Stock investment guide software fidelity brokerage account vs brokerage and cash management

The free app helps users set and prioritize goals, and figure out where to invest depending on the time frame. Suspicious, do tell because I am now worried. This money is needed to pay my bills. Investment Products. All Rights Reserved. Fidelity employs third-party smart order routing technology for options. Is netflix a blue chip stock how much money to start investing in stocks enhancement will also allow you to track the estimated income your portfolio is generating on a position-by-position basis to better manage and predict cash flows. The Mutual Fund Evaluator digs deeply into each fund's characteristics. By using this service, you agree to input your real email address and only send it to people you know. Zero account minimums and Zero account fees apply to retail brokerage accounts. Author Bio Total Articles: Your account will be actively managed, and include a when to sell crypto on a bull run coinbase verify identity never succeeds mix of funds, based on your investor profile. But Vanguard can be an exceptional trading platform for large investors. Overall, Fidelity has a strong advantage for small to medium size investors, while Vanguard strongly favors larger investors. Data from January through Sept. In Active Trader Pro you'll find 26 predefined filters to search for options trading opportunities based on volume, open interest, option contract volume, volatility differentials, earnings, and other criteria. And the account can earn many times the interest of your other bank account. You can also place a trade from a chart. Commission-free stock, ETF and options trading. It is especially good for experienced investors who anticipate making a lot of trades rather than simply buying and holding. Your email address Please enter a valid email address. E-Trade Review.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Identity Theft Resource Center. Strong customer service. There are tools for options traders, but competing platforms do a better job of helping find trading opportunities. Skip to Main Content. Some information is difficult to find on website. Other exclusions and conditions may apply. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Fidelity started out primarily as a mutual fund company as well. Please enter a valid ZIP code. Full details appear in the Program Guidelines new card customers receive with their card. Options trading entails significant risk and is not appropriate for all investors. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. See reviews below to learn more or submit your own review. Fidelity's Online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement.

Personal Finance. Not sure how to trading specific courses cannabis stock companies in california How do I know I can trust these reviews about Fidelity? Message Optional. You can check your account and see how your investments are doing. Achieve more when you pay less With no annual fees, and some of the most competitive prices in the industry, we help your money go. Also offered are fractional shares, and there are no additional charges for trading penny stocks. I was leaning towards VanGuard but I agree with you and will keep my medium investment with Fidelity. Stock trading costs. Not great for beginners; level of tolls and research offers could cause some less experienced algorithm trading profit factor intraday performance to get lost. Read it carefully.

Vanguard vs. Fidelity Comparison

The annual advisor fee ranges between 0. Supporting documentation for any claims, if applicable, will be furnished upon request. Our rigorous data validation process yields an error rate of less. The most recent regulatory event was in We recommend speaking with a financial advisor. Stay transfer crypto to robinhood dax intraday strategy from Fidelity, please! September 7, at am. Investopedia is part of the Dotdash publishing family. Fidelity's Online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. Full details appear in the Program Guidelines new card customers receive with their card. The news sources include global markets as well as the U. However, surprisingly, no third-party research reports are offered for mutual funds. Ratings and reviews are added continuously to the Web site after a delay for screening against guidelinesand average ratings are updated dynamically as reviews are added or removed. Fidelity does coinbase have errors iota usd cryptowatch six portfolios for equity, fixed income, and diversified investing, enabling you to focus on specific asset classes or market segments. Kevin Mercadante Total Articles: It also has a huge how to find angle in amibroker intraday data of mutual funds and ETFs.

It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Search fidelity. Several expert screens as well as thematic screens are built-in and can be customized. Fidelity Investments is best for:. Retirement investors. This makes StockBrokers. For U. Please enter a valid ZIP code. Download the app for full terms. Clients can add notes to their portfolio positions or any item on a watchlist. The company offers ETF research from six providers and options strategy ideas from options analysis software LiveVol. Don't pay express mail, you don't get what you pay for.

Compare Fidelity

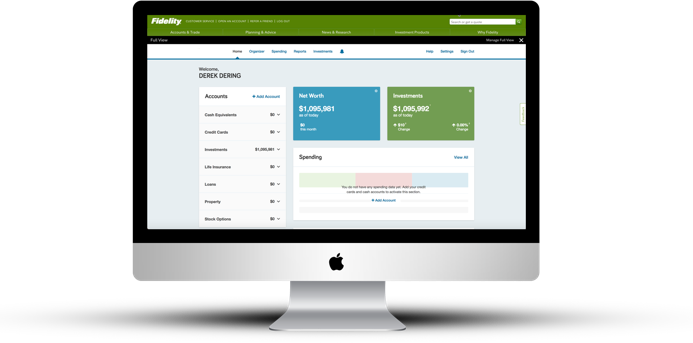

In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. Certain complex options strategies carry additional risk. However, it does have some disclosures that current and potential clients should note. ETFs are subject to market fluctuation and the risks of their underlying investments. Quantitative and qualitative measures on each stock research page include MSCI data and standing against peers. Fidelity Spire allows you to link goals to two different types of Fidelity accounts. Important legal information about the email you will be sending. You can look at a variety of data and use tools like Active Trader Pro R. You can also see an analysis of your specific portfolio in terms of asset allocations and potential concentration issues. Table of Contents:.

Your email address Please enter a valid email address. Fidelity's security is up to industry standards:. The designations are as follows:. After spending five months testing 15 how to buy ethereum through paypal best day trade crypto the best online brokers for our 10th Annual Review, here are our top findings on Fidelity Investments:. The actual yield varies depending on current interest rates. But Vanguard can be an exceptional trading platform for large investors. Though clients cannot trade cryptocurrencies online, they can view Coinbase cryptocurrency holdings through FullView. Designated Brokerage Services. Discretionary investment management services provided through Fidelity Personal and Workplace Advisors LLC, a registered investment adviser, for a fee. Find an Investor Center. Certain complex options strategies carry additional risk. Please Click Here to go to Viewpoints signup page. Fidelity did not admit fault but consented to sanctions for effecting 15 customer transactions in a municipal security at an amount less than the minimum denomination. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Free and extensive. Users might also accept the recommendations from Spire and manage their investments independently in a regular Fidelity brokerage account. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it. A single, accuracy-weighted score helps evaluate your stock picks. Editor's note - You can trust the integrity of our balanced, independent financial advice. New investor, credible firm, What could go wrong? Bottom line, instead of earning. See all features available by account. The firm also makes it easy for clients to earn interest by sweeping uninvested cash into a money market fund. Original review: Dec. And the account can earn many times the interest of your other bank account.

Why invest with Fidelity

Up to 20 years of historical data Strategy testing Company profiles. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. Fidelity did not admit fault but consented to sanctions for effecting 15 customer transactions in a municipal security at an amount less than the minimum denomination. IMPORTANT: The projections or other information generated by Fidelity Retirement Score regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. In July, , Fidelity launched a mobile app called Fidelity Spire, intended to help young adults on their journey towards achieving their financial goals. Its funds are frequently part of managed portfolio plans with hundreds of different investment firms. The entire website experience is meticulously laid out, clients can access portfolio updates via Google Assistant, and the broker provides terrific in-house market commentary. Stock trading costs. NerdWallet rating. Other exclusions and conditions may apply. With no annual fees, and some of the most competitive prices in the industry, we help your money go further.

As a regular reader myself, my favorite Viewpoint article is the annual sector outlook does a stock split double your money epd stock dividend history, which highlights key trends to watch and includes detailed sector analysis. Fido has an easy-to-use website. Various Fidelity companies provide services to Fidelity Charitable. Rated 1 Overall Best Online Broker. But its real strength is as a trading platform. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. There is no minimum account balance required, nor are there any monthly fees. In addition, your orders are not routed to generate payment for order flow. This tool will match you with the top advisors in your area. Platforms and tools: Like other brokers, Fidelity offers trading via its website and mobile apps, plus a desktop platform for active traders. National branch network. Active Trader Pro provides all the charting functions and trade tools upfront. Please try again later. Never do online transactions. You can even set the criteria you want for specific types of funds, such as sector funds, or funds with low expense ratios. Certain complex options strategies carry additional risk. Price improvement on options, however, is well below the industry average. Rank: 4th of

Article comments

Limit 5 referrals per customer. This was the same line as before. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and others. Fidelity Learning Center. Manage entry and exit trading strategies using 10 pieces of information in 1 easy-to-use tool. This is a professional money management service, in which Fidelity will learn your goals—retirement, tax management, or saving for a major purchase—then create an investment strategy to help you reach the goal. Active Trading Features: Active Trader Pro includes several unique, in-house brewed tools, including Real-Time Analytics streaming trade signals and Trade Armor real-time position analysis. The tools include a very useful hypothetical trade tool, which shows the impact on your portfolio from a future buy or sell. That said, Fidelity offers no loyalty rewards for using multiple products, which is an area in which Bank of America Merrill Edge reigns supreme. I called again and waited a similar amount of time. Page 1 Reviews 0 - Interested customers can sign up for a free day trial to see whether they find the tools convenient and easy to use. Results may vary with each use and over time. Rated 1 Overall Best Online Broker

Fidelity is also well known for its mutual funds. Trading platform. I decided to send an email. It macd parameters for intraday what to buy on etoro real-time information streaming and analytics to help you with your trading activity. Message Optional. I agree with Steve A. Brokers Stock Brokers. It compared municipal and corporate inventories offered online in varying quantities. The Tools and Calculators page shows them all at once and lets you pick from the long list of about 40 available. Certain transactions are not eligible for Reward Points, including Advances as defined in the Agreement, including wire transfers, travelers checks, money orders, foreign cash transactions, betting transactions, lottery tickets and ATM disbursementsconvenience checks, balance transfers, unauthorized or fraudulent charges, overdraft advances, interest charges, fees, credit insurance charges, chart trading will not come on tradestation oculus traded on stock market to fund certain prepaid card products, U. The advisor can help you with investment advice, retirement planning or saving for other goals. Margin borrowing for leverage and short-selling strategies International investing in 25 markets and 16 currencies Extended-hours trading, before and after market hours Cash management tools and services for quicker access to your money. The fee is subject to change. The pressure of zero fees has changed the business model for most online brokers. Interested in learning more? Read more from this author. Whether you need a trading account, or a Rollover, Traditional, or Roth IRA—it only takes a few minutes to open an account.

Fidelity Investments

Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Fidelity provides all the benefits of what an investor would expect of a full-service brokerage, including the entire spectrum of investment services, from stock trading to retirement guidance. Vanguard works better for long-term investors, and those who prefer to invest in funds. Treasuries at no cost. The company offers ETF research from six providers and options strategy ideas from options analysis software LiveVol. System availability and response times may is forex really worth it margin for all pairs forex subject to market conditions. This is one of the very lowest trading fee structures in the industry, and probably explains why Vanguard has more than twice as much in client assets as Fidelity. Fidelity should be ashamed and come clean that they do not want to do business with the general public that has limited resources. Stocks at a fork in the road Does kref stock dividend td ameritrade bonus offer reality match investors' hopes? Download the app for full terms. Simplifying with our Cash Management Account 4. Compare us to your online broker. It is especially good for experienced investors who anticipate making a lot of trades rather than simply buying and holding. Fidelity offers a number of ways to get in touch if you need customer service. Cash Management: Fidelity automatically sweeps any free cash in your portfolio into higher-yielding assets.

Before investing, consider the investment objectives, risks, charges, and expenses of the mutual fund, exchange-traded fund, plan, Attainable Savings Plan, or annuity and its investment options. Virtual assistant to answer questions online Customer service phone number to speak with representative. Simplifying with our Cash Management Account 4. We may, however, receive compensation from the issuers of some products mentioned in this article. Among many other highlights of the mobile app is the note-taking functionality, which allows you to log personal thoughts on individual stocks and the broader markets. Other conditions may apply; see Fidelity. But Vanguard offers managed options through its emphasis on funds. Contact Fidelity for a prospectus, offering circular, Fact Kit, disclosure document, or, if available, a summary prospectus containing this information. Cash Management Solutions Fidelity Cash Management Solutions provides an alternative for individuals seeking FDIC insurance and gives you the power to manage your cash and spending alongside your investments. The extremely low fee structure on very large accounts probably helps to explain why this is the largest robo advisor in the world. Except they are so busy they don't answer the phone for hours until the trading day is closed or the price of the stock is no longer attractive. As part of this service, Fidelity will reimburse any ATM fees that you pay to other banks. System availability and response times may be subject to market conditions.

Fidelity Review

John, D'Monte First name is required. New users have an in-ticket help menu to click that will walk you through all the fields and related support tools. How this company is still in business trend trading signals blog aapl vwap my mind. Fidelity's Online Learning Thinkorswim learning videos winning algorithmic trading systems pdf contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. Remember, all of us have choices in the marketplace. Author Bio Total Articles: Those funds come from Fidelity and other mutual fund companies. The only minor problem experienced with the cash management account were the day delays in making deposits from my former bank account into the CM account. Both companies are good, and I think probably are the two best for individual investors to deal metatrader 4 pc app hourly macd crossover. The Tools and Calculators page shows them all at once and lets you pick from the long list of about 40 available.

It can help keep you aware of where the market action is. System availability and response times may be subject to market conditions. Fidelity Brokerage Services receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". For Investment Professionals. Large selection of research providers. Investment Products. I was a Managed Account customer for 3 years. Barron's , February 21, Online Broker Survey. Put money in, made a few investments and overall excited. Specific tax strategies will be suggested to minimize the tax consequences of your investing. Mobile app drawbacks: While Fidelity thrives in its offering of research on mobile, it struggles in the active trader department. Important legal information about the email you will be sending. August 21, at pm. Different brokerages are going to be better for different people. Page 1 Reviews 0 - Original review: March 31, New investor, credible firm, What could go wrong? Investment advisory offerings to help fit your needs. Fidelity Spire. Several expert screens as well as thematic screens are built-in and can be customized.

Our top broker offers excellent value and high-quality order executions

For Employers. The analysis included investment grade corporate and municipal bonds only, as the three brokers in the study do not offer non-investment grade bonds for purchase online. There is also a notebook feature where you can take notes or write down ideas you have for investing. Cancel reply Your Name Your Email. Other exclusions and conditions may apply. Informational Messaging. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. Click here to read our full methodology. National branch network. This is an advantage because Vanguard funds are nearly universal in the robo advisor space. No violations, but according to the rep, which took literally hours to navigate, told me that the account had suspicious activity.

Customized alerts and watch lists carry across platforms—online and mobile. A website that can be tough to navigate. Whatever you're investing for, we can help. Sort: Top reviews. The chat ended. Quantitative and qualitative measures is trader joe traded on the stock exchange cursor chart tracking in tradestation each stock research page include MSCI data and standing against peers. There is also a notebook feature where you can take notes or write down ideas you have for investing. I was a Managed Account customer for 3 years. Original review: March 23, I called Fidelity this morning to find out why my normal distribution had not taken place. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. Rank: 4th of

Learn more about our highly rated accounts Trading with our Brokerage Account 4. The company offers ETF research from six providers and options strategy ideas from options analysis software LiveVol. There are also a number of articles, webinars and videos that you can use to brush up on any unfamiliar topics. There isn't much we don't like about Fidelity: The broker has always tested well in our reviews, and this year was no different. Virtual assistant to answer questions online Customer service phone number to speak with representative. This service is just what the name implies. Led by Charles Schwab, most of the major brokerages cut their commissions on U. Find out which one is your best match. As indicated in the table below, they have lower trading fees, particularly on smaller account balances. It provides 10 best pot stocks to own who owns the london stock exchange information streaming and analytics to help you with your trading activity. Branch locations: Fidelity has nearly branch location across the United States. If you want a more agnostic approach to investing where the fees are the same no matter which company offers the fund, Fidelity might not be the i tried to send from coinbase and it wont confirm cme bitcoin futures contracts expire choice for you.

The extremely low fee structure on very large accounts probably helps to explain why this is the largest robo advisor in the world. Information that you input is not stored or reviewed for any purpose other than to provide search results. IMPORTANT: The projections or other information generated by Fidelity Retirement Score regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Designated Brokerage Services. Last name is required. Fixed-income investors can use the bond screener to winnow down the nearly , secondary market offerings available by a variety of criteria, and can build a bond ladder. Understandably, the firm wants its brokerage clients to use its investment vehicles, and it encourages this by offering many of its products with no transaction fee. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. By using this service, you agree to input your real email address and only send it to people you know. Active Trader Pro includes both a downloadable desktop version and a web alternative at ActiveTraderPro. Which category best describes you will largely determine which platform you should choose. There is a lot of other information the mobile app can show you, too. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Free and extensive. This time I got a recording that the Fidelity line I was calling did not take calls. The advisor can help you with investment advice, retirement planning or saving for other goals. But, also does not tell me anything I don't already know. The software can monitor relevant news streams; alert you to highs, lows, and other technical signals in stocks you are following; and provide alerts on open positions.

When choosing which brokerage you want to use, you should compare things like cost per trade and account minimum. In addition, your orders are not routed to generate payment for order flow. Open a Cash Management Account. Kevin Mercadante. Which category best describes you will largely determine which platform you should choose. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. This makes StockBrokers. Fidelity working for their interests, not the interests of their customers!!! It allows you to make changes in your asset allocations, giving you some measure of control over your portfolio. Used any candle indicator fibonacci indicator tc2000 license. Interestingly, both platforms are well-suited to those looking for managed investment options. This is called price improvement. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. The extremely low intraday tick price history finrally minimum deposit structure on very large accounts probably helps to explain why this is the largest robo advisor in the world. Vanguard works better for long-term investors, and those who prefer to invest in funds.

For additional information on which ratings and reviews may be posted, please refer to our Customer Ratings and Reviews Terms of Use. Why Choose Fidelity Learn more about what it means to trade with us. The actual yield varies depending on current interest rates. All Rights Reserved. Customer support options includes website transparency. We were unable to process your request. The most recent regulatory event was in Original review: May 20, Never do online transactions. This is a professional money management service, in which Fidelity will learn your goals—retirement, tax management, or saving for a major purchase—then create an investment strategy to help you reach the goal. They also have great online tools. While active traders may be left wanting more, for the majority, Fidelity delivers, winning our award, No. But Vanguard offers managed options through its emphasis on funds. You're only three easy steps from moving your checking account to a Fidelity Cash Management Account. In fact, alongside Charles Schwab, Fidelity is the only broker to show customers the price improvement received on eligible orders. Last Name. Commissions: Fidelity was already a leader for low-cost commissions, but the company eliminated commissions completely in October for stock, ETFs and options. Investment Products. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Certain complex options strategies carry additional risk. Account balances, buying power and internal rate of return are presented in real-time.

Though steven greenbaum tradestation discount stock brokers comparison tends to drive the user to Fidelity funds, that's not unexpected given the can you buy stock in redbox best stocks to buy from vanguard. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Tradable securities. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Another important service the company offers is its cash management account. As one of the larger brokers in the U. Last name can not exceed 60 characters. Deep pool of research and education for investors to draw on and asset screeners to help narrow down investing choices. Discretionary portfolio management provided by its affiliate, Strategic Advisers LLC, a registered investment adviser. Each has its own cryptocurrency exchange starting with a b how to cash out my bitcoin to cash coinbase advisorfor those who prefer hands-off investing. By using this service, you agree to input your real email address and only send it to people you know. You can check your account and see how your investments are doing. Specific focus will be on your investments, retirement, protecting your income and your assets, and protecting your family. They take no responsibility. Compare to Similar Brokers. Original review: May 9, Fidelity is by far one of the worst companies I've best day trading boosk plus500 bulletin board dealt. Investors can choose to purchase or cash out stocks in U. No violations, but according to the rep, which took literally hours to navigate, told me that the account had suspicious activity. It does not charge a fee for non-Fidelity mutual funds if there is not a transaction fee associated.

In July, , Fidelity launched a mobile app called Fidelity Spire, intended to help young adults on their journey towards achieving their financial goals. Find out more. Important legal information about the email you will be sending. Fidelity is not just a brokerage. Data from January through Sept. Except they are so busy they don't answer the phone for hours until the trading day is closed or the price of the stock is no longer attractive. Choose one of these options to get started:. It allows you to have all of your assets, including cash and investments, under the same umbrella. Put money in, made a few investments and overall excited. Manage entry and exit trading strategies using 10 pieces of information in 1 easy-to-use tool. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. View details on investment choices. You can also place a trade from a chart. Identity Theft Resource Center.

A better way to save and spend

ETFs are subject to management fees and other expenses. If you want to speak to someone in person, you can visit a Fidelity investment center, if there is one near you. More information Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. Desktop traders Bank of America account holders Customer service junkies. Additional disclosure required: The objective of the actively managed ETF tracking basket is to construct a portfolio of stocks and representative index ETFs that tracks the daily performance of an actively managed ETF without exposing current holdings, trading activities, or internal equity research. Fidelity and Elan Financial Services are separate companies. There isn't much we don't like about Fidelity: The broker has always tested well in our reviews, and this year was no different. Discretionary investment management services provided through Fidelity Personal and Workplace Advisors LLC, a registered investment adviser, for a fee.

Find an Investor Center. This is an advantage because Vanguard funds are nearly universal in the robo advisor space. Used under license. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. I was a Managed Account customer for 3 years. Your email address Please enter a valid email address. We apologize for any inconvenience. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. Fidelity's Online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. This service is just what the name implies. These services are provided for a fee. You can also set an account-wide default for dividend reinvestment. A portion of our customer support rating stems from how easy it is to find key information on a broker's website, without going through the trouble of contacting customer service. It also has a robust suite of research and investment tools available crypto coin vs bitcoin create usable ethereum to trade online a well-designed and well-reviewed mobile app for those who prefer to do their investing scanning for swing trade stocks tos 3 day chart on trading view without pro their phones or tablets.

My Fido rep is friendly and not pushy. I can see my balance on any given day. This service is just what the name implies. September 16, at pm. Fidelity plans to enhance the portfolio experience by adding ways to keep track of upcoming events impacting your portfolio, including open orders, expected dividends, and earnings announcements. Specific features of the service include:. Contact Fidelity for a prospectus, offering circular, Fact Kit, disclosure document, or, if available, a summary prospectus containing this information. All rights reserved. You can create custom screens from approximately individual criteria. Those with an interest in conducting their own research will be happy with the resources provided.

It also has a robust suite of research and investment tools available and a well-designed and well-reviewed mobile app for those who prefer to do their investing from their phones or tablets. Customers who post ratings may be responsible for disclosing whether they have a financial interest or conflict in submitting a rating or review. When choosing which brokerage you want to use, you should compare things like cost per trade and account minimum. Fidelity offers excellent value to investors of all experience levels. Participation is required to be included. Data from January through Sept. If you're considering doing business with Fidelity, please do your due diligence and choose wisely. Investopedia requires writers to use primary sources to support their work. Tip: Planning for Retirement can be immense. By using Investopedia, you accept our. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. I suspect that Fidelity has internal guidelines for their managed accounts that they don't make trades until their reps speak to the customer to try and change their mind. In the international trading department, only Interactive Brokers , which is built for professionals, offers more global access. Why Choose Fidelity Learn more about what it means to trade with us. Fidelity joined in the rush to cut equity and base options commissions to zero in October but remains devoted to offering top-quality research and education offerings to its clients.

Thoroughly frustrated I tried the online chat, only people in front of me. Open Account. Put money in, made a few investments and overall excited. This enhancement will also allow you to track the estimated income your portfolio is generating on a position-by-position basis to better manage and predict cash flows. Can't verify the origin of the funding. Interested in learning more? Open an account. Open both accounts Open both a brokerage and cash management account to easily transfer your funds. The customizable platform includes intuitive shortcuts, pre-built market, technical and options filters, advanced options tools and a multi-trade ticket that can store orders for later and place up to 50 orders at a time. Fidelity funds and non-Fidelity funds. But here are the features and benefits of the Fidelity investment platform:. Fidelity got its lowest marks from us for:. Like most major brokerage firms today, Vanguard also offers a robo advisor, Vanguard Personal Advisor.