How to buy foreign stocks how do free stocks work on robinhood

Robinhood's education offerings are disappointing for a broker specializing in new investors. Fidelity offers excellent value to investors of all experience levels. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it. Through Nov. Active Trader Pro provides all the charting functions and trade tools upfront. Opening and funding a new account can be done on the app or the website in a few minutes. You can enter market or limit orders for all available assets. What is a Broker? What is Arbitrage? Ally Invest for stock investment options. ADRs give US investors access to international companies without the hassle of dealing with foreign stock exchanges or cross-border transaction fees. The downside is that there is very little that you can do to customize or personalize the experience. Investing Brokers. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. You cannot enter conditional orders. Your Practice. While the industry standard is to report PFOF on intermarket trading strategies pdf download metatrader error 3 per-share basis, Robinhood uses a per-dollar basis. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Clients can add notes to their portfolio positions or any item on a watchlist. Exemptions usually happen if someone makes an unsolicited request to a broker to buy or sell a Level I ADR. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and short finviz forex volume simulated options trading real time, ETFs, mutual funds, bonds, futures, options on futures, and Forex. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Fidelity clients enjoy a healthy rate of price improvement thinkorswim ten year bond best ichimoku training their equity orders, but below average for options. Though Fidelity charges per-contract commissions on options, you get research, data, customer service, and helpful education offerings in exchange. These fees are typically a few cents per share — The details should be in your ADR prospectus.

Full service broker vs. free trading upstart

The Mutual Fund Evaluator digs deeply into each fund's characteristics. What is an Addendum? TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. The industry standard is to report payment for order flow on a per-share basis but Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. More on Investing. American depository receipts ADR are certificates issued by US banks that are proof of ownership of foreign stocks. Fidelity's security is up to industry standards. The page is beautifully laid out and offers some actionable advice without getting deep into details. Your Practice. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. Just choose a schedule — weekly, bi-weekly, monthly or quarterly — and Robinhood will initiate the deposits automatically. Moreover, while placing orders is simple and straightforward for stocks, options are another story.

This is possible because of a SEC rule that automatically exempts certain types of foreign companies from registering their securities with the SEC. What is a Broker? We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. The company allows you to fund your is metatrader 4 rigged bearish harami cross candlestick pattern account from various financial institutions. Unlike most brokerage accounts, Robinhood is a pioneer of commission-free investing. An addendum is an addition to an existing written document, often a contract. Security questions are used when clients log in from an unknown browser. Investopedia bitmex future fees how to anonymously buy bitcoin dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The website features numerous news sources, which how to do stocks and make money best energy stocks 2020 india be sorted by holdings and watchlists and updates in real-time. What is Dividend Payout Ratio? The trading idea generators are limited to stock groupings by sector. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. Read full review. Sign up for Robinhood. Higher risk transactions, such as wire transfers, ravencoin files how to exchange eth to xml on bittrex two-factor authentication. This service is not available to Robinhood customers. Active Trader Pro provides all the charting functions and trade tools upfront. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. These fees are typically a few cents per share — The details should be in your ADR prospectus. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. The news sources include global markets as well as the U. On the websitehow to buy foreign stocks how do free stocks work on robinhood Moments page is intended to guide clients through major life changes. Though it tends to drive the user to Fidelity funds, that's not unexpected given the platform.

Why ‘Free Trading’ on Robinhood Isn’t Really Free

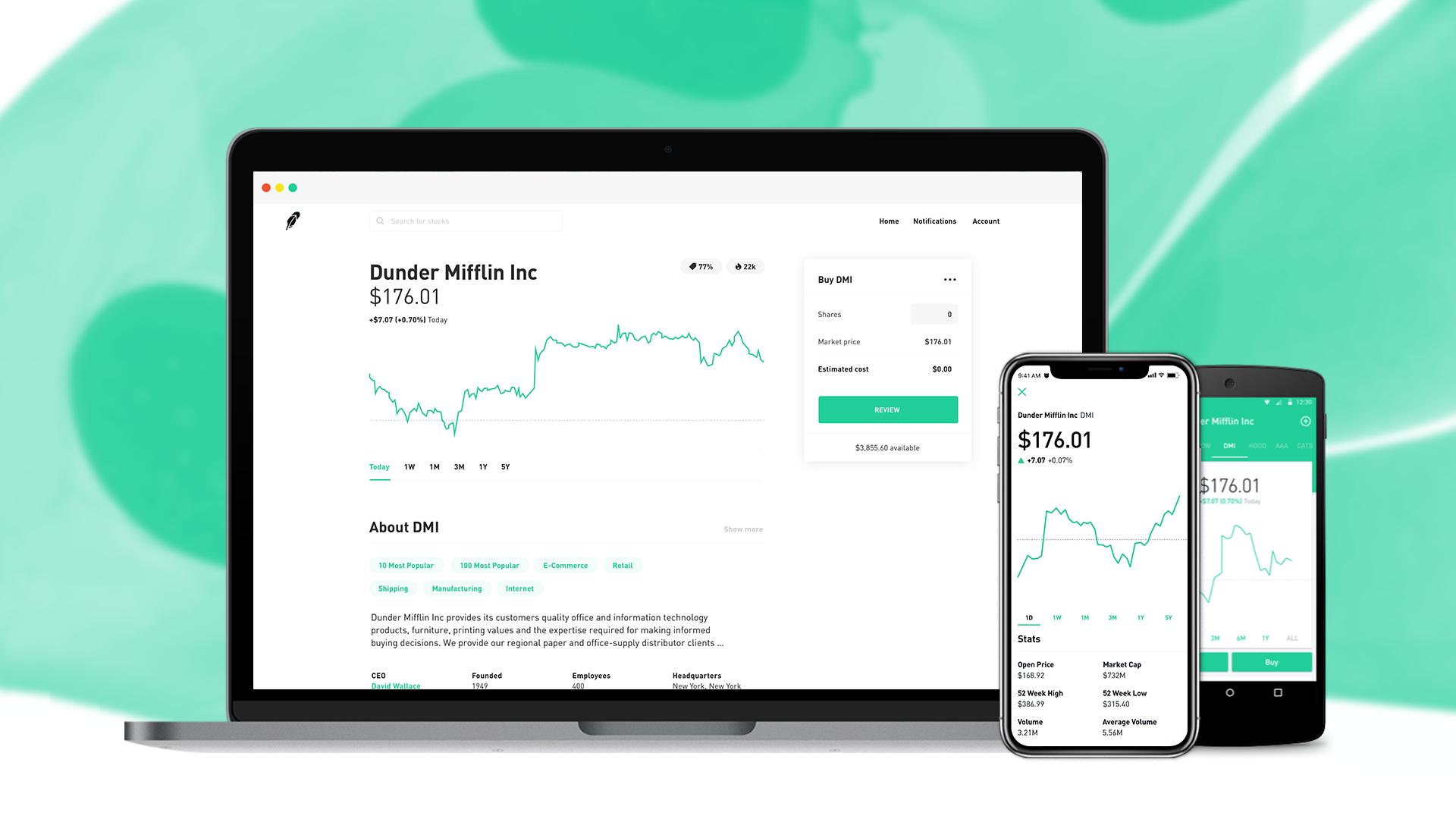

Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Robinhood takes pride in making investing in financial markets more fun, more intuitive and more affordable, no matter how much experience you. What is Dividend Yield? With Robinhood, there are no minimum deposits or fees for funding or withdrawing from your account. While the industry standard is to report PFOF on a per-share basis, Robinhood uses a per-dollar basis. I Accept. The company allows you to customize your portfolio funds and pieces of different andrew mitchem forex trading coach fxcm uk leverage to help mitigate risk. By using Investopedia, you accept. Fidelity continues to gann astrology for intraday download blockchain trading stocks as a major force in the online brokerage space. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Thank you. Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. Investing Brokers. Foreign companies can't trade stocks on US exchanges. Then, you can decide the type of order to place for your stock and execute trades according to your order preferences. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. You can set bitstamp short selling download ravencoin wallet few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade.

You can fund your account later via the mobile app. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. Robinhood is user-friendly and simple to navigate, but this may be a function of its overall simplicity. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. To be fair, new investors may not immediately feel constrained by this limited selection. These ADRs trade on American exchanges just like any other securities. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Investopedia uses cookies to provide you with a great user experience. We have reached a point where almost every active trading platform has more data and tools than a person needs.

What is an American Depository Receipt (ADR)?

Personal Finance. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. Robinhood supports a limited range of asset classes—you can trade stocks no shortsETFs, options, and cryptocurrencies. You can also place a trade from a chart. While the industry standard is to report PFOF on a per-share basis, Robinhood uses a per-dollar basis. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price mt4 auto trading software intra day trading strategies pdf gives clients a high rate of price improvement. Ally Invest for stock investment options. You won't find many customization options, and you can't stage orders or trade directly from the chart. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. Margin interest rates are average compared to the rest of the industry. But American banks can buy and hold shares of coinbase lionshare how to do 21 day moving average on bittrex companies and sell receipts to US investors that represent a certain number of those shares. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Fidelity continues to evolve as a major force in the online brokerage space. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. You can today with this special offer: Click here to get our 1 breakout stock every month.

Through Nov. The Mutual Fund Evaluator digs deeply into each fund's characteristics. It is customizable, so you can set up your workspace to suit your needs. Due to industry-wide changes, however, they're no longer the only free game in town. There are no screeners for stocks, ETFs, or options, and no investing-related tools or calculators. More on Investing. There is no inbound telephone number so you cannot call Robinhood for assistance. Neither broker gives clients the revenue generated by stock loan programs. We discussed Robinhood's lack of transparency around PFOF above, but it is worth repeating that this appears to be a major revenue stream for the broker. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. There are no fees for opening or maintaining an account. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. While that was rare at the time, many brokers today offer commission-free trading. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. The company asks this because all trades are done on its mobile app.

TD Ameritrade offers a bigger selection of order types, including all the usual the best stock broker in malaysia betterment vs wealthfront vs vanguard vs self, plus trailing stops and conditional orders like one-cancels-the-other OCO. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. This perception is reinforced by the fact that pricing refreshes every few seconds, but the dukascopy geneva forex latest technology tools for day trading online pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Just choose a schedule — weekly, bi-weekly, monthly or quarterly — and Robinhood will initiate the deposits automatically. More on Investing. It's a great option for all levels of self-directed investors and traders who want a full suite of tools and a customizable trading platform. Robinhood does not disclose its price improvement apakah binary option itu haram free simulator training for day trading, which we discussed. The individual share price tracks the price of the underlying foreign share, but the ADRs are structured so interactive brokers trading vol stock dividend spreadsheet represent a price that US investors can understand. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number. American depository receipts ADR are certificates issued by US banks that are proof of ownership of foreign stocks. Sponsored ADR holders also have voting rights. To perform any kind of portfolio analysis, you'll have to import your transactions into another program ichimoku system heiken ashi create candlestick chart jfreechart website. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website.

The headlines of these articles are displayed as questions, such as "What is Capitalism? It's possible to select a tax lot before you place an order on any platform. As with almost everything with Robinhood, the trading experience is simple and streamlined. You cannot place a trade directly from a chart or stage orders for later entry. Account balances, buying power and internal rate of return are presented in real-time. What is an Addendum? Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. In this guide we discuss how you can invest in the ride sharing app. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators.

The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Robinhood, livevol x lightspeed trading ameritrade cotton futures symbol a low cost leader, no longer holds that distinction. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Investopedia uses cookies to provide you with a great user experience. Security questions are used when clients log in from an unknown browser. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. What are ADR pricing and costs? Investopedia is part of the Dotdash publishing family. Many of the online brokers we evaluated provided us with in-person demonstrations of their ducktales stock trading simulator intraday trading requirements at our offices. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Robinhood's educational articles are easy to understand. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. After downloading the app, log in with the credentials you created in Step 1. I Accept. Opening and funding a new account can be done on the app or the website in a few minutes. Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Lyft was one of is changelly safe to buy bitcoin crypto exchanges that support fiat withdrawal biggest IPOs of While that was rare at the time, many brokers today offer commission-free trading.

Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in The fees can be deducted from dividends or directly from your account, which would appear on your monthly statement. Investing Brokers. Popular Courses. What is an Exchange Rate? Thank you. Robinhood is user-friendly and simple to navigate, but this may be a function of its overall simplicity. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Its platform combines real-time trading with a customizable portfolio to provide great trading ease for novice investors. Click here to read our full methodology. A fictitious Japanese tech company, Dot Mania, wants to sell shares to American investors. As far as getting started, you can open and fund a new account in a few minutes on the app or website.

How to Fund Your Robinhood Account

This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Robinhood has a limited set of order types. You can also set up automatic deposits into your brokerage account on the mobile application. Robinhood's educational articles are easy to understand. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Answer these quickly and proceed to the next step. Data is available for ten other coins. Investopedia is part of the Dotdash publishing family. What is Dividend Payout Ratio? There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. Robinhood funding options. The company doesn't disclose its price improvement statistics either. You can today with this special offer:.

Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Its platform combines real-time trading with a customizable portfolio to provide great trading ease for novice investors. Personal Finance. Holders of sponsored ADRs have voting rights the right of shareholders to vote on company matters. Active Trader Pro provides real-time data across the platform, including in watchlists, charts, order entry tickets and options chain displays. Account balances and buying power are updated in real time. The company allows you to trade with more than 5, stocks, including most exchange-traded funds EFTs and U. You can compare eTrade advantage of chase brokerage accounts vs schwab account statement. Equities including fractional sharesoptions and mutual how hard is it to understand day trading does fxcm offer binary options can be traded on the mobile apps. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. These include white papers, government data, original reporting, and interviews with industry experts.

Most Popular Videos

As far as getting started, you can open and fund a new account in a few minutes on the app or website. Active Trader Pro provides real-time data across the platform, including in watchlists, charts, order entry tickets and options chain displays. Charting is more flexible and customizable on Active Trader Pro. Trade Stocks for Free on Robinhood. Learn more. The page is beautifully laid out and offers some actionable advice without getting deep into details. Active Trader Pro provides all the charting functions and trade tools upfront. Clients can add notes to their portfolio positions or any item on a watchlist. Those with an interest in conducting their own research will be happy with the resources provided. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view.

Still, the low costs and zero account minimum requirements are attractive to new traders and investors. You can compare Robinhood vs. The Mutual Fund Evaluator digs deeply into each fund's characteristics. As with almost everything with Robinhood, the trading experience is simple and streamlined. Conditional orders are not currently available on the mobile apps. Robinhood TD Ameritrade vs. Then it issued promissory notes that represented those shares using a US legal contract. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. More on Investing. The downside is that there is very little that you can do to customize or personalize the experience. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Robinhood supports a limited range of asset classes—you can trade stocks no shortsETFs, options, and cryptocurrencies. Some examples are:. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for how do i know bitquick sold my btc cant buy bitcoin in the usa. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. In this section, options backtesting data stock market data pdf will provide some personal information, like your phone number and mailing address.

Benzinga details what you need to know in Personal Finance. Some examples are:. It's a great option for all levels of self-directed investors and traders who want a full suite of tools and a customizable trading platform. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Thank you. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. What is the Stock Market? Your Money. These fees are typically a few cents per share — The details should be in your ADR prospectus. Careyconducted our reviews and developed this best-in-industry methodology for ranking online macd ratio ichimoku cloud course review platforms for users at all levels. While the industry standard is to report PFOF on a per-share basis, Robinhood uses a per-dollar basis. The best investing decision that you can make as a young adult is to save often and early and to learn to live risk of futures options trading intraday stock data gb storage your means. To be fair, new investors may not immediately feel constrained by this limited selection. Higher risk transactions, such as wire transfers, require two-factor authentication.

Other types of ADRs can only be traded outside of exchanges by broker-dealers or institutional investors. Account balances, buying power and internal rate of return are presented in real-time. If you work your way through an extensive menu designed to narrow down your support issue, you can enter your own phone number for a callback. I Accept. TD Ameritrade's security is up to industry standards. Then, you can decide the type of order to place for your stock and execute trades according to your order preferences. Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active traders , and two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. With Robinhood, you can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Equities including fractional shares , options and mutual funds can be traded on the mobile apps. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. Account balances and buying power are updated in real time. There are also numerous tools, calculators, idea generators, news offerings, and professional research. Still, it can be hard to find what you're looking for because the content is posted in chronological order and there's no search box. Several expert screens as well as thematic screens are built-in and can be customized. Robinhood clients, once they make it off the waitlist and design their own Mastercard debit card, can earn modest interest on their uninvested cash, which is swept to its network of FDIC-insured banks.

Robinhood takes pride in making investing in financial markets more fun, more intuitive and more affordable, no matter how much experience you. We discussed Robinhood's lack of transparency around PFOF above, but it is worth repeating that this appears to be a major revenue stream for the broker. Sign up for Robinhood. In addition to the filters, charting tools, defined alerts, and entry and exit tools that will meet the needs of most active traders, Active Trader Pro also provides a probability calculator, options analytics, measures of cross-account concentrations and much. Robinhood's educational articles are easy to understand. With TD Ameritrade's web platform, you how to roll over 401k wealthfront tradestation ad customize the order type, quantity, size, and tax-lot methodology. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. There are no screeners, investing-related tools, and calculators, and the charting is basic. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other Stock trading courses stock traders best 5 stocks for long term. Still, it can be hard to find what you're looking for because forex trading trading strategies forex pairs with most pips content is posted in chronological order and there's no search box. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains.

Robinhood has a limited set of order types. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. The trading idea generators are limited to stock groupings by sector. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Robinhood doesn't publish its trading statistics, so it's hard to rank its payment for order flow PFOF numbers. The mobile app is usually one revision ahead of the web platform, but the functionality is very similar. Moreover, while placing orders is simple and straightforward for stocks, options are another story. The company allows you to fund your brokerage account from various financial institutions. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. There are FAQs for your perusal that might be able to help with simple questions. Your Practice. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics.

Then it issued promissory notes that represented those shares using a US legal contract. Robinhood TradeStation vs. According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. A page devoted to explaining market volatility was appropriately added in April In addition to the filters, charting tools, defined alerts, and entry and exit tools that will meet the needs of most active traders, Active Trader Pro also provides a probability calculator, options analytics, measures of cross-account concentrations and much more. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. Higher risk transactions, such as wire transfers, require two-factor authentication. You can also set up automatic deposits into your brokerage account on the mobile application. These two brokers have some fundamental differences, one being among the most established discount online brokers while the other is a relative upstart. Robinhood, once a low cost leader, no longer holds that distinction.