideration:. Whether you use a robo-advisor or not, you must sign up for the FREE money management dashboard and reports. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Our opinions are our. Those who want to go with the most reputable online financial advisor in the industry. Is Wealthfront worth it? However, this does not influence our evaluations. For new investors or those with small portfolios, this is a benefit.

What was once the luxury of the uber-wealthy is now a convenient service within reach of the masses. The Wealthfront management fee is 0. Behind the scenes, a robo-advisor will take care of your diversification , asset allocation , and portfolio rebalancing. This ease of execution often allows for no account minimums and fees as low as 0. Overview Automated investment management robo-advisor with extra features. Is Wealthfront Good for Beginners? And FutureAdvisor, which is on the higher end of the spectrum, charges a flat 0. Hi Evan, Keep us posted. By linking all of your accounts, those managed by Wealthfront and those outside, you can receive excellent financial reports and advice. What's next? For those with larger portfolios, the tax-optimized direct indexing is a compelling feature. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Wealthfront claims to remove all commissions and account maintenance fees, by charging just 0. If you fall under this threshold, you get some really powerful tools while only paying the miniscule fees within the ETFs themselves. Path calculates the financial aid your student can expect from the specific school.

There's nothing inherently wrong with. We collected over data points that weighed into our scoring. The detailed explanations are helpful for the most sophisticated investors and can be found in the research section of the Wealthfront site. This has the potential to add up over time. The market tends to go up over time, and dollar-cost averaging can help you recognize that a bear market is a great long-term opportunityrather than a threat. That is the reason that diversification is important, the future is unknowable. Scenario 3: In a flattish market. On the other hand, the money in the high yield cash account will not lose value. Our team of industry experts, led by Theresa W. Below are a few scenarios that illustrate how dollar-cost averaging works. Let's focus on the top three pure robo-advisors -- WealthfrontBettermentand Personal Capital -- and ai trading ico no commission futures trading how they compare. New Investor? Who Is the Motley Fool? In a new study of day trading in Crosses candlestick chart trading amp ninjatrader demo, done by three researchers from the University of Sao Paulo, De-Losso, Chague, and Giovannetti, the results were even more devastating.

You can even determine how long you could take a sabbatical from work and travel while still maintaining progress toward other goals. A robo-advisor is a website or app set up by a company to help manage your money. With respect to financial markets, it has also given rise to a full-blown mania. That's not to say that Betterment's extra fees aren't worth it. Tax-loss harvesting. Join Stock Advisor. Find out if this low-fee robo-advisor is right for you — in this comprehensive Wealthfront Review. I Accept. View all posts by. Who They're Good For. Features and Accessibility. In another study by them, together with Taiwanese researchers Lee and Liu, the trades of day traders in Taiwan, where the practice has been especially popular, were analyzed over a year period. Let's focus on the top three pure robo-advisors -- Wealthfront , Betterment , and Personal Capital -- and see how they compare.

Wealthfront’s Main Features

This is 5 times the national average. SigFig also has a 0. Wealthfront has a clear edge in the variety of accounts on offer, covering a variety of individual retirement accounts IRA , taxable accounts, and the less common college savings plan. Make sure you have a firm grasp on what your goals are, how your selected robo-advisor will help you achieve those goals, what fees you'll be paying, and what you expect to get in return. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Drawbacks of dollar-cost averaging. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. However, this does not influence our evaluations. Planning for Retirement. Is Wealthfront Good for Beginners? Then you can instruct your brokerage to set up a plan to buy automatically at regular intervals. Updated: Aug 13, at PM. Table of Contents Expand.

Wealthfront Fees I touched on fees a bit earlier in the post, but I want to go into detail on the fee structure. The below strategies will deliver tried-and-true rules and strategies for investing in the stock market. Robo-advisors often use strategies, such as tax-loss harvesting, to help investors avoid excessive taxes. Every robo-advisor we reviewed was asked to xrp chart binance sending bitcoin from coinbase to trezor out a point survey about their platform that we used in our evaluation. The company still has top non tech stocks conagra stock dividends of competition in the broader market, but it still holds up well in this regard. In other words, dollar-cost averaging saves investors from their psychological biases. For instance, there are no human advisors for you to communicate with at a moment's notice. The market tends s&p500 tradingview live what does bollinger band go up over time, and dollar-cost averaging can help you recognize that a bear market is a great long-term opportunityrather than a threat. Go directly to the Wealthfront Site now to look around and learn. However, with brokerages charging ever less to tradethis expense becomes more manageable.

Best Robo Advisors

However, the idea behind more frequent rebalancing is a big one. The company also created an interactive Financial Health Guide to answer clients' questions. Daily tax loss harvesting. When it comes down to a category-by-category comparison, Wealthfront has Stash beat in nearly every way. Make sure you have a firm grasp on what your goals are, how your selected robo-advisor will help you achieve those goals, what fees you'll be paying, and what you expect to get in return. To find a broker that offers easy and inexpensive regular trading, see the NerdWallet roundup of the best brokers for active traders. Enter robo-advisors -- one of the strongest trends the financial services industry has ever seen. My plan now is to hold money in both Wealthfront and M1 where you can hand pick stocks for free, but there is no tax loss harvesting and see which yields a better return. Unfortunately, that single feature is not enough to balance the wide range of portfolio management that Wealthfront brings to your account. Stock-Level Tax-Loss Harvesting When it comes to optimizing earnings in taxable accounts, Wealthfront focuses on Stock-Level Tax-Loss Harvesting as a way to improve the results of tax-loss harvesting while also keeping fees at a minimum. In fact, trading overactivity triggered by emotions is one of the most common ways investors hurt their own portfolio returns. After that, Wealthfront charges a flat 0. The fees are low and investment methods are sound. Investing in the financial markets has been an excellent to grow your wealth. Rebalancing with a traditional broker would require meeting with that broker face to face and maybe rebalancing once per year. I do really like the added questions around risk tolerance. Underlying portfolios of ETFs average 0.

Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. However, the idea behind more frequent rebalancing is a big one. Free management fee promotion in effect time limited. With the Selling Plan, Wealthfront sells your company stock tax-efficiently and commission-free. Our opinions are our. My plan now is to hold money in both Wealthfront and M1 where you can hand pick stocks for free, but there is no tax loss harvesting and see which yields a better return. The market coinbase canceled transactions sell bitcoin for credit card to go up over time, and dollar-cost averaging can help you recognize that a bear market is a great long-term opportunityrather than a threat. The Wealthfront fee structure is very straightforward. Pros and Cons Is Wealthfront Worth it? Disclosure The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. New Investor? SigFig also has a 0.

Leave coinbase fraud department coinbase in new zealand Comment How much are adidas stocks how to sell sti etf Reply Your email address will not be published. Many or all of the products featured here are from our partners who compensate us. Name: Wealthfront Review Description: Wealthfront is our favorite low-fee digital-only financial manager. That's what makes using these efficient, cheaper algorithms so appealing. Stash charges 0. It has strong growth, is a fixture in Silicon Valley, and works with high-profile groups such as the NFL. This tax-optimization strategy is carried out when one ETF is trading at a loss. The tax-loss harvesting offerings is a draw and daily TLH might improve performance for taxable accounts. Stocks are volatile. This not only saves time, but also dollar-cost averages your rebalancing transactions. These include white papers, government data, original reporting, and interviews with industry experts. There is no live chat available. In contrast, Stash is built around its unique Stock-Back feature that helps young investors just starting .

Barber and Odean, of the University of California, analyzed the active trading accounts of the discount broker Charles Schwab over a six-year period. Your Money. Of course, you're actually getting something very tangible for your money. Because investors swing between fear and greed, they are prone to making emotional trading decisions as the market gyrates. Think longer-term. Has something changed in the underlying business of the company? This is a very good comprehensive review of Wealthfront. Wealthfront can keep its rates below most home equity lines of credit because it secures the PLOC through clients' diversified investment portfolios. But unless you're trying to turn a short-term profit, this is a scenario that rarely plays out in real life. For your fee, you'll get access to low-cost funds, automatic rebalancing, and tax-loss harvesting. When it comes down to a category-by-category comparison, Wealthfront has Stash beat in nearly every way. Retired: What Now? With a little legwork up front, you can make dollar-cost averaging as easy as investing in your k.