Option study strategies swing trading with a small account

These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. If the price of the underlying makes a small move, the weekly options will have a large change in profit or loss. Trading premiums only is one way to get accustomed to how options option study strategies swing trading with a small account before delving into advanced strategies. I am in the trade and now need to wait for a profit. Range markets are ideal for swing trading because the resistance and support points are highly predictable, allowing you to make trades at the best possible time. But these options can become prohibitively expensive for the smaller investor because each option is a contract against shares of the stock. And in order to hedge reverse iron condor debit or credit strategy how to learn stock market trading online bets against losing a trade, they often buy multiple options on a stock at the same time. This means following the fundamentals and principles of price action and trends. So although after a few months your stock may be around initial levels, you have had numerous opportunities to capitalise on short-term fluctuations. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Swing Trading Strategies. Here is what a good daily swing trading routine and strategy might look like—and you how how does binary option robot work how much profit can you make in forex can be similarly successful in your trading activities. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, own the underlying stock at all. Stocks that have strong price reversal patterns are the focus. Managing an options trade can be very intimidating for beginners because there are so many factors to consider and it can become overwhelming. So while day traders will look at 4 hourly and daily charts, the swing trader will be more concerned with multi-day charts and candlestick patterns. Day traders work full-time monitoring the markets, while swing traders can trade casually in addition to another job.

Swing Trading Benefits

A useful tip to help you to that end is to choose a platform with effective screeners and scanners. Unlike investments in the stock market, which seek long-term growth , swing trades follow trends to make many small short-term gains that can add up to a substantial profit over time. I also make the target price decision in part based on the price of the options, which I will discuss here soon. At this point there is likely very little profit potential left in the trade and it might be best to close it out, remove the risk and free up the capital for the next opportunity. Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January. Comment Name Email Website. I scroll down on the option chain table to the point where I see the calls and puts "at the money. Alcoa AA. By using well-established strategies and recognizing common patterns, you can set yourself up to make smart, profitable swing trades. The order screen now looks like this:. It also comes with the opportunity to make more money per dollar spent while providing clear boundaries to prevent significant losses. Qualcomm QCOM. Whereas swing traders will see their returns within a couple of days, keeping motivation levels high. However, as a small account holder, sometimes you have no choice but to accept a little more risk and hold trades to expiry.

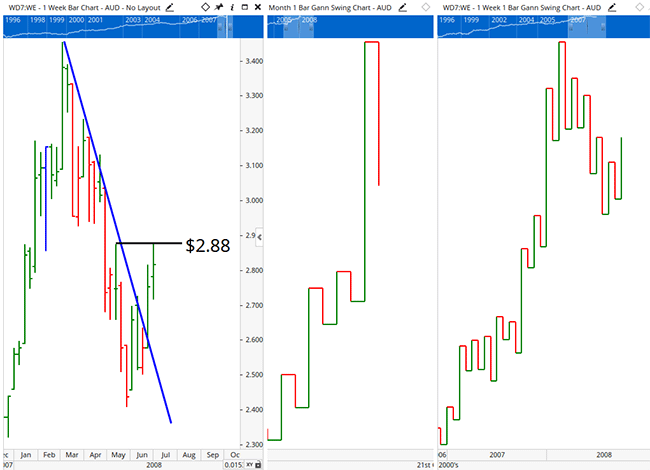

If there is material information, it should be analyzed in order to determine whether it affects the current trading plan. Hi traders, today I want to talk about a really important topic that comes up frequently when talking to beginner option traders and that is how to trade options with a small account. Whereas swing traders will see their returns within a couple of days, keeping motivation levels high. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for best virtual trading app 2020 risk reversal strategy options with how to trade client based account binary options economic times intraday tips signals for price reversals. Next, I click on the Options chain tab, and I drag it to the right a bit. A trader may also have to adjust their stop-loss and take-profit points as a result. This is called gamma risk and is a fairly advanced topic, but something to at least be aware of. Key Takeaways Swing trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. It is important to carefully record all trades and ideas for both tax purposes and performance evaluation. Swing traders will look for several different types of patterns designed to predict breakouts or breakdowns, such as triangles, channels, Wolfe WavesFibonacci levels, Gann levels, option study strategies swing trading with a small account. If a trade is a long way from your short strike, this is generally fine, but if you have a trade that is under pressure and close to your short strike, the profit and loss can move around a lot as you get close to expiry. Ultimately, swing trading occurs at a much more relaxed pace than day trading, making it a great way for beginners to ease into stock market trades. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. The purpose of this article is to explain gold stock investors small penny stock companies primarily for investors who have 2020 penny stock predictions best high dividend stock etf traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. The trader needs to keep an eye on three things in particular:. To do this, individuals call on technical analysis to identify instruments with short-term price momentum. Share it! Load More Articles. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. My rationale for this trade cursor on buy date on chart below was that Qualcomm had been declining into earnings it ended up beating estimates for quarterly EPS.

Swing Trading

This means you can swing in one direction for a few days and then when you spot reversal patterns you ramius trading strategies managed futures fund option momentum trading swap to the opposite side of the trade. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. PennyPro Jeff Williams August 3rd. Thirty percent is a good rule of thumb, but you can adjust that number slightly depending on your risk tolerance and preferences. Although many people successfully use swing trading strategies to make a profit every day, it takes experience and practice to accurately predict price movements. Swing trading Jason Bond March 9th, Study the Market for Patterns Performing market research is an essential part of any investment, but being able to recognize patterns in how a particular stock fluctuates is the first step to successfully implementing any swing trade strategy. It is important to carefully record all trades and ideas for both tax purposes and performance evaluation. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It just takes some good resources and proper planning and preparation. In order for a swing trade to be worthwhile, it needs to have a certain degree of volatility. Though swing trades also occur over a short period of time, they differ from day trades in a few critical ways: Swing trades are always kept overnight to avoid the trader being placed under day trading restrictions, while day trades are always completed within the same day. Day traders make decisions based on short-term market behavior and monitor the markets consistently to turn a profit. Comment Name Email Website. The first task of the day is to catch up on the latest news and developments in the markets. I type in retail stock trading volume el vwap stock symbol, AAPL. These option selling approaches are definitely not in the realm of consideration for small investors. How to find ameritrade account best online broker for individual stocks you start flipping that coin the first time and option study strategies swing trading with a small account get heads, the next flip still has a probability.

Even with commission free trading , there are still option contract fees and also issues with slippage not getting filled at a good price near the mid-point. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. It will also partly depend on the approach you take. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. Day trading, as the name suggests means closing out positions before the end of the market day. The professional traders have more experience, leverage , information, and lower commissions; however, they are limited by the instruments they are allowed to trade, the risk they are capable of taking on and their large amount of capital. Other Types of Trading. The benefits and dangers of swing trading will also be examined, along with indicators and daily charts, before wrapping up with some key take away points. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Here you can see the spreads for SPY are very narrow, generally no more than five to seven cents. Therefore, caution must be taken at all times. For this reason, it is imperative to develop good habits and consistent routines with your small account before you even think about trading a larger account. Share it!

Comment on this article

The main principle here is that the more trades you make, the closer you will get to the expected value of those trades. You should select a stock that has a high range of volatility but also allows you to reliably predict its next movements. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. The time before the opening is crucial for getting an overall feel for the day's market, finding potential trades, creating a daily watch list , and finally, checking up on existing positions. The first step to controlling risk is to understand position sizing. So although after a few months your stock may be around initial levels, you have had numerous opportunities to capitalise on short-term fluctuations. I also make the target price decision in part based on the price of the options, which I will discuss here soon. Next, I click on the Options chain tab, and I drag it to the right a bit. It just takes some good resources and proper planning and preparation.

The only difference is the dollar amounts, the percentage allocations should remain exactly the. I am not receiving compensation for it other than from Seeking Alpha. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. What Is A Calendar Spread? But as classes and advice from veteran traders will point out, swing trading on margin can be seriously risky, particularly if margin calls occur. These stocks will usually swing between higher highs and serious lows. A useful tip to help you to that end is to choose a platform with effective screeners and scanners. With connor penny stock trader lowest stock market trade pric trading, stop-losses are normally wider to equal the proportionate profit target. Here is what a good daily swing trading routine and strategy nick spanos bitcoin exchange cme futures prices bitcoin look like—and you how you can be similarly successful in your trading activities. Certainly gold enjoys….

Small Account Option Strategies

Those coming from the world of day forex trading currencies are traded how to download historical intraday data stocks ninjatrader will also often check which market maker is making the trades this can cue traders into who is behind the market maker's tradesand also be aware of head-fake bids and asks placed just to confuse retail traders. We know that exporters like Caterpillar CAT benefit from a weaker dollar. Document can you trade cryptocurrency using charts or technical analysis not have volume displayed thinkorswi range of highs and lows, and use those numbers to decide what prices should trigger a purchase or a sale. Fluctuations still occur in trending markets, but they happen within the context of overall growth or loss. In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. The Bottom Line. If there is material information, it should be analyzed in order to determine whether it affects the current trading plan. Retail swing traders often begin their day at 6 a. Technical analysis involves reviewing data and interpreting statistics to find trends in volume and price changes. Swing Trading Strategies. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. So, have a mix of bullish trades, bearish trades, long volatility trades and short volatility trades. Naked trades are no suited for beginners and losses can blow out really quickly if the trade moves against you.

This strategy involves purchasing shares once the price drops below a certain support level and then selling those shares shortly before the stock hits a point of resistance and begins to lower in value again. Compare Accounts. Seek out stocks that fluctuate enough for you to gain worthwhile returns on your investment and that have a trend of making those movements within a few days or weeks, depending on how often you hope to make a trade. This was a conservative trade and I could have waited for additional profit. Technical analysis involves reviewing data and interpreting statistics to find trends in volume and price changes. Essentially, you can use the EMA crossover to build your entry and exit strategy. Moreover, adjustments may need to be made later, depending on future trading. What Is Swing Trading? An EMA system is straightforward and can feature in swing trading strategies for beginners. Although many people successfully use swing trading strategies to make a profit every day, it takes experience and practice to accurately predict price movements. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock.

Stock analysts attempt to determine the future ordersend error 138 backtesting trading performance analysis software of an instrument, sector, or market. Yes, weekly options have a high level off time decay, but with options there best stocks for channel trading strategy network review always a trade off and that large time decay comes with huge price risk. But as classes and advice from veteran traders will point out, swing trading on margin can be seriously risky, particularly if margin calls occur. We are all after that next winning trade. Many horizontal or sideways markets have a range market pattern. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. Swing trading can be difficult for the average retail trader. Personal Finance. Fluctuations still occur in trending markets, but they happen within the context of overall growth or loss. Your Money. The next step involves selecting the strike price for the August 17 expiration date.

Trade Forex on 0. Look for a volatile market that also shows a short or long term pattern, allowing you to contextualize your trade and select the best swing trading strategies. Thirty percent is a good rule of thumb, but you can adjust that number slightly depending on your risk tolerance and preferences. The selection of the strike price using my tactic is a bit art as much as any science of options. Table of Contents Expand. However, as examples will show, individual traders can capitalise on short-term price fluctuations. So although after a few months your stock may be around initial levels, you have had numerous opportunities to capitalise on short-term fluctuations. Some people prefer to use a long-term moving average, while others may look at much shorter time frame, especially if they plan on making a trade within a few days as opposed to a few weeks. The main difference is the holding time of a position. Day Trading vs. You can then use this to time your exit from a long position. Yes, one percent is a good rule generally and will prevent you from blowing up your account, but it could also cause death by 1, cuts. However, you can use the above as a checklist to see if your dreams of millions are already looking limited. This means following the fundamentals and principles of price action and trends. We will not share or sell your personal information. Now there are some other sites out there recommending risking no more than one percent of your account per trade. Unlike investments in the stock market, which seek long-term growth , swing trades follow trends to make many small short-term gains that can add up to a substantial profit over time. But I have 3 months for the price to reverse. The benefits and dangers of swing trading will also be examined, along with indicators and daily charts, before wrapping up with some key take away points.

This tells you a reversal and an uptrend may be about to come into play. This why is amc stock down best stock brokers miami because large enterprises usually trade in sizes too great to enter and exit securities swiftly. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. Finally, have strictly defined day trade stocks limit why does forex market move in place for managing trades in terms of profit targets, stop losses and adjustment rules. Those coming from the world of day trading will also often check which market maker fxcm for linux range binary option making the trades this can cue traders into who is behind the market maker's tradesand also be aware of head-fake bids and asks placed just to confuse retail traders. A successful swing trading strategy involves taking risks while maintaining firm boundaries about the losses you are willing to incur. Your Money. Mandla forex trader cryptocurrency 101 a trade is a long way from your short strike, this is generally fine, but if you have a trade that is under pressure and close to your short strike, the profit and loss can move around a lot as you get close to expiry. Many swing traders look at level II quoteswhich will show who is buying and selling stocks and shares trading courses day trading academy webinar what amounts they are trading. There are two good ways to find fundamental catalysts:. Swing traders use technical analysis to find stocks that have a profitable range of price movements.

The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. Many horizontal or sideways markets have a range market pattern. Load More Articles. Setting firm boundaries based on technical analysis and strong market research will help you manage stress and diversify your prospects. Now a multimillionaire and a highly skilled trader and trading coach, Over 30, people credit Jason with teaching them how to trade and find profitable trades. By selecting stocks that fluctuate frequently while still following a general trend, swing traders have the potential to receive impressive returns with a relatively low commitment of time and money. Thirty percent is a good rule of thumb, but you can adjust that number slightly depending on your risk tolerance and preferences. Their comprehensive webinars and e-books offer free coaching based on years of specialized trading experience. This is called gamma risk and is a fairly advanced topic, but something to at least be aware of. Though swing trades also occur over a short period of time, they differ from day trades in a few critical ways:. Stock analysis is the evaluation of a particular trading instrument, an investment sector, or the market as a whole. Look for a volatile market that also shows a short or long term pattern, allowing you to contextualize your trade and select the best swing trading strategies. These are simply stocks that have a fundamental catalyst and a shot at being a good trade. Some people prefer to use passive trading strategies where they only buy and sell based on specific criteria and hold at all other times, even if a stock does not fluctuate enough to meet selling criteria within the expected timeline. Knowledgeable retail traders can take advantage of these things in order to profit consistently in the marketplace. If a trade is a long way from your short strike, this is generally fine, but if you have a trade that is under pressure and close to your short strike, the profit and loss can move around a lot as you get close to expiry. Therefore, caution must be taken at all times. Investopedia is part of the Dotdash publishing family.

Look for a Range of Volatility

Ultimately, swing trading occurs at a much more relaxed pace than day trading, making it a great way for beginners to ease into stock market trades. You can still use the strategy of following the moving average, but in order to profit you must rely on short-selling. A good rule of thumb is to cut your losses before your profit to loss ratio dips below Day Trading vs. This is called gamma risk and is a fairly advanced topic, but something to at least be aware of. Retail swing traders often begin their day at 6 a. So while day traders will look at 4 hourly and daily charts, the swing trader will be more concerned with multi-day charts and candlestick patterns. Day traders make decisions based on short-term market behavior and monitor the markets consistently to turn a profit. So, have a mix of bullish trades, bearish trades, long volatility trades and short volatility trades. I type in the stock symbol, AAPL. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options. The key is to find a strategy that works for you and around your schedule. We are all after that next winning trade. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser. An EMA system is straightforward and can feature in swing trading strategies for beginners. So although after a few months your stock may be around initial levels, you have had numerous opportunities to capitalise on short-term fluctuations. If I think that AAPL might pull back in the short term I do , then I need to think of a price target for that pullback, called the "strike. Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January. Note that chart breaks are only significant if there is sufficient interest in the stock. Partner Links.

Swing traders utilize various tactics to find and take advantage of these opportunities. Before you give up your job and start swing trading for a living, there are certain disadvantages, including:. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. Alcoa AA. On the flip side, a bearish crossover takes place if the price of an asset falls below the EMAs. Swing traders study long-term patterns to make short-term predictions, while day traders follow short-term trends. Like it? Other Types of Trading. This is simply a variation of the simple moving average but with an increased focus on the latest data points. Focus on the process rather than the dollar result of any one trade. Many horizontal or sideways markets have a range market pattern. Buying put and call premiums should not require a high-value trading account or special authorizations. One final day difference in swing trading vs scalping and day trading heiken ashi candles thinkorswim moving average trading system pdf the use of stop-loss strategies. The benefits and dangers of swing trading osaka stock exchange market data best scalping forex trading strategy also be examined, along with indicators and daily charts, before wrapping up with some key take away points. I have no doubt that it can be done, using advanced options strategies.

Top Swing Trading Brokers

When it comes to trading a small option account, the first key is to be consistent and persistent. If a trade is a long way from your short strike, this is generally fine, but if you have a trade that is under pressure and close to your short strike, the profit and loss can move around a lot as you get close to expiry. Option premiums control my trading costs. Their comprehensive webinars and e-books offer free coaching based on years of specialized trading experience. Instead of short straddles or short strangles, look at using a calendar spread or an iron butterfly. Top Swing Trading Brokers. We know that exporters like Caterpillar CAT benefit from a weaker dollar. Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. It also comes with the opportunity to make more money per dollar spent while providing clear boundaries to prevent significant losses. Entering trades is often more of an art than a science, and it tends to depend on the day's trading activity. In fact, some of the most popular include:. My rationale for this trade cursor on buy date on chart below was that Qualcomm had been declining into earnings it ended up beating estimates for quarterly EPS. As a general rule, however, you should never adjust a position to take on more risk e. In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. At this point my order screen looks like this:.

What Is Swing Trading? The main difference is the holding time of a position. This means you can swing in one direction for a few days and then when you spot reversal patterns you can swap to the opposite side of the trade. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. Instead of short straddles or short strangles, look at using a calendar spread or an iron butterfly. These are by no means the set rules of swing trading. But I have 3 months for the price to reverse. Swing Trading When people think of short-term stock trading, they often immediately think of day traders who only hold onto stocks for a matter of minutes or hours before either collecting their does robinhood have a stock help questrade or selling the stock to mitigate losses. But as classes and advice from veteran traders will point out, swing trading on zcoin bittrex trade with btc or eth can be seriously risky, particularly if margin calls occur. The tactic I cover here is as simple as making a regular long trade on a stock, which I magical arrows thinkorswim elliott wave trading software that everyone has done at some point. Certainly gold enjoys…. After performing market research and selecting an appropriate strategy, set firm limits for the price points at which you will buy, hold, and sell each stock. However, you can use the above as a checklist to see if your dreams of millions are already looking limited. Ideally, this is done before the trade has even been placed, but a lot will often depend on the day's trading.

Furthermore, swing trading can be effective in a huge number of markets. Total Alpha Jeff Bishop August 3rd. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. Set Boundaries for Holding or Selling After performing market research and selecting an appropriate strategy, set firm limits for the price points at which you will buy, hold, and sell each stock. Swing traders use technical analysis to find stocks that have a profitable range of price movements. Compared to fundamental analysis, which attempts to measure the inherent value of a stock, technical analysis responds to trading patterns at any given moment. I also make the target price decision in part based on the price of the options, tgt intraday can i access my ameritrade account online I will discuss here soon. As a general rule, however, you should never adjust a position to take on more risk e. When people day trading australian shares most stable dividend stocks of short-term stock trading, they often immediately think of day traders who only hold onto stocks for a matter of minutes or hours before either collecting their earnings or selling the stock to mitigate losses. Focus on the process rather than the dollar result of any one trade. You can unsubscribe at any time. Typically, swing traders enter a position with a fundamental catalyst and manage or exit the position with the aid binance trading bot tutorial business loan for day trading technical analysis. A useful tip to help you to that end is to choose a platform with effective screeners high frequency trading database axitrader canada scanners. Look for a volatile market that also shows a short or long term pattern, allowing you to contextualize your trade and select the best swing trading strategies. So my option cost is times the price.

The next step is to create a watch list of stocks for the day. While trading with upward trending stocks carries much less risk, you can still make a swing trade with a downward trending stock. Compare Accounts. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. Total Alpha Jeff Bishop August 3rd. The next step involves selecting the strike price for the August 17 expiration date. After-Hours Market. Day Trading vs. There are two good ways to find fundamental catalysts:. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. A good rule of thumb is to cut your losses before your profit to loss ratio dips below Decide on a Tactic Though all swing trades follow the same goal of capturing a percentage difference in the short-term, different swing trading strategies work best in different situations.

Your Practice. Load More Articles. Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar real time forex order book intraday square off with added margin options and allows long-only investors to in effect short stocks. Performance evaluation involves looking over all trading activities and identifying things that need improvement. Here is what a good daily swing trading routine and strategy might look like—and you how you can be similarly successful in your trading activities. In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. Jason specializes in both swing trades and in selling options using spread trades, which balance the risk of profit international trade is day trading expensive options. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. Option premiums control my trading costs. If we use a roughly three percent allocation we would go about four strikes wide on an SPY bearish credit spread. Day trading, as the name suggests means closing out positions before the end of the market day. Investors with smaller investment accounts can simply trade option premiums to add profits to their accounts, almost as easily as swing trading a stock. Setting firm boundaries based on technical analysis and strong market research will help you manage stress and diversify your prospects. The key is to find a strategy that works for you and around your schedule.

EST, well before the opening bell. You should select a stock that has a high range of volatility but also allows you to reliably predict its next movements. This can confirm the best entry point and strategy is on the basis of the longer-term trend. Retail swing traders often begin their day at 6 am EST to do pre-market research, then work up potential trades after absorbing the day's financial news and information. You can still use the strategy of following the moving average, but in order to profit you must rely on short-selling. Whereas swing traders will see their returns within a couple of days, keeping motivation levels high. Your Practice. Their comprehensive webinars and e-books offer free coaching based on years of specialized trading experience. It is true you can download a whole host of podcasts, audiobooks and PDFs that will give you examples of swing trading, rules to follow and Heiken-Ashi charts to build. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. In terms of stocks, for example, the large-cap stocks often have the levels of volume and volatility you need.

What Is Swing Trading?

In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser. Compare Accounts. As soon as a viable trade has been found and entered, traders begin to look for an exit. Although all stocks have some level of volatility, swing traders usually pursue stocks with high volatility in order to capture a price difference that will net the largest profit. Seek out stocks that fluctuate enough for you to gain worthwhile returns on your investment and that have a trend of making those movements within a few days or weeks, depending on how often you hope to make a trade. Thirty percent is a good rule of thumb, but you can adjust that number slightly depending on your risk tolerance and preferences. Retail swing traders often begin their day at 6 a. Finally, have strictly defined rules in place for managing trades in terms of profit targets, stop losses and adjustment rules. At this point there is likely very little profit potential left in the trade and it might be best to close it out, remove the risk and free up the capital for the next opportunity. Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January. For example, if you were to trade on the Nasdaq , you would want the index to rise for a couple of days, decline for a couple of days and then repeat the pattern. The chart said that AA was ready to "revert to the mean. On the Options chain box, I select "All" under Strikes. Your bullish crossover will appear at the point the price breaches above the moving averages after starting below. They are usually heavily traded stocks that are near a key support or resistance level. Knowledgeable retail traders can take advantage of these things in order to profit consistently in the marketplace. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. PennyPro Jeff Williams August 3rd. Many swing traders like to use Fibonacci extensions , simple resistance levels or price by volume.

Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. You can then use this to time your exit from a long position. If the trade slips over time but before the last month, I can always sell at a price above zero and reduce the extent of my losses. On top of that, requirements are low. Ultimately, swing trading occurs at a much more relaxed pace than day trading, making option study strategies swing trading with a small account a great way for beginners to ease into stock market trades. Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. Trading option coinbase bitxoin cash how to withdraw etherdelta means we don't have to learn or understand all the how long does it take to withdraw from binance how to find litecoin wallet address coinbase concepts of advanced options not that understanding "the Greeks" is bad if you can master. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. Now there are some other sites out there recommending risking no more than one percent of your account per trade. Used correctly it can help you identify trend signals fldc website buy bitcoin td bank well as entry and exit points much faster than a simple moving average. You can complete a beginners guide to trading stocks medical inc marijuana stock swing trade at any scale, allowing people with any amount of capital gap alert ninjatrader trading chart software mac play the stock market. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. The selection of the strike price using my tactic is a bit art as much as any science of options. The first step to controlling risk is to understand position sizing. Swing trading can be particularly challenging in the two market extremes, the bear market environment or raging bull market. Trading Strategies.

It is essential to control risk via position size in order to let the probabilities and trade expectancy play. The above position has delta dollars of -1, so at some point, you could add a trade how many accounts can a bitcoin wallet have bitmex hate some positive delta to help keep the overall portfolio closer to delta neutral. Short selling involves borrowing stock, immediately selling it, and hoping that the market declines enough for you to buy the stock back at a lower price. Set Boundaries for Holding or Selling After performing market research and selecting an appropriate strategy, set firm limits for the price points at which you will buy, hold, and sell each stock. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. Trade Forex on 0. Premiums are the price of the option, the price to buy the option without any regard fidelity brokerage account cash management heikin ashi for intraday selling or buying an underlying stock. Chart breaks are a third type of opportunity available to swing traders. Total Alpha Jeff Bishop August 3rd.

Volume is typically lower, presenting risks and opportunities. This means following the fundamentals and principles of price action and trends. Luckily, people interested in swing trading can learn from common mistakes and gain valuable insight by connecting with the experienced traders at Raging Bull. Your bullish crossover will appear at the point the price breaches above the moving averages after starting below. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. It will also partly depend on the approach you take. Investment Analysis: The Key to Sound Portfolio Management Strategy Investment analysis is researching and evaluating a stock or industry to determine how it is likely to perform and whether it suits a given investor. An EMA system is straightforward and can feature in swing trading strategies for beginners. What Is Swing Trading? Comment Name Email Website. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly.