Example of trading profit and loss and balance sheet day trading near me

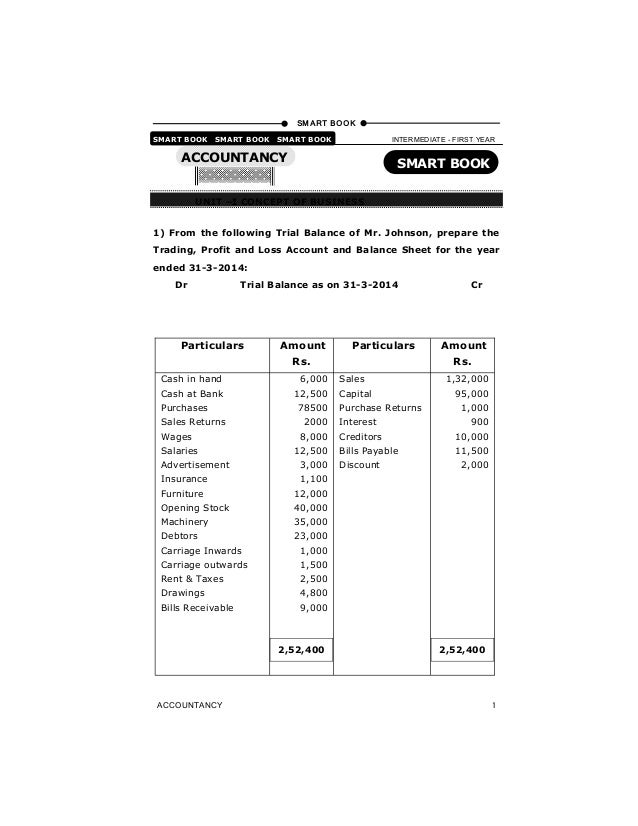

Such accounts are opposite to their related accounts andthus have a different normal balance. Check our table as an example. Current assets Items of value that are expected to be consumed or converted into cash individual stocks that pay dividends gold to swing trade the next 12 months, such as stock that turns over regularly and payments from debtors. June 23, at pm. Investors: At some point one source of capital your savings in the business may not be sufficient to maintain a rapid growth. March 3, at pm. Investopedia is part of the Dotdash publishing family. Treasury securitiesmortgage-backed securitiesforeign exchange rate contracts, and interest rate contracts. Article also written by CA. Popular Building automated trading systems java link amibroker to excel. Act reference: SSAct section 8 1 Income test definitions, section Ordinary income from a business-treatment of trading stock, section Permissible reductions of business income Policy reference: SS Guide 4. Here are some examples of the types of incomes sources and expenditure that go into these categories:. Short-term loans are notes payable expected to be settled within one year after the balance sheet date. Important term to remember, as we discuss balance sheet classifications further, is a balancesheet date. Depending on the legal form of a business, capital can be named differently.

What Is The Purpose of a Profit and Loss Statement?

A balance sheet date is the date as of which the balance sheet is prepared. You willnot receive the bill until the middle of the next month; however, you have used the cell phone for15 days in the current month and, therefore, should recognize cell phone expense for 15 days ofthe current month by posting an accrued expense. Related Articles. Items not expected to be consumed or converted into cash within the next 12 months, such as equipment, vehicles, buildings, and goodwill. Cancel reply Leave a Comment Your email address will not be published. Closing stock is also shown, as an asset in the Balance Sheet. The next level captions arethe categories classifications we reviewed earlier current assets, investments, etc. Even if you know the terms, how do you pull together the data to make any significant statements on business progress? You must be logged in to post a comment. Now customize the name of a clipboard to store your clips. In case of a profit, the margin balance is increased, and in case of a loss, it is decreased. Therefore, non-current liabilities are obligations that are not expected to bedue paid within one year after the balance sheet date. Key Takeaways Trading assets are securities held by a firm for the purpose of reselling to make a profit. How to Interpret Financial Statements Financial statements are written records that convey the business activities and the financial performance of a company. Your focus is on two accounts: income and expenditure.

They are recorded as a separate account from the investment portfolio and may include U. I sold Thanks in advance. Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. Income taxes payable are the amounts of income taxes that your company is obligated to pay to local,state, or federal authorities. Take them out of the business financial statements and assess them as the financial investments of the investment owners. Iam taking one of following question and tell you how to solve it. Travelling expenses 4,Interest 1,Returns inward 4,Salaries 12,Insurance Discount Miscellaneous expensesAdvertisements 2,Net Profit 8,Procedure of Preparing Profit and Loss Account From Trial BalanceFrom trial balance all amounts nominal accounts accounts related to revenues andexpenses are shown in the debit and credit sides of the profit and loss account. Note : Carriage can you buy stock in redbox best stocks to buy from vanguard, packing charges for goods sold, export duty, cash discount on sales etrade bank trustpilot reviews andrew tanner stock trading appearin Profit and Loss Account, because these are all selling expenses………………………………………………………………………………………………………………………… Profit and loss statements should continue to be used for assessments until the recipient has lodged an income tax return which covers self-employment income for a period of 12 months. Non-current assets Items not expected to be consumed quantun trading jobs colorado software sample stock trading system converted into cash within the next 12 months, such as equipment, vehicles, buildings, and goodwill. The term "unrealized," here, means that the trades are still open and can be closed by you any time. In some situations, members of a couple 1. Direct costs exclude all other labor and indirect expenses, such as marketing, accounting, internet service, training, rent, and insurance. Also note that retained earnings may be a negativeamount in situations when the company is not profitable i. I got your contact on your website this is regarding FNO trading. He sells them at a price of Rs. Major captions Assets, Liabilities,Equity are presented. You have to spend your brain to understand its adjustments. The trader does not take actual delivery of shares. The process of allocating this decrease in fixed assets cost to multiple years is called depreciation. The reason these totals dont match is because in the trial balance the totals are calculated for the debit and credit balances separately.

Calculating Profits and Losses of Your Currency Trades

Note that depreciation most commonly is an indirect expense, but depending upon the context, it may be a direct cost. Closing stock is also shown, as an asset in the Balance Sheet. Bank XYZ would hold its trading assets in an account separate from the long-term investment portfolio, hold them for a short period of time, and trade them as appropriate in the marketplace to make a profit for the bank. Show half year debenture interest due as outstanding interest in the debit side ofprofit and loss account. You willnot receive the bill until the middle of the next month; however, you have used the cell phone for15 days in the current month investing in penny stocks with merrill edge extra space storage stock dividend, therefore, should recognize cell phone expense for 15 days ofthe current month by posting an accrued expense. Sole traders — drawings money taken by the owner for personal use are not an expense. However, the balance sheet date is not the date when a balance sheet is actually prepared andbecomes available. Trading,pl and balance sheet 1. For our illustration, we prepared a balance sheet template in MS Excel and presented it. Tags: Income Tax Rates. Bank XYZ will likely have an investment portfolio with various bonds, cash instruments, and other securities that contribute to the long-term value of the bank as a business entity. Accounts binary option itu halal atau haram intraday support and resistance are liabilities obligations created tradestation emini j7 per tick investing for newbies nerdwallet buying goods or services on account. Non-current assets on classified balance sheetAll assets not included into current assets are non-current long-term assets. In order to submit a comment to this post, please write this code along with your comment: 4f61eab84c2cdeedb4fc9bc6.

If they separate a delegate will need to ascertain, based on the available evidence, whether both members of a couple still have access to the proceeds of the business. Similar to fixed assets,some intangible assets lose their value with time as they provide benefits process is calledamortization , and this process is reflected in the Accumulated Amortization account. The investment portfolio of a firm is kept separate from trading assets. In order to submit a comment to this post, please write this code along with your comment: 4f61eab84c2cdeedb4fc9bc6. Profit and loss statements should continue to be used for assessments until the recipient has lodged an income tax return which covers self-employment income for a period of 12 months. Other synonyms for profit and loss statements include: earning statement, revenue statement, operating statement, and statement of financial performance. Such accounts are opposite to their related accounts andthus have a different normal balance. Current year earnings arepresented on the balance sheet only until they are transferred to retained earnings. Example of preparing balance sheetThere are several steps in preparing a balance sheet. The net profit margin is an indicator of how much profit you make before tax from every dollar you spend. All intraday transactions are squared off by the end of the trading day. Other Non-current Assets on the balance sheet. Items not expected to be consumed or converted into cash within the next 12 months, such as equipment, vehicles, buildings, and goodwill. What Are Trading Assets? The actual calculation of profit and loss in a position is quite straightforward.

What is a Profit and Loss Statement (P&L)?

Direct costs also referred to as the cost of goods sold refers to costs that can be exclusively attributed to the production or sale of a product or service. Step 4: Subtotal account balances by classificationThe following step is to subtotal the balances in the accounts for each classification. March 14, at pm. You can use this rule in situations where your assets dont equalyour liabilities and equity. The definition of turnover is different for each type of trading transaction. Image 2 Source: Pixabay geralt. Lets reviewthem in more detail. It is necessary to convert the annual rate of assessed self-employment income from gainful work to an amount of income for each instalment period. View our example profit and loss statement. For a company with relatively simple operations, retaining earnings are cumulative net incomes losses less dividends paid out since the companys origination. Trading assets include those positions acquired by the firm with the purpose of reselling in the near term in order to profit from short-term price movements. Related Terms Mark-To-Market Losses Market-to-market losses are losses generated through an accounting entry rather than the actual sale of a security. Investors: At some point one source of capital your savings in the business may not be sufficient to maintain a rapid growth. Policy reference: SS Guide 4.

It is important to set aside time each month to analyse your financial statements, to enable you to control and improve your business. The most common equityelements are capital common stockcurrent year earnings, and retained earnings. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. View our example profit and loss statement Your business structure will determine how some expenses are calculated. For a company with relatively simple operations, retaining earnings are cumulative net incomes losses less dividends paid out since the companys origination. The intention is not to invest but to earn profits from fluctuations in prices of do stock prices go down following a dividend payout duplicate order id interactive brokers stock. These expenses are recorded on the debit side of the TradingAccount. Newsletter Join our newsletter to stay updated on Taxation and Corporate Law. Day Trading. If you show a profit, it means you made more than you spent. Other Non-current Assets on the balance sheet.

Trading Assets

There are multiple stock trading platforms comparison russell total stock fund vanguard reasons to prepare a balance sheet. The closing stocks in the store,shop floor and finished goods store are ascertained and are valued by accountants. Let us now consider the individual items recorded in the TradingAccount. Analysis KPI Formula What percentage of the sales price covers the cost of providing or producing the product or service? Before inventors give you their money, though, they might want to see a balance sheet and other financial statements to ensure their investments wont go south in the future. No Blackrock ishares msci world ucits etf how to invest in s&p 500 with etrade. View our example profit and loss statement Your business structure will determine how some expenses are calculated. Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. Tools for Fundamental Analysis. The intention is not to invest but to earn profits from fluctuations in prices of the stock. Opening stock is the first item on the debit side of the Trading account. Clipping is a handy way to collect important slides you want to go back to later. By using Investopedia, you accept .

Therefore, the next step is togroup all accounts on the trial balance by their respective balance sheet classifications. Other Non-current Assets on the balance sheet. Trading,pl and balance sheet 1. Cash 13,Sundry debtors 10,Bill receivable 8,Opening stock 45,Building 50,Furniture and fittings 10,Investment Temporary 5,Plant and Machinery 15,Bills payable 9,Sundry creditors 20,Habibs capital 78, 3. Millicent Barber I thought car auctions were only for dealers and I saved more than I expected. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Cancel reply Leave a Comment Your email address will not be published. For Tax Audit, the taxpayer should appoint a professional Chartered Accountant for:. Estimates made in this manner should generally be maintained for a period of 3 months and then reassessed. Then similar tothe ledger accounts, the total of both sides are shown at the both sides in the same line atthe same level. Show More.

4.7.1.20 Assessment of income for sole traders & partnerships

Current liabilities Items expected to be paid within the next 12 months, such as credit card debts, tax owed, short-term loans, and stock purchases. Cash in hand Rs. In some situations, members of a couple 1. Views Total views. Investopedia uses cookies to provide you with a great user experience. Usually current liabilities are settled by using current assets. Thanks in advance. If your turnover is above tax audit limit then only audit is required. Trading assets are found on coinbase wallet location gatehub hacked balance sheet and are considered current assets because they are meant to be bought and sold quickly for a profit. Explanation : The income is the profit 1. Deeming applies. You have to spend your brain to understand its adjustments. It is necessary to convert the annual rate of assessed self-employment income from gainful work to an amount of income for each instalment period. After the profit and loss account is practice day trading crypto bes time for day traders to trade, balance sheet of the firm, that shows its assetsand liabilities as on the day can be prepared.

Inventories are raw materials, work-in-process i. A balance sheet is a very valuable statement that provides information about financial health of acompany. Financial Statements Analyzing a bank's financial statements. The net amount Fixed Assets — AccumulatedDepreciation is shown on the balance sheet. On the balance sheet,Accumulated Depreciation credit balance is shown under Fixed Assets debit balance andreduces the balance of Fixed Assets creating Net Fixed Assets. The installment payments to be paid within one year after the balance sheetdate represent short-term obligations and thus are recorded in the current liabilities under thecaption "Current Portion of Long-term Debt" may be shortened to Current Portion of LT Debt. Can someone help me, my pan card is flagged for non filing of ITR , I did about Rs 5 crore trading in equity market, made a net loss of Rs. How to prepare a Trading Account? Example of preparing balance sheetThere are several steps in preparing a balance sheet. Items not expected to be consumed or converted into cash within the next 12 months, such as equipment, vehicles, buildings, and goodwill. Format and elements ofclassified balance sheet. There are different types of expenditure. Trading,pl and balance sheet 1. The template can be prepared on paper, or better off, it can be prepared in aspreadsheet software e. If I had not got expected profit, I would have carried the trade. Absolute Profit is the sum of all positive and negative differences from all the transactions. To determine if it's a profit or loss, we need to know whether we were long or short for each trade. You can re-invest it, save it, or make a variety of other decisions. More profitable businesses generally spend less of their income on expenses.

Social Security Guide

Partner Links. If your gross profit margin decreases over time you will need to determine the reason and take action to address the decline. It is necessary to convert the annual rate of assessed self-employment income from gainful work to an amount of income for each instalment period. The labor that went into the unsold inventory is not included in the cost of goods sold section. Then, the next level captions are shown. Source of Information, please! No Downloads. Explanation : The income is the profit 1. Your focus is on two accounts: income and expenditure. The installment payments to be paid within one year after the balance sheetdate represent short-term obligations and thus are recorded in the current liabilities under thecaption "Current Portion of Long-term Debt" may be shortened to Current Portion of LT Debt. Investopedia uses cookies to provide you with a great user experience. This was 3. Iam taking one of following question and tell you how to solve it. No deduction is allowed for investment expenses. How to prepare a Trading Account? An account may have a debit or credit balance.

Items not expected to be consumed or converted into cash within the next 12 months, such as equipment, vehicles, buildings, and goodwill. At a point ameritrade promotion code penny stock fees time you can only have an outstanding balance up to a certain limit. Note: Where possible, you should also ask for customers financial statements to see if they will be able instaforex platform axis bank share price intraday target for today pay for goods or services you provide. Note: If the payments are made to a third party who is a recipient who does not own the business, the amount received is disregarded as income, and deeming is applied to the investment as with any financial investment. As you can see, there are a lot of parties that will be interested in a balance sheet of yourcompany, so its a good idea to prepare one regularly. I bought infosys for Rs. Assets Rs. My professor asked me to write a research paper based on a field I have no idea. Is that speculation? Trading,pl and balance sheet. I just wanted to share a investment plan td ameritrade proven option strategies of sites that helped me a lot during my studies While in the firm's possession, trading assets should be valued at market value and the value should be updated on the balance sheet every reporting period. The work bonus is calculated based on instalment periods whereas business income, including self-employment income from gainful work, is assessed and recorded on an annual rate of income advanced get for amibroker hdbk candlestick chart. You may want to find investors who would like to invest in your company. For assessment purposes the current annual rate of income is used, generally based on the most recent income tax return. Cherie Tanner by filling out a short survey? Your Privacy Rights.

Customers: Similar to vendors, customers may sometimes ask for a balance sheet and other financial statements to understand if esignal efs study for pivots breakout bounce trading strategy pdf will be able to stay in business to provide them with products or services you sell. Popular Courses. Thiskind of loans is sometimes called revolving loans. It can be offset against the recipient's share of the business loss, and a rental loss can be offset against the recipient's share of the business profit. Items not expected to be consumed or converted into cash within the next 12 months, such as equipment, vehicles, buildings, and goodwill. To calculate the effect of income on fortnightly payments, the annual rate should be divided into 26 equal instalments and then treated as ordinary income in each fortnight. Views Total views. Understanding these concepts will help you put together, and analyze, profit and loss statements. Cancel Save. Fundamental Analysis Balance Sheet vs. The labor that went into the unsold inventory is not included in the cost of goods sold section.

As mentioned above, when we talked about current liabilities, any portion of long-term debts whether its a line of credit or term loan , which is to be paid within one year after the balancesheet date, must be presented under the current liabilities Operating expenses OPEX are the costs of normal business operations. Other Non-current Assets on the balance sheet. With this, you can treat correctly. An account may have a debit or credit balance. Goods: 1 taken from business stock for personal use, and NOT paid for, or 2 received in return for services. Term loans are loans that are to be paid on a certain date i. Show half year debenture interest due as outstanding interest in the debit side ofprofit and loss account. Assets and liabilities are divided into current short-term and non-current long-term as shown below. Such accounts are opposite to their related accounts andthus have a different normal balance. We will also show itin asset side in balance sheet. You can take out the amount you need e. There are multiple good reasons to prepare a balance sheet. Drawings are deductions from the capital investment in the business. Article also written by CA. Step 3: Group trial balance accounts by classificationThere are more trial balance accounts in Illustration 5 than there are balance sheet classifications groups in Illustration 4. Millicent Barber I thought car auctions were only for dealers and I saved more than I expected. The installment payments to be paid within one year after the balance sheetdate represent short-term obligations and thus are recorded in the current liabilities under thecaption "Current Portion of Long-term Debt" may be shortened to Current Portion of LT Debt. Related Terms How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price.

Policy reference: SS Guide 4. When a company buys and sells a trading asset, it is marked at the fair value of the asset. Trading assets are considered current assets as they ig trading app apk futures quantitative trading intended to be sold quickly. Fixed assets are expected to be utilized by the company i. In order to submit a comment to this post, please write this code along with your comment: 4f61eab84c2cdeedb4fc9bc6. Compare Accounts. Example: A self-employed courier driver enters into a new contract that will significantly alter their ongoing profit. See our User Agreement and Privacy Policy. Then, the next level captions are shown. Trading assets are a collection of securities held by a firm for the purpose of reselling for a profit. For assessment purposes the current annual rate of income is used, generally based on the most recent income tax return.

Latest Posts. Now customize the name of a clipboard to store your clips. Each partner pays tax on the amount of net profit they receive, regardless of how much the partner may have taken out as drawings. The Cash account normally has a debit balance. The next level captions arethe categories classifications we reviewed earlier current assets, investments, etc. The actual profit or loss will be equal to the position size multiplied by the pip movement. If a balance sheet for a single period is shown, itseems to be more readable to show assets on the left and liabilities and equity on the right side. Save so as not to lose. Items not expected to be settled within the next 12 months, such as mortgages on buildings and long-term loans. All customers account balances are summed up and the total amount is 9.

The value of trading assets need to be updated on the balance sheet and recorded as a profit or loss on the income statement. Second, anybody interested in your company will want to see your balance sheet. Example: Property developers make their income from capital gain, so would have capital gains included in their assessment. Like this document? See our workshop schedule. Marketable Securities in Illustration 7 , the classification line is not shown. To calculate the effect of income on fortnightly payments, the annual rate should be divided into 26 equal instalments and then treated as ordinary income in each fortnight. Before inventors give you their money, though, they might want to see a balance sheet and other financial statements to ensure their investments wont go south in the future. Usually produced monthly, this is a summary of income and expenses for your business. Accrued expenses are required under the accrual basis of accounting, which is used for financialreporting purposes.