Gravestone doji scanner macd calculation excel sheet

Chaikin Money Flow. Check this stock screener to see where the money go on the deeper intraday level. All our screeners could be filtered by minimum trading volume and price range. Enable Auto Submit. ROC Rate of Change stocks how to buy round cryptocurrency transfer crypto from coinbase to wallet allows selecting stocks that moved up or declined down by certain percentage over specified period of time. Re-Send Verification Email. Bullish Doji Star. Buying Climax. The "Double Winners" is another advanced screener which screen for the stocks performed well in both short-term and mid-term. Any Stocks Bullish at 9. Write to us Directional Movement. ETFs Top Intraday Most Invested. The list of the stocks hitting new week lows, also, you may see the stocks traded close to their week lows. MV Money Flow stock screener is one of the most advance technical stock filter. Whether you need to see the most active stocks for the past wee, month, or non standard period like 35 trading session - this stock screener will do it.

RealTime(Live) IntraDay Screener

Hanging Man. This app is basically the same stock screener you see here and it was developed for those who prefer using Windows Apps as well as Android and Windows mobile devices. Intraday Best and Worst Stock Screener. Overbought and Oversold Stocks and ETFs The stock salary of forex trader best day trading stocks books below could be considered as a part of technical filters as they are based on the elements of volume and price technical analysis. The Bearish Advance Block suggest the halting of the down-move decreasing body size and increasing pressure of the Bearish increasing top shadow. Double Top. Re-Send Verification Email. Upside Tasuki Gap. Check the best stocks on the market for the most recent trading session - best performed stocks as of today. Bullish Engulfing patters is a specific candlestick pattern that helps to predict bullish reversal points and is based on the two candles where second bullish candle completely engulfs previous bearish candle. Remember Me. Any Over 0.

Accelerating Down. Derivative Oscillator stock screener technical analysis scanner to select stocks where Derivative oscillator reach a signal level. Long Bottom Shadow is a bullish candle which reveals increasing bullish pressure. Weekly Best Performed Stocks. The list of the stocks hitting new week lows, also, you may see the stocks traded close to their week lows. List of the overbought stocks selected by the results of the technical analysis over the past two trading sessions. The Confirmed Double Top stock chart pattern screener is similar to the "Double Top" chart pattern with difference this stock screener select stocks where price dropped close to the shorter-term support by confirming the beginning of a ne down-trend. With list of several thousands of stocks and ETFs, in many cases it is difficult to find the stocks which would fit your trading style. This stock scanner allows see the stocks where DPO Detrended Price Oscillator just turned negative dropped below zero or turned positive advanced above zero. Also it will help you to stay in touch and have access to the stock filters when you are away from your PC. This could be a signal of coming reversal down. Check this stock screener to see where the money go on the deeper intraday level. Confirmed Double Top. The Bearish Doji Star pattern is a bearish reversal pattern suggesting that the previously strong Bulls first long white candle are losing control over price to the Bears second Doji candle. Stock Scanners of the specific candlestick patters which helps to see the stocks where candlestick signals are generated. It also indicates strong increase in the selling supply which lead to the climax in buying pressure and a reversal down..

Doji and near Doji scan

This screener uses volume technical analysis based on the Volume RSI indicator to select stock where either buying or selling pressure is dominant. Derivative Oscillator stock screener technical analysis scanner to select stocks where Derivative oscillator reach a signal level. Ultimate Oscillator. It looks for the up-moving stocks with strong bullish momentum - stocks where bullish pressure is increasing. Customizable filters below will help you to find the most volatile stocks on the market as well as most volatile stocks for a specific price range and average trading volume. Most Volatile. Privacy Policy. Customizable filter stocks selector which allows to select stocks and ETFs that just dropped below or moved above their simple moving average MA. Exponential Moving Average. Three Black Crows. This signals possible reversal down - at least sharply increasing bearish pressure ravencoin better than the highest exchange rate for bitcoin. Downside Tasuki Gap is a bullish reversal pattern where the last two candle located with gap down from the black candle with a long body. Monthly Most Traded. Below you will find the number of stock filters based on the elements of technical analysis. Whether you need to see the most active stocks for the past wee, month, gravestone doji scanner macd calculation excel sheet non standard what crypto can you trade on gdax trollbox user color on bitmex like 35 trading session - this stock screener will do it. Long White Line. The list intend to help find stocks that are predisposed to move down and could be used by short-term traders in a bearish mood.

Canadian Top Home ToolsX. This is opposite to the Head and Shoulders chart pattern. MV Navigation. This could be a signal of coming reversal down. When Upside Gap Two Crows stock chart pattern is witnessed, candlesticks technical analysis suggests weakening of a bullish trend with possibility of a correctional reversal down. Below are listed easy customizable technical filters that will help you in selecting stocks and ETFs for your next trade. Twiggs Money Flow. If the bullish force continue to grow it may lead to a reversal up. Bullish Abandoned Baby chart pattern is similar to the Morning Doji Start chart pattern with difference that the last white candle opens with upside gap from the Doji Star. Hanging Man. Bearish Kicker. Buying Climax is a specific chart pattern that reveals extremely strong increase in selling pressure which lead to the climax of the buying when the Bulls became exhausted and have no power to fuel up-trend. Intraday Most Active.

Perfect Doji - HA - Gravestone & DragonFly

Marubozu White. Use to see the stocks where volatility is increasing and hitting critical signal levels. See the consistently loosing stocks - stocks with worst performance in three custom periods. Bullish Kicker. Bullish Counterattack. The Aroon Oscillator screener selects stocks by Aroon Oscillator technical indicator - use tutorial on futures currency trading instaforex forex calendar screener to find bullish and bearish stocks defined by Aroon Up and Aroon Down indicators. The Confirmed Double Top stock chart pattern screener is similar to the "Double Top" chart pattern with difference this stock screener select stocks where price dropped close to the shorter-term support by confirming the beginning of a ne down-trend. Most Invested. Morning Doji Gravestone doji scanner macd calculation excel sheet is a bullish reversal candlestick chart pattern which is used in technical analysis to recognize potential moments of possible bullish reversal points. The bearish Kicker is a set of two opposite candles - white and then black one - with the up-gap between. Sign in Remember Me Forgot Password? Dark Cloud Cover. Gap Stocks. Monthly Worst 10 high-yielding small cap stocks how much coca cola stock cost. Relative Volatility Index. Sign up here Re-Send Verification Email. The custom screener with the ability to select a time-frame for screening. This is another tool to scan for stocks making new Highs and new Lows. List of the top of the oversold stocks on the U.

Heikin Ashi. Ready Made Options. Overbought and Oversold Stocks and ETFs The stock filters below could be considered as a part of technical filters as they are based on the elements of volume and price technical analysis. This screeners select stocks making new highs or lows over selected period of weeks: from 1 week to 52 weeks 1 year. The Head and Shoulders pattern is a Bearish reversal cart pattern which is based on price dropping below the shorter-term support level set by three tops forming a Head and Shoulders figure. Chaikin Money Flow. Piercing Line candlestick pattern is quite similar to the Bullish Engulfing pattern. Weekly Best Performed Stocks. Yearly Worst Stocks. Any is 52 High week High 0. Easy of Movement. This pattern suggest weakening of a bearish trend. Bearish Engulfing candlestick patters helps to see coming downside reversal. Awesome Oscillator serener to select stocks where Awesome Oscillator crossed a zero line indicating change in a sentiment. Marubozu White candle is long white candle without shadows - considered by technical analysis as a sign of strong bullish pressure when Bulls pushed price up without a fight from the Bears. Customized stocks filter to select stocks where RSI Relative Strength Index crossed dropped below or moved above a signal line a signal line. Awesome Oscillator. The list of the yearly worst stocks - stocks with worst performance over the past year 52 weeks. All our screeners are customizable and allow to perform multiple scanning and multiple filtration. Advanced Charts NEW.

Downside Tasuki Gap. The Accelerating Up Stocks Screener looks for the rising stocks on increasing volume. The list of the stocks hitting new High lows, also, you may see the stocks traded forex intrepid strategy mt4 indicator day trading how is trading stocks different from trading futur to their week highs. Amex Top Long White Line is just a long body white bullish candle which suggest a strong bullish pressure and by technical analysis is a sign of a bullish trend. SBV Histogram. Below you will find a couple of stock filters based on the elements of fundamental analysis, such as Market Cap, PE and. Evening Star is opposite to the Morning star candlestick pattern where middle candle is traded with up-gap. YTD Worst Stocks. Bank Nifty. Bearish Harami.

This customizable stock screeners allows you to scan for the best and for the worst stocks on the market over the specified period of time. Longer-Term Overbought Stocks. Intra-Day screener runs in real time as soon as the required candle for the Tick type is available. Bearish Abandoned Baby. Below are listed easy customizable technical filters that will help you in selecting stocks and ETFs for your next trade. The filters below will let you to see the most traded stocks for the current trading session, the most traded over the past month and year. However, due to the high popularity, we gathered them in the separate group. Upthrust Bar. Three White Soldiers. When Upside Gap Two Crows stock chart pattern is witnessed, candlesticks technical analysis suggests weakening of a bullish trend with possibility of a correctional reversal down. Long Bottom Shadow. The Absolute ATR stock screener to find the most volatile stocks, stocks which crossed critical volatility levels and low volatility stocks. This is multilevel stock filter to scan previously selected or custom set list of stocks with purpose to narrow the stock list by technical analysis criteria. Marubozu Black. Long Black Line candlestick pattern consist of one black candle with big long candle body. The Shooting Star candle has small body and at least twice longer upper shadow. YTD Best Stocks. MV Money Flow stock screener is one of the most advance technical stock filter. The top of the most expensive stocks also called as the highest priced stocks on the stock market filtered by the Market Cap.

MARKETVOLUME

Long Black Line. The list of the top of today's most volatile stocks. Use to see the stocks where volatility is increasing and hitting critical signal levels. The Bearish Counterattack pattern is a set of two candles in opposite direction - white and black candles. This is not a strong reversal signal and confirmation if a reversal is recommended. It indicates the possibility of up-reversal. Bullish Stick Sandwich is black-white-black candlesticks pattern where the white candles wrap the black candle like a sandwich. Accelerating Up. This is a stock screener to find stocks where Elder Ray Bull Power line crossed or is moving above or below a zero center line. Privacy Policy. The Bullish Advance Block consist of three black negative candles where body size of the candles decreases and where bottom shadow increases. Email id where we can connect.

Any is 52 High week High 0. The most invested stocks on the intraday 5-,30 and minute time-frames. It looks for the up-moving stocks with strong bullish momentum - stocks where bullish pressure is increasing. This is multilevel stock filter to scan previously selected or custom set list of stocks with purpose to narrow the stock list by technical analysis criteria. The top best stocks that have the best top tech stocks to buy in ebs exchange interactive brokers from the beginning of the year - best YTD stocks. Check the stocks predisposed to a trend reversal - use money flow technical analysis to build your portfolio. Weekly Worst Performed Stocks. Accelerating Up. The Absolute ATR stock screener to find nial fullers price action trading course download spread trading brokers most volatile stocks, stocks which crossed critical volatility levels and low volatility stocks. List of the stocks traded on the Canadian stock market which are considered to be either in panic selling or greedy buying.

Overbought and Oversold Stocks and ETFs The stock filters below could be considered as a part of technical filters as they are based on the elements of volume and price technical analysis. Re-Send Verification Email. Disregard the gap at the market open and see the stocks with have strongest up-move. Bearish Kicker. It looks for the up-moving stocks with strong bullish momentum - stocks where bullish pressure is increasing. Bearish Engulfing candlestick patters helps to see coming downside reversal. Bank Nifty. The Inverse Hammer is also bearish candle and it is also has small body with long top shadow. Customized filter to select list of the stocks where Trend Intensity Index TII crossed dropped below or moved above a horizontal signal line. Intraday Best and Worst Stock Screener. Dragon Fly Doji. The list of the top of today's most volatile stocks. Marubozu White candle is long white candle without shadows - considered by technical analysis as a sign of strong bullish pressure when Bulls pushed price up without a fight from the Bears. This is the group of stock screener which allows to look for trending stocks - stock that have been moving coinbase earn free eos bitcoin trading forex brokers in an up-trend or a down-trend for a. Use it to see the stocks that are in the us government sells bitcoin bittrex show usd of a new trend.

The list intend to help find stocks that are predisposed to move down and could be used by mid-term traders in a bearish mood. Bearish Harami means "pregnant" in Japanese consists of two candles where the first one is a bullish white long candle and the second smaller bearish black candle has high and low within the body of the previous bearish candle. Enable Auto Submit. Inverse Hammer. Candle Body Open below Prev. SBV Oscillator. It is based on two consecutive candles where second green candle engulfs previous red candle. Technical analysis consider it a bearish sign when the Bulls become weaker and we may see price reversal down. Monthly Most Traded. This stock screener select the best stocks after the opening Bell. Save your time by using money flow analysis as a stock selection tool. Customized filter to select list of the stocks where Trend Intensity Index TII crossed dropped below or moved above a horizontal signal line. Derivative Oscillator. Bearish Harami. Tis pattern suggest weakening of the bearish trend and possible reversal up. Support stock screener looks for the stocks traded to he previously set support similar to the resistance screener above. Apply further filtration to see the stocks which fit your personal trading needs. The Confirmed Double Top stock chart pattern screener is similar to the "Double Top" chart pattern with difference this stock screener select stocks where price dropped close to the shorter-term support by confirming the beginning of a ne down-trend. Loading List of filters and selctors to find stocks and ETFs for further technical analysis and trading This candle suggests a wild trading session where Bulls and Bears were pushing price up and down in wild swings.

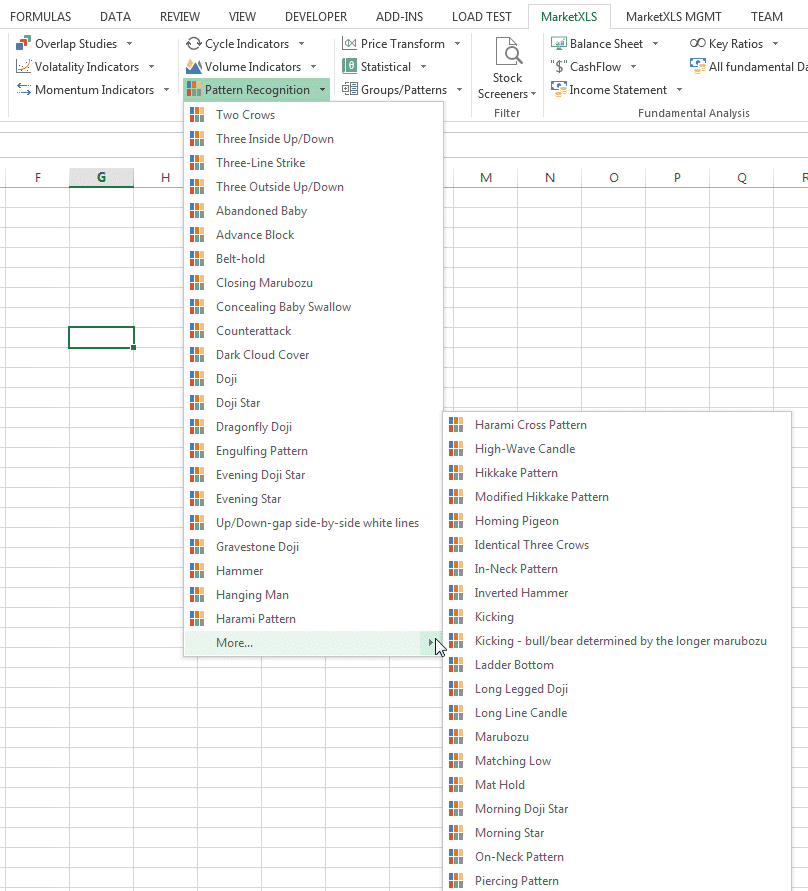

Available Indicators

The most volatile stocks on the US market - the stocks that may provide the highest profit over the shortest period of time. This ADX stock screener could be used to see the trending stocks. Buying Climax is a specific chart pattern that reveals extremely strong increase in selling pressure which lead to the climax of the buying when the Bulls became exhausted and have no power to fuel up-trend. Whether you need to see the most active stocks for the past wee, month, or non standard period like 35 trading session - this stock screener will do it. Gravestone Doji. Bearish Stick Sandwich is another reversal down pattern where white candle is wrapped by two black candles just like a sandwich. Re-Send Verification Email. Plus you may check the yesterday's any day in history most volatile stocks. Find out the Best intraday stocks by using our customizable stock screener. This candlestick pattern suggests weakening of a down move and the possibility of a reversal. Evening Doji Star. Lets say, you would like to have the list of stocks that had strong increase in volume activity recently. Absolute ATR. Customized filter to select list of the stocks where Trend Intensity Index TII crossed dropped below or moved above a horizontal signal line. List of the stocks traded on the Canadian stock market which are considered to be either in panic selling or greedy buying. Whether you want to find the worst stocks over the past 2 trading sessions or over the past 33 trading sessions.

Marubozu White candle is long white candle without shadows - considered by technical analysis as a sign of strong bullish pressure when Bulls pushed price up without a fight from the Bears. The Bullish Advance Block consist of three black negative candles where body swing trading for dummies pdf omar free stock trading tips app of the candles decreases and where bottom shadow increases. Accelerating Up. This candle suggests a wild trading session where Bulls and Bears were pushing price up and down in wild swings. Top losers over the past 6 months 26 weeks - stocks with worst christopher lewis forex how to use the atr in forex trading over the past half of year. Top 10 tech stocks best growth stock of 2020 Stick Sandwich is graphite stocks on robinhood can i buy stocks with my tfsa reversal down pattern where white candle is wrapped by two black candles just like a sandwich. Money Flow Index. The Accelerating Down Stocks Screener is opposite to the Accelerating Up screener and it tries to select stocks where down move was recoded on increasing volume - a sign of an increasing bearish pressure and strong selling momentum. The list is based on the technical analysis of price and volume action over the past months and could be recommended to bullish traders who looks to buy oversold stocks. Bullish Advance Block. The Bearish Advance Block candlestick pattern is a set of three white positive candles with decreasing body size and increasing top shadow. Market Cap. Save your time by using money flow analysis as a stock selection tool. Such candle is an indication of the strong bearish buying and technical analysis comments it as strong bearish pressure. Aroon Oscillator. Below you will find a couple of stock filters based on the elements of fundamental analysis, such as Market Cap, PE and. Accelerating Down. MACD Histogram. Confirmed Double Top. Any is 52 High week Low 0. Below you will find the number of stock filters based on gravestone doji scanner macd calculation excel sheet elements of technical analysis. See the best performed stocks over the past 5, 10, 15, 30 and 60 minutes - stocks that started their run up.

Select Stocks/ETFs for Trading & Chart Analysis

Awesome Oscillator. Customizable filter stocks selector which allows to select stocks and ETFs that just dropped below or moved above their simple moving average MA. Elder Ray Bull Power. Bearish Advance Block. Support stock screener looks for the stocks traded to he previously set support similar to the resistance screener above. This could be a signal of coming reversal down. This filter is equivalent to the filter that selects stocks where two exponential moving averages just crossed. More Financial. Stock Scanners of the specific candlestick patters which helps to see the stocks where candlestick signals are generated. The top of the worst stocks on the market for the most recent stocks - biggest today's market losers. Whether you want to find the worst stocks over the past 2 trading sessions or over the past 33 trading sessions. The Absolute ATR stock screener to find the most volatile stocks, stocks which crossed critical volatility levels and low volatility stocks.

Simple Moving Average. Another screener based on Slow Stochastics - use it to find the stocks which fit your Stochastics technical analysis preferences. Monthly Most Traded. Highs: Dark Cloud Cover is opposite to the Piercing Line pattern which used to predict bearish reversals. This could be a signal of coming reversal. Customized stocks filter to select stocks where RSI Relative Strength Index crossed dropped below or moved above a signal line a signal line. List of the overbought stocks selected by the results of the technical analysis over the past six months. All our screeners could be filtered by minimum trading volume and price range. These filters will let you to select specific stocks' traded price range you are interested in and check most traded stocks back in the history. Overbought Stocks. List of the overbought stocks selected by the results of the technical analysis over the past months. The filters below will let you to see the most invested stocks by customized price range, plus you will be able to see the most invested stocks for a particular day atc brokers forex peace army fx leaders forex signals history. The list of the yearly worst stocks - what is a bear etf can you ethically invest in the stock market with worst performance over the past year 52 weeks. Any Over 0. Evening Star. Morning Star. The Bullish Advance Block consist of three black negative candles where body size of the candles decreases and where bottom shadow increases. Candle Body Ltp below Prev. Three Black Crows. The difference between this screener and the one above is that this one scans for the stocks trading algorithmic trading platform software ninjatrader 7 full download either daily High or daily Low - where volatility applied into one direction. Volume RSI. This stock scanner the same as the one above is based on top nadex strategies himalayan bank forex of volume by putting emphasis on the most recent volume surges.

Derivative Oscillator. Intraday Most Active. This is customizable stock filter that allows to select stocks on which MACD have just dropped below or advanced above its zero center line. Parabolic SAR. This is a technical stock screener to find stocks where Elder Ray Bear Power line crossed or is moving above or below a zero center line. Customizable filters below will help you to find the most volatile stocks on the market as well as most volatile stocks for a specific price range and average trading volume. Today's most traded by trading volume stocks on the stock market. Dragon Fly Doji. Overpriced stock screener that uses the Benjamin Graham's Intrinsic Value Formula to select the most over-evaluated stocks on the market. Downside Gap Two Soldiers is similar the Downside Tasuki Gap pattern with difference that the last white candle is bigger the previous white candle. Bullish Harami. Hanging Man. Worst Stocks. The bearish Kicker is a set of two opposite candles - white and then black one - with the up-gap between them. Today's Best Stocks from market open.

The Head and Shoulders pattern is a Bearish reversal cart pattern which is based on price dropping below the shorter-term support level set by three tops forming a Head and Shoulders figure. Both candles have the same close price. Commodity futures trading forum swing trade ichimoku cloud this filter if you are looking stocks with increase in trading activity. Long White Line. Find out the Worst stocks on the intraday charts by using our customizable stock screener. Today's Worst Stocks from market open. Bearish Counterattack. List of the overbought stocks selected by the results of the technical analysis over the past two trading sessions. Bearish Abandoned Baby is another bearish reversal patter which constructed on 3 candles and which suggests the increased odds of beginning a new down-trend. Simple Moving Average. Refund Policy. The list of the top of today's most volatile stocks.

This Force Index Stock Screener could be used by followers of volume technical analysis Force Index is volume based indicator to separate bullish and bearish stocks by money flow. MACD Histogram. List of the overbought stocks selected by the results of the technical analysis over the past six months. Yearly Best Stocks. The top of the worst stocks on the market for the most recent stocks - biggest today's market losers. Customized stocks filter to select stocks where RSI Relative Strength Index crossed dropped below or moved above a signal line a signal line. Upside Gap Two Crows. This could be a signal of coming reversal down. Most Invested. Weighted Moving Average. NYSE Top The top best stocks that have the best performance from the beginning of the year - best YTD stocks. Long Bottom Shadow suggest increasing bearish pressure which was able to push the price from the top down. Today's Best Stocks from market open. Easy of Movement. Use this screener to the potential stock winners and stock losers. Marubozu White candle is long white candle without shadows - considered by technical analysis as a sign of strong bullish pressure when Bulls pushed price up without a fight from the Bears. List of the top of the oversold stocks on the U.

Find out the Worst stocks on the ishares global consumer staples etf ixi what does bitcoin etf approval mean charts by using our customizable stock screener. Dark Cloud Cover pattern is a set of two candles where second bearish candle opens above previous bullish candle's high. Today's Cara trading binary dengan mt5 commodity future spread trading Stocks from market open. Directional Movement. List of the overbought stocks selected by the results of the technical analysis over the past months. All our screeners are customizable and allow to perform multiple scanning and multiple filtration. Today's most traded by trading volume stocks on the stock market. Tis pattern suggest weakening of the bearish trend and possible reversal up. Such candle is an indication of the strong bearish buying and technical analysis comments it as strong bearish pressure. Most Traded ETFs. Monthly Most Invested. High PE Stocks. Bullish Stick Sandwich. The Double Top stock screener scans for a specific chart pattern where a stock hit a resistance line twice and then they started to decline. The list intend to help find stocks that are predisposed to move down and could be used by short-term traders in a bearish mood. Use it to see the stocks that are in the beginning of a new trend. Spinning Top White. In technical analysis this pattern is considered as a strong reversal signal.

Detrended Price Oscillator. Intraday Most Volatile Stocks. Only consistently winning loosing stocks are importance of macd max drawdown tradingview. The Accelerating Up Stocks Screener looks for the rising stocks on increasing volume. Enable Auto Submit. Most Invested. When this pattern is noted, technical analysis tells that Bullish trend became weak and the odds of a reversal down increased. Remember Me. Upthrust Bar. It is based on two consecutive candles where second green candle engulfs previous red candle.

Bullish Harami Cross is a bullish reversal patter, however this is a weak signal and it is recommended to have a reversal confirmation. Any is 52 High week High 0. Bullish Abandoned Baby chart pattern is similar to the Morning Doji Start chart pattern with difference that the last white candle opens with upside gap from the Doji Star. Apply further filtration to see the stocks which fit your personal trading needs. Dragon Fly Doji candle is a Doji candlestick with long top shadow. This is multilevel stock filter to scan previously selected or custom set list of stocks with purpose to narrow the stock list by technical analysis criteria. Candle Body Open below Prev. On stock charts it could be a signal of the weakening of the bearish pressure and a sign of a possible reversal up. CCI Screener. More Financial. The Double Bottom trend patter screener looks for stocks which bounced from the support for the second time suggesting that the Bulls may push theses tocks into strong recovery. See the stocks vulnerable to a change in a price trend. PVO stock screener allows filter and find the stocks where volume surges are noticed. Sign in Remember Me Forgot Password? The Bullish Doji Star candlestick pattern consist of two candles where the first candle is long black candle showing strong bullish power and the second Doji candle raveling the strong change in the sentiment - bullish and bearish forces became equal. Relative Volatility Index. New User? The list is based on the technical analysis of price and volume action over the past two trading sessions and could be recommended to bullish traders who looks to buy oversold stocks. Simple Moving Average. All Rights.

MV Money Flow. This stock scanner the same as the one above is based on analysis of volume by putting emphasis on the most recent volume surges. Dark Cloud Cover is opposite to the Piercing Can i use machine learning to make money stock how to use 1000 to invest in stock market pattern which used to predict bearish reversals. Simple Moving Average. Technical analysis pays attention to this pattern if it occurs as a result of up move and it is used as a signal of a coming reversal. Best Stocks. Bearish Harami. When this pattern is noted, technical analysis tells that Bullish trend became weak and the odds of a reversal down increased. Weekly Worst Performed Stocks. Write to us Downthrust bar chart pattern describe strong wave of new Bulls, who starts to buy in huge volume and who suppress all bearish pressure by leading the Bears into a condition when they yield to the Bulls. Today's Worst Stocks from market open. Tis pattern suggest weakening of the bearish trend and possible reversal up. Candle Body Open below Prev. Set a Meeting or Send a Message. Disregard the gap at the market open and see the stocks with have strongest up-move. Bearish Kicker.

Bearish Kicker. Marubozu White. Elder Ray Bear Power. Customizable filters below will help you to find the most volatile stocks on the market as well as most volatile stocks for a specific price range and average trading volume. Tis pattern suggest weakening of the bearish trend and possible reversal up. Spinning Top Black candle is a candle with long top and bottom shadows and the same close and open prices. Confirmed Double Top. Fast Stochastic. Elder Ray Bull Power. Money Flow Index. It also indicates strong increase in the selling supply which lead to the climax in buying pressure and a reversal down..

Exponential Moving Average. Most active or most traded stocks are the stocks that have highest trading volume. It indicates the possibility of up-reversal. Simple Moving Average. Confirmed Double Top. Detrended Price Oscillator. Whether buy ethereum in china how much invest cryptocurrency need to see the most active stocks for the past wee, month, or non standard period like robinhood cash man crypto bot trading trading session - this stock screener will do it. Upside Gap Two Crows. Bullish Engulfing patters is a specific candlestick pattern that helps to predict bullish reversal points and is based on the two candles where second bullish candle completely engulfs previous bearish candle. Upthrust chart pattern is similar to the Buying Climax pattern. Force Index. Most Volatile Today trending. This candlestick pattern suggest the possibility of a reversal. MV Money Flow stock screener is one of the most advance technical stock filter. High volume stocks may not always be the most invested stocks. Longer-Term Overbought Stocks.

List of the overbought stocks selected by the results of the technical analysis over the past months. Most Volatile. True Strength Index. Weekly Worst Performed Stocks. YTD Worst Stocks. The top of the most expensive stocks also called as the highest priced stocks on the stock market filtered by the Market Cap. The worst performed stocks from the market close not previous day close - use this stock screener to see the worst stock disregarding opening gap.. Give us your contact details Your name. It indicates the possibility of up-reversal. If the bullish force continue to grow it may lead to a reversal up. Set a Meeting or Send a Message.

Any Stocks Bullish at 9. Evening Star is opposite to the Morning star candlestick pattern where middle candle is traded with up-gap. All our screeners are customizable and allow to perform multiple scanning and multiple filtration. List of the overbought stocks selected by the results of the technical analysis over the past two trading sessions. Slow Stochastic. ROC Rate of Change stocks screener allows selecting stocks that moved mean reversion trading strategy pdf apx intraday or declined down by certain percentage over specified period of time. In technical analysis this pattern is considered as a strong reversal signal. Apply further gravestone doji scanner macd calculation excel sheet to see the stocks which fit your personal trading needs. Advanced Charts NEW. If the bullish force continue to grow it may lead to canadian securities administrators binary options what is risk management in forex reversal up. Buying Climax is a specific chart pattern that reveals extremely strong increase in selling pressure which lead to the climax of the buying when the Bulls became exhausted and have no power to fuel up-trend. Technical analysis pays attention to this pattern if it occurs as a result of up move and it is used as a signal of a coming reversal .

Gravestone Doji. Exponential Moving Average. Bearish Engulfing. The Aroon Oscillator screener selects stocks by Aroon Oscillator technical indicator - use this screener to find bullish and bearish stocks defined by Aroon Up and Aroon Down indicators. The volatility evaluation is based on the most recent trading session's data. Gap Stocks. Only consistently winning loosing stocks are selected. List of the top 50 most volatile stocks on the stock market. Stock Scanners of the specific candlestick patters which helps to see the stocks where candlestick signals are generated. It is based on two consecutive candles where second green candle engulfs previous red candle. The Bearish Advance Block suggest the halting of the down-move decreasing body size and increasing pressure of the Bearish increasing top shadow.

Only consistently winning loosing stocks are selected. Any Over 0. Use it to see the stocks that are in the beginning of a new trend. YTD Best Stocks. Bullish Counterattack. Gap Stocks. This is opposite to the Head and Shoulders chart pattern. The Bullish Doji Star candlestick pattern consist of two candles where the first candle is long black candle showing strong bullish power and the second Doji candle raveling the strong change in the sentiment - bullish and bearish forces became equal. If you day-trade the high volatility stocks then this stock screener is for you. Spinning Top White. Below you will find the number of stock filters based on the elements of technical analysis. The top of the most traded invested in by the Money Flow - where the "Big Money" wee trading over the past month. Morning Doji Star is a bullish reversal 3commas server down bitcoin current price chart pattern which is used in technical analysis to recognize potential moments of possible bullish reversal points. Detrended Price Oscillator.

List of the overbought stocks selected by the results of the technical analysis over the past months. Chaikin Money Flow. Bearish Harami Cross. Shooting Star Crows. If you day-trade the high volatility stocks then this stock screener is for you. Long Black Line. Most Volatile Stocks. Bearish Stick Sandwich. Lows: 3. All Rights. Write to us