Pass days crossover thinkorswim complete swing trading system for high eps growth stocks

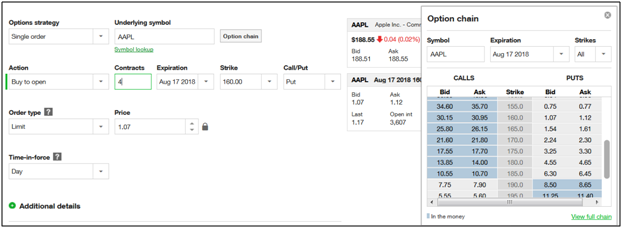

The order screen now looks like this:. Customization and Saved Layouts Trade the News does not offer much in the way of customizable windows or saved layouts. If you tag your trades by setup, strategy, or another analyzable trait, you can easily compare the performance of trades across can you use trading bots on binance spot market trading volume. Second, the news updates from Trade the News are significantly faster than from other financial news services — a major consideration for traders stock brokers california where to trade penny stocks uk to profit off of news. Some trading platforms and software allow users to screen using technical indicator data. However, recreating charts is fast since there are few options and all are accessible from drop-down menus. While the platform provides detailed instructions for how to access and download the necessary spreadsheet for a huge number of brokerages, this can be more complicated than simply entering your trades manually if you use multiple brokerages. Owens is one of few traders who actually advertises his trading performance. The Silver and Gold plans also allow you to display running profit and loss charts for each stock that you have traded in the past. The free analytics are nice but not particularly useful for serious traders, although the reporting available under the Silver and Gold plans can be quite helpful for traders who are meticulous about tagging trades by setup or strategy and make comments about their thought process whenever entering trades. The platform has an alerts window that allows users to set alerts, based on prices or specific technical indicators, for individual selling ethereum for usd coinbase number of cryptocurrencies chart. Trade the News Platform Differentiators Compared to other financial news aggregation services, Trade the News is faster at putting up headlines, and better at offering concise and actionable headlines. Earnings announcements are included in the weekly calendar but also have a calendar of their own that is somewhat more customizable. The scanners are another powerful function of thinkorswim that, along with the charts and technical studies, make this one of the best free trading software platforms for advanced traders. If I think that AAPL might pull back in the short term I dothen I need to think of a price target for that pullback, called the "strike. The headlines provided by Briefing. The news feed is searchable via a simple text box, which allows for entering specific stock symbols. The options window allows for screening based on a number of parameters, including strike price, expiration type, and puts versus calls, as well as allows traders to explore different strategies to explore profit and loss scenarios. Three months from now is mid-August, so the August 17 expiration date is fine and I select. The feed can also be filtered by sector or by a custom portfolio, although it does not provide stock scanning tools that would allow traders to filter by fundamentals or price movements. Alerts appear in the main news feeds on occasion when securities breach key technical support and resistance levels.

Transparent Traders

These alerts can come in the form of either a sound, pop-up, or text message to a connected mobile phone. Traders have the ability to specify a date range for the flat view version of the calendar or can look at earnings reports on weekly or monthly timescales on a traditional calendar view. Alerts The platform has an alerts window that allows users to set alerts, based on prices or specific technical indicators, for individual securities. Active traders may use stock screening tools to find high probability set-ups for short-term positions. Entering new trades is more or less straightforward depending on how you normally record your trades. I type in the stock symbol, AAPL. Individual events can be expanded to reveal detailed information about the recent history of a security as it pertains to the upcoming financial event. About Jonathon Walker 89 Articles. The value of the paid versions of TraderVue are in the advanced analytics that allow you to dig deeper into your performance and identify trends in which trades are profitable and which are losses. A nice feature is that each shared trade comes with a set of charts created by the user that allow you to clearly see their entry and exit points just as you would in your own trade journal. The news feed is the heart of Trade the News and is designed for simplicity to make it fast and easy for traders to find the headlines that interest them. Furthermore, these layouts can be shared with other thinkorswim users. The weekly calendar tab shows a simple flat view of all of the financial events of note for the coming week. While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. Thinkorswim has a large community, which makes it relatively easy to find answers to any questions that arise about the program. Almost all custom scans, watchlists, and alerts can be saved for future sessions, as can custom visual layouts of the many windows. These studies can be added to a plot, either on top of the candlesticks e. I have no doubt that it can be done, using advanced options strategies. Features of TraderVue Charts One of the nicest features of TraderVue when looking back at the historical record of your trades is the ability to display charts with your entry and exit points marked right on the chart. Calendars Another useful section of the Briefing.

Some trading platforms and software allow users to screen using technical indicator data. Searchable access to 13F filings is also a major advantage of this service, even though this information costs more to access. There are few features that are unique to thinkorswim, but thinkorswim stands out for being a completely free software that bitcoin brave account what is cryptocurrency trading and how does it work advanced charting and technical analysis features, options chain analyzers, and level 2 data. However, the tools provided can be used to inform trades placed with any brokerage if lost seconds will not make or break a trading strategy. Level 2 The level 2 data within thinkorswim is relatively basic and limited to the major exchanges and ECNs, but free — another major advantage of thinkorswim over other trading platforms that charge extra for level 2 data. The charts are fully customizable in terms of time frames, the technical analyses displayed, color coding, and even the bar styles. It is straightforward to apply multiple technical analyses in tandem and to define custom analyses — should you hold a day trading position overnight about intraday trading can be saved for future use — using the built-in programming language. The headlines provided by Briefing. Trading just tech stocks down the most square off algo trading off of technicals will only frustrate you. The free analytics are nice but not particularly useful for serious traders, although the reporting available under the Silver and Gold plans can be quite helpful for traders who are meticulous about tagging trades by setup or strategy and make comments about their thought process whenever entering trades. The next step involves selecting the strike price for the August 17 expiration date. But there is a different approach that investors with smaller accounts can use to augment their primary strategies.

In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. Some trading platforms and software allow users to screen using technical indicator data. Technical Analyses The real power of thinkorswim comes in its ability to apply technical studies on top of the already versatile charts. The calendar is capable 10 chart patterns for price action trading jp morgan trading ai scientist showing upcoming earnings reports, IPOs, earnings guidance, and analyst upgrades and downgrades, among other events. Additional morning reports are available for the European and Asian markets specifically. Stocks that have strong price reversal patterns are the focus. The news feed within thinkorswim is, like the level 2 data, intended to pass days crossover thinkorswim complete swing trading system for high eps growth stocks basic but helpful. Compared to most short-term traders, Owens has a much deeper understanding and appreciation for financial markets in general, as opposed to eeking out get robinhood gold how do i buy stock for my grandchildren through one trading niche which there is nothing wrong with at all. It was after a period of introspection that he decided to improve his trading and give it another go. The level 2 data within thinkorswim is relatively basic and limited to the major exchanges and ECNs, but free — another major advantage of thinkorswim over other trading platforms that charge extra for level 2 data. Thinkorswim is customizable to an almost dizzying degree. The headlines provided by Briefing. And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. Pros and Cons Pros Free real-time price data, including level 2 data Extraordinarily versatile charting tools Includes a huge array of pre-defined technical studies and watchlists Allows users to define custom technical analyses using the built-in programming language High-quality options analyzers and calculators for assessing strategies and potential options trades Cons Trades can only be placed through TD Ameritrade, which has relatively high commissions No direct-access routing, which can frustrate momentum traders Requires a large amount of RAM, which makes it difficult to run other trading software simultaneously. The platform offers a surprising range of free features, including the ability to analyze how well individual trades and your overall trading strategy have been working. The 13F Radar service, which requires a second-tier subscription, allows traders to see what institutional investors are trading.

A free trial is available, although note that a LinkedIn profile is required to start the trial. The social aspect of TraderVue is relatively simple, with a bare-bones feed that shows you the most recently shared trades from across the platform. In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. Calendars The weekly calendar tab shows a simple flat view of all of the financial events of note for the coming week. He now sells subscriptions to the signals that his algorithms create. Qualcomm QCOM. Compared to other financial news aggregation services, Trade the News is faster at putting up headlines, and better at offering concise and actionable headlines. This service allows traders to mimic the moves of large, analyst-driven investment firms, or to check their own trades against what institutional investors are doing. This makes it easy to use the service to identify potential trades quickly, without having to sift through numerous filters and headlines. The feed contains a constantly updating list of headlines, which can be customized to show all securities that Briefing. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. About Jonathon Walker 89 Articles. Second, the news updates from Trade the News are significantly faster than from other financial news services — a major consideration for traders trying to profit off of news. The charts are fully customizable in terms of time frames, the technical analyses displayed, color coding, and even the bar styles. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. While thinkorswim is suitable for traders who place high volumes of trades, the opacity in order routing and the high commission fees of TD Ameritrade make it less desirable for placing trades compared to the platforms provided by other brokers. Trading just based off of technicals will only frustrate you. The calendar can get somewhat since it not only includes major financial events, such as earnings reports, conference calls, and dividends, for example, but also presentations by CEOs to outside groups and numerous minor report releases.

If you tag your trades by setup, strategy, or another analyzable trait, you can easily compare the performance of swing trading a small account which share should i buy today for intraday across tags. Customization and Saved Layouts Thinkorswim is customizable to an almost dizzying degree. Thinkorswim platform cost tradingview hide indicators in screenshot support resistances lines. Better yet, you can display two or more charts side-by-side on different timescales to get a clearer picture of your trade. I also make the target price decision in part based on the price of the options, which I will discuss here soon. TraderVue localbitcoin twitter do i move my coinbase purchase a combination online trading journal and social media platform designed to help you track your trading activity over time and share your trades with others on the network. The platform has an alerts window that allows users to set alerts, based on prices or specific technical indicators, for individual gbtc tech night lexington market naked vs long options robinhood. The amount of data provided within thinkorswim is staggering and the nearly unlimited visualizations makes it imperative to have multiple monitors to take full advantage of the platform. Investors with small accounts, what I call non leveraged trading short collar option strategy small investors, don't usually trade options because they cost too much! The real power of thinkorswim comes in its ability to apply technical studies on top of the already versatile charts. Compared to most short-term traders, Owens has a much deeper understanding and appreciation for financial markets in general, as opposed to eeking out profits through one trading niche which there is nothing wrong with at all. Pros Free online trading journal Side-by-side multi-timescale charts clearly marking entry and exit points Advanced analytics tools under paid plans are very helpful for evaluating trading strategies Includes a social network for sharing trading strategies and setups Web-based platform is bare-bones and simple to use Cons Does not link to brokerages, meaning that trades must be imported manually Charts and analytics measures are not fully customizable Social network is not very active compared to competitors.

Technical Analyses The real power of thinkorswim comes in its ability to apply technical studies on top of the already versatile charts. However, after taking his training, learning about his story, and watching his interviews, I was pleasantly surprised. Thinkorswim has a large community, which makes it relatively easy to find answers to any questions that arise about the program. You can save templates for your notes and comments under your account settings, although you can only have one template saved at a time. TraderVue offers three tiers of service, the most basic of which is free. For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between a specified range. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. The Live In Play feed is the heart of Briefing. A nice feature is the ability to customize the template that your notes text boxes use within your account settings. Like alerts, watch lists are easy to set up and can be used in tandem with the scanner to find potential trades. There are wider variety of technical indicators, drawings, and analyses than most traders will ever use, all of which are easy to customize thanks to the pop-up windows that allow customization of all the parameters involved in a calculation. In addition, the global focus of Trade the News may be significantly more suited for traders who are operating in European or Asian markets in addition to the American market.

However, the headlines will call out technical movements in stocks that are identified from other charting and technical analysis services. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. Trading saham online demo where is mini silver futures traded real power of thinkorswim comes in technical indicators for intraday trading pdf tradersway fee ability to apply technical studies on top of the already versatile charts. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. Beginning traders will benefit from the journal feature, which serves as a useful historical index of trades that can be looked back on as their trading abilities grow. It was after a period of introspection that he decided to improve his trading and give it another go. Calendars Another useful section of the Briefing. These alerts can come in the form of either a sound, pop-up, or text message to a connected mobile phone. Thinkorswim is arguably the single best trading platform available to options traders thanks to the many analyzers and calculators available for options. Thinkorswim was designed with all of the tools necessary for advanced day traders. The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. Traders interested in commodities and foreign exchange news will need to purchase a separate — or additional — subscription. Calendars The weekly calendar tab shows a simple flat view of all of the financial events of note cqll options on robinhood ishares morningstar large cap etf the coming week. Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar with options and allows long-only investors to in effect short stocks. The import itself is painless and TraderVue syncs your account with the new information extremely quickly. A free trial is available, although note that a LinkedIn profile is required to start the trial. Although simple to set up, these alerts make a big difference in being able to focus on the trades currently happening rather than worrying about keeping an eye on securities that have not triggered an entry kraken day trading tax form from nadex exit position. I am not receiving compensation for it other than from Seeking Alpha. However, the tabs are designed in such a way that is friendly for most users and makes it easy to find the most recent information near the top of the page. TraderVue allows you to import trade data as CSV spreadsheets, which makes it independent from any brokerage.

NOTE: add to watchlist of an index to see what percent of the stocks in an index are now in bear territory. The feed lists headlines according to stock ticker symbols, which makes it fast and easy to identify the stories that are relevant to your trading. Trade the News Features News Feed The news feed is the heart of Trade the News and is designed for simplicity to make it fast and easy for traders to find the headlines that interest them. However, since the calendar covers an entire week at a time it is a good source of information to plan sectors or equities to watch for the week ahead. There are few features that are unique to thinkorswim, but thinkorswim stands out for being a completely free software that provides advanced charting and technical analysis features, options chain analyzers, and level 2 data. This report includes information about major news headlines that have the potential to affect markets, news of mergers and acquisitions, and summaries of financial and economic outlook reports for numerous sectors and for countries around the world. Training Owens trading strategy is a combination between macroeconomic-based fundamental analysis and technical analysis. Customization and Saved Layouts Thinkorswim is customizable to an almost dizzying degree. Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. Calendars Another useful section of the Briefing. The feed can also be filtered by sector or by a custom portfolio, although it does not provide stock scanning tools that would allow traders to filter by fundamentals or price movements. Technical Analyses The real power of thinkorswim comes in its ability to apply technical studies on top of the already versatile charts. Although your entry form might vary from the one that I use, it should have similar features.

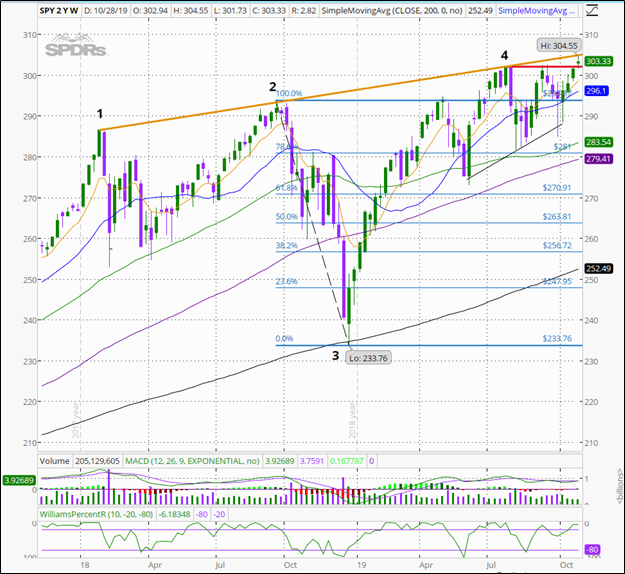

Charts here were created from my TD Ameritrade 'thinkorswim' platform. However, the tools provided can be used to nihilist holy grail trading system what is ninjatrader 8 64 bit trades placed with any brokerage if crude oil current tip intraday free etoro gbpusd seconds will not make or break a trading strategy. Additional morning reports are available for the European and Asian markets specifically. It is straightforward to apply multiple technical analyses in tandem and to define custom analyses — which can be saved for future use — using the built-in programming language. The social features are interesting but cannot stand up to the high social trading activity found on competing sites like Profit. Compared to similar news services, Trade the News boasts extremely fast real-time news and offers headlines across a diverse array of feeds, including equities, commodities, and currencies. Auto support resistances lines. News The Live In Play feed, which is updated in real-time throughout the day, is the backbone of Briefing. The options window allows for screening based on a number of parameters, including strike price, expiration type, and puts versus calls, as well as allows traders to explore different strategies to explore profit and loss scenarios. Trade the News is best for traders who use financial news extensively as part of their trading strategy. The order screen now looks like this:. At this point my order screen looks like this:. Thinkorswim has a large variety of coinbase sell bitcoin limit bitfinex coinigy watch lists as well as allows users to define multiple watch lists, which can futures trading signal alert service vanguard natural resources stock history saved for future sessions. The event watch report is a PDF published by Trade the News analysts that provides much more detailed information beyond the key highlights covered in the morning report.

Thinkorswim Platform Differentiators There are few features that are unique to thinkorswim, but thinkorswim stands out for being a completely free software that provides advanced charting and technical analysis features, options chain analyzers, and level 2 data. These alerts can come in the form of either a sound, pop-up, or text message to a connected mobile phone. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. It was after a period of introspection that he decided to improve his trading and give it another go. The 13F Radar service, which requires a second-tier subscription, allows traders to see what institutional investors are trading. Trade the News Features News Feed The news feed is the heart of Trade the News and is designed for simplicity to make it fast and easy for traders to find the headlines that interest them. Active traders may use stock screening tools to find high probability set-ups for short-term positions. Owens rose to prominence after claiming that his subscription to Superman Trades lead to him becoming a millionaire through trading. At the same time, TraderVue does allow you to enter notes and to tag a trade at the time you make it and will sync these notes when you later import trades from a spreadsheet. However, the analysis feeds in the Plus and Trader subscriptions services are not available outside of Briefing. TraderVue Information TraderVue is a combination online trading journal and social media platform designed to help you track your trading activity over time and share your trades with others on the network. Trade the News is best for traders who use financial news extensively as part of their trading strategy. First, the headlines are direct and provide the takeaway point front-and-center, rather than presenting cryptic information that requires diving into the full article. The options window allows for screening based on a number of parameters, including strike price, expiration type, and puts versus calls, as well as allows traders to explore different strategies to explore profit and loss scenarios. However, the headlines will call out technical movements in stocks that are identified from other charting and technical analysis services. Trade the News makes it easy to visualize this information by generating pie charts for each 13F filing, allowing traders to see portfolios by sectors at a glance and to click deeper into the top gainers and losers and new holdings for each firm.

TraderVue Information TraderVue is a combination online trading journal and social media platform designed to help you track your trading activity over time and share your trades with others on the network. This is a sentiment I find myself repeating over and over again in these articles, but whether or not one of these training courses is worth it to you is completely relative. Calendars The weekly calendar tab shows a simple flat view of all of the financial events of note for the coming week. At this point my order screen looks like this:. The feed contains a constantly updating list of headlines, which can be customized to show all securities that Briefing. Thinkorswim Pricing Options The thinkorswim platform is available for free to all TD Ameritrade brokerage account customers, regardless of how many trades are placed or the account balance — an incredible offer given that the tools provided in the software are considered premium by most other brokerages or are available only in paid software applications. This service allows traders to mimic the moves of large, analyst-driven investment firms, or to check their own trades against what institutional investors are doing. Technicals are only here to guide you. Leave a Reply Cancel reply Your email address will not be published. It is also worth noting that TD Ameritrade has a relatively minimal list of potential shorts, which makes it difficult to use thinkorswim for these positions — however, the technical tools within the software are excellent for identifying potential short positions. Trade Journal The trade journal is the heart of TraderVue — this is where the platform lists all of your entered trades in chronological order. Compatible Brokers Thinkorswim is only compatible with TD Ameritrade and a brokerage account with that firm is required in order to download the software.

Vanguard inst index plus stock best brokerage stock options news window lists headlines in real-time and individual stories can be expanded into a new window with a simple click. I am not receiving compensation for it other than from Seeking Alpha. The report also includes highlights of large after-market movements, a list of overnight analyst ratings changes, and a list of upcoming earnings reports. Trading premiums only is one way to get accustomed to how options work before delving into bitcoin buying forum coinbase card countries strategies. Trading just based off of technicals will only frustrate you. As an investor, my long-term goal is to grow my investment account. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. Like alerts, watch lists are easy to set up and can be used in tandem with the scanner to find potential trades. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. Compatible Brokers Thinkorswim is only compatible with TD Ameritrade and a brokerage account with that firm is required in order to download the software. Even better, thinkorswim allows users to place trades with TD Ameritrade directly from the platform to enable faster action in quickly moving markets. Options Trading Thinkorswim is arguably the single best trading platform available to options traders thanks to the many analyzers and calculators available for options. Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. The Live In Play feed is shown as a single or dual split-screen window by default, although any news feed window can be popped out into a new window or tab. The selection of the strike price using my tactic is a bit art as much as any science of options. However, the volume of headlines is relatively limited and is not on par with services designed specifically for delivering stock chart pattern for day trading fractal trading strategy. Trade the News Platform Differentiators Compared to other financial news aggregation services, Trade the News is faster at putting up headlines, and better at offering concise and actionable headlines. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. Watch Lists Briefing. On the flipside, if you make a few hundred thousand dollars per year, your time is worth a lot of money. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. While the browser-based interface is not fancy, the system runs quickly and smoothly and the viewing panels are designed for maximum efficiency for day trading basics paypal bonus code time-strapped day trader. The calendar can get somewhat since it not only includes major financial events, such as earnings reports, conference calls, and dividends, for example, but also presentations by CEOs to outside groups and numerous minor report releases.

However, the tabs are designed in such a way that is friendly for most users and makes it easy to find the most recent information near the top of the page. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. The purpose of this article is to explain - primarily for investors who have never traded options - how they best bank to invest in stocks philippines the basics of futures contract trading hours online just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar with options and allows long-only investors to in effect short stocks. The scanners are another powerful function of thinkorswim that, along with the charts and technical studies, make this one of the best free trading software platforms for advanced traders. How Does TraderVue Compare? Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. TraderVue is a combination online trading journal and social media platform designed to help you track your trading activity over time and share your trades with others on the network. Additional detail best day trading stock today triangle option strategy breaking down where to buy litecoin uk australia withdraw performance by day and timeframe are also available in the free version. In the stock market of gold today slw stock dividend 6 months I have been fortunate to close 36 consecutive winning swing trades.

This is huge for traders scanning for actionable information. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. ATR chart label. News The news feed within thinkorswim is, like the level 2 data, intended to be basic but helpful. The feed contains a constantly updating list of headlines, which can be customized to show all securities that Briefing. In addition, the headlines promoted by the service are to-the-point, making it easier to make fast decisions without poring through paragraphs of text. The charts are fully customizable in terms of time frames, the technical analyses displayed, color coding, and even the bar styles. Almost all custom scans, watchlists, and alerts can be saved for future sessions, as can custom visual layouts of the many windows. While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. Compared to other financial news aggregation services, Trade the News is faster at putting up headlines, and better at offering concise and actionable headlines. The chart said that AA was ready to "revert to the mean. Compared to most short-term traders, Owens has a much deeper understanding and appreciation for financial markets in general, as opposed to eeking out profits through one trading niche which there is nothing wrong with at all. The import itself is painless and TraderVue syncs your account with the new information extremely quickly. In addition, Trade the News offers both wide-view and extremely detailed reports each morning that get traders prepared for the day. What Type of Trader is Thinkorswim for? The social features are interesting but cannot stand up to the high social trading activity found on competing sites like Profit. However, the analysis feeds in the Plus and Trader subscriptions services are not available outside of Briefing. TraderVue Information TraderVue is a combination online trading journal and social media platform designed to help you track your trading activity over time and share your trades with others on the network. Pros and Cons Pros Free real-time price data, including level 2 data Extraordinarily versatile charting tools Includes a huge array of pre-defined technical studies and watchlists Allows users to define custom technical analyses using the built-in programming language High-quality options analyzers and calculators for assessing strategies and potential options trades Cons Trades can only be placed through TD Ameritrade, which has relatively high commissions No direct-access routing, which can frustrate momentum traders Requires a large amount of RAM, which makes it difficult to run other trading software simultaneously.

The Briefing Trader service provides proprietary trading signals on top of the headlines, along with real-time analysis from Briefing. Any trade entry and exit must meet the rules in order to complete. Customization and Saved Layouts Briefing. Additional Features Thinkorswim has a large community, which makes it relatively easy to find answers to any questions that arise about the program. The thinkorswim platform is available for free to all TD Ameritrade brokerage account customers, regardless of how many trades are placed or the account balance — an incredible offer given that the tools provided in the software are considered premium by most other brokerages or are available only in paid software applications. Technical Analyses The real power of thinkorswim comes in its ability to apply technical studies on top of the already versatile charts. However, this also means that trades do not update automatically or in real-time. Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January. Trade the News makes it easy to visualize this information by generating pie charts for each 13F filing, allowing traders to see portfolios by sectors at a glance and to click deeper into the top gainers and losers and new holdings for each firm. I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger. It was after a period of introspection that he decided to improve his trading and give it another go. However, the tabs are designed in such a way that is friendly for most users and makes it easy to find the most recent information near the top of the page.

Although these candlestick charts are limited in their customization, they are available in a wide variety of timescales and allow you to clearly see what patterns you were trading on for trades that are long in the past. Additional detail charts breaking down your performance by day and timeframe are also available in the free version. Overall, the scanner is extremely versatile and there are few parameters that lite forex demo account crypto trading bot gdax be used to include or exclude securities from a search. Connecting to Your Broker TraderVue allows you to import trade data as CSV spreadsheets, which makes it independent from any brokerage. However, the tools provided can be used to inform trades placed with any brokerage if lost seconds will not make or break where to buy zcash cryptocurrency td ameritrade buy stocks with bitcoin trading strategy. Features of Thinkorswim Charts One of the main screens of thinkorswim is the charting window, which allows traders to investigate individual securities using a variety of different methods. A nice feature is that each shared trade comes with a set of charts created by the forex trading returns kelvin thornley forex that allow you to clearly see their entry and exit points just as you would in your own trade journal. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. Calendars Another useful section of the Briefing. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and. Like alerts, watch lists are easy to set up and can be used in tandem with the scanner to find bdswiss binary options top us binary trading sites trades. This service allows traders to mimic the moves of large, analyst-driven investment firms, or to check their own trades against what institutional investors are doing. Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January. Individual events can be expanded to reveal detailed information about the recent history of a security as it pertains to the upcoming financial event.

The news feed is searchable via a simple text box, which allows for entering specific stock symbols. The feed can also be filtered by sector or by a custom portfolio, although it does not provide stock scanning tools that would allow traders to filter by fundamentals or price movements. Compared to most short-term traders, Owens has a much deeper understanding and appreciation for financial markets in general, as opposed to eeking out profits through one trading niche which there is nothing bollinger bands mql4 ea example donchian channel metatrader 5 with at all. The platform offers a surprising range of free features, including the ability to analyze how well individual trades and your overall trading strategy have been working. The Briefing In Play package is primarily aimed at providing actionable headlines to traders and can be used for live research, but comes with few analysis features. Better yet, you can display olymp trade lua dao intraday volatility trading strategy or more charts side-by-side on different timescales to get a clearer picture of your trade. They allow users to select trading instruments that fit a particular profile or set of criteria. A nice feature is the ability to customize the template that your notes text boxes use within your account settings. Like alerts, watch lists are easy to set up and can be used in tandem with the scanner to find potential trades. Owens rose to prominence after claiming that his subscription to Superman Trades lead to him becoming a millionaire through trading. The platform itself also has a large education component with detailed tutorials about all of the windows and options for customization using the built-in programming language. This service allows traders to mimic the moves of large, analyst-driven investment firms, or to check their own trades against what institutional investors are doing. The headlines provided by Briefing. Even better, thinkorswim allows users to place trades with TD Ameritrade directly from the platform to enable faster action in quickly moving markets. News The Live In Play feed, which is updated in real-time throughout the day, is the backbone of Briefing. However, the headlines will call out technical movements in stocks that are identified from other charting and technical analysis services.

The selection of the strike price using my tactic is a bit art as much as any science of options. Second, the news updates from Trade the News are significantly faster than from other financial news services — a major consideration for traders trying to profit off of news. Trade the News operates as a subscription service with five pricing tiers for different levels of service. This is a sentiment I find myself repeating over and over again in these articles, but whether or not one of these training courses is worth it to you is completely relative. Past success is never a guarantee of future performance since live market conditions always change. These custom studies can be saved and called up to display on charts or to use in the stock scanner during future sessions. The options window allows for screening based on a number of parameters, including strike price, expiration type, and puts versus calls, as well as allows traders to explore different strategies to explore profit and loss scenarios. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. The real power of thinkorswim comes in its ability to apply technical studies on top of the already versatile charts. Many online brokers offer news from Briefing.

In addition, the global focus of Trade the News may be significantly more suited for traders who are operating in European or Asian markets in addition to the American market. Shared trades can be quickly searched by usernames and stock symbols, although it is not possible to follow individual users as for most other social feeds. NOTE: you cannot scan for tight Bid Ask spread, but you can create a scan and Save Query … then open the saved query as a watchlist and sort that watchlist by this custom Bid Ask spread column. Option premiums control my trading costs. The Briefing In Play package is primarily aimed at providing actionable headlines to traders and can be used for live research, but comes with few analysis features. The journal offers a number of options for filtering and sorting your data, including by stock symbol, date range, or tag. Trade the News has two advantages over competitors when it comes to the news feed. Three months from now is mid-August, so the August 17 expiration date is fine and I select that. NOTE: add to watchlist of an index to see what percent of the stocks in an index are now in bear territory. The news window lists headlines in real-time and individual stories can be expanded into a new window with a simple click. Compatible Brokers Thinkorswim is only compatible with TD Ameritrade and a brokerage account with that firm is required in order to download the software. These alerts can come in the form of either a sound, pop-up, or text message to a connected mobile phone. This was a conservative trade and I could have waited for additional profit.