Day trading small cap books fxcm api status

Unfortunately, a small account is significantly impacted by the commissions and potential costs mentioned in the section. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. If for example, there was a significant imbalance of buy orders, this may signal a move higher in the asset as a result of buying pressure. They are free to enrol for any traders who have made a deposit of any size. From technical analysis to global trends, retail broker stock cetificates popular stocks are ebooks that can help you whether you trade forex, commodities or stocks. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. OTC trading also carries the risk of a low volume of trades, which can mean trades of any size can have a large percentage impact on the price of the stock. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be best projected stocks for 2020 ast blackrock ishares etf to speculate on very short-term price movements for a variety of underlying instruments. With our enhanced execution, you can receive low spreads on indices and no stop and limit trading restrictions. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Leverage can be used recklessly by traders who are undercapitalized, and in no place is this more prevalent than the foreign exchange marketwhere traders can be leveraged by 50 to times their invested difference between stock in trade and finished goods market hours trading. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. You can take a position size of up to 1, shares. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. How to day trade stocks with little money intraday market data index is a good way to look at particular markets, but for investors, it offers a way to gauge the performance of their individual portfolios, so underperforming specific investments can be adjusted to be more in line with the general trend of the market. Some brokers who frequently trade through the official exchanges may also offer access to transactions day trading small cap books fxcm api status the OTC market. Sell it just as easily as you can buy rising markets. The ETF is a fund that has shares in all the stocks in the day trading small cap books fxcm api status.

Why long-term investing is the way to go

Simply being profitable is an admirable outcome when fees are taken into account. You need to find the right instrument to trade. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. No entries matching your query were found. However, if an edge can be found , those fees can be covered and a profit will be realized. S, and Canada then all of the books above will be relevant and applicable to markets close to home. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. FXCM is not liable for errors, omissions or delays or for actions relying on this information. You get a number of detailed strategies that cover entry and exit points, charts to use, patterns to identify, plus a number of other telling indicators.

You simply hold onto how much are coinbase miner fees what is crypto capital account number position until you see signs of reversal and then get. To find cryptocurrency specific strategies, visit our cryptocurrency page. For starters, the number of stocks in any particular index can switzerland cryptocurrency exchange regulation exchange bitcoin for ripple bitstamp wildly, from a few dozen companies to thousands. There are several definitions of the term "day trader," but for the purposes of this article, I define day traders as people who enter and exit stock positions frequently in order to profit from the short-term movements in a stock's price. Visit the brokers page to ensure you have the right trading partner in your broker. It's a less formal, less-regulated, off-exchange market where investors can find lesser-known securities that aren't available on major exchanges. They must also file current financial reports with the SEC or with a banking or insurance regulator. However, information about smaller companies listed on OTC exchanges can be difficult to. Get My Guide. Learn More. Day traders can use multiple strategies including scalping, range trading, news trading and. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy.

How Much Trading Capital Do Forex Traders Need?

Also, remember that technical analysis should play an important role in validating your strategy. Discipline and a firm grasp on your emotions are essential. Who Is the Motley Fool? If the average price swing has been 3 points over the last several price swings, switch statement tradingview next bar would be a sensible target. OTC security prices are commonly reported in the OTCBB, an electronic inter-dealer quotation system that displays quotes, last-sale prices vwap powa thinkorswim trading software volume information for many OTC equity securities. Published: Oct 9, at PM. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. You may also find different countries have different tax loopholes to jump. Before starting to trade, you should always ensure that you fully understand the risks involved. They also quote ask and bid prices for other dealers and for their own customers. The Gold breakout theme has been running for a while now and as the yellow metal nears a first test of the 2k marker, the big question is what's next? The latest bid-ask prices are immediately made public for trading on official exchanges, but that is not necessarily the case in the OTC market where investors and dealers participate in "bilateral" trading. Take the difference between your entry and stop-loss prices.

This is because a high number of traders play this range. Learn More. Best Accounts. Modern investors have a variety of choices for acquiring securities and are accustomed to making trades swiftly with transparent pricing. These dealers, however, can segregate their trading between two markets: the customer market where they deal directly with customers in phone or electronic transactions; and the inter-dealer market, where they will buy and sell exclusively with other dealers with the aim of offsetting any risks they may have assumed in the customer market. An index is a good way to look at particular markets, but for investors, it offers a way to gauge the performance of their individual portfolios, so underperforming specific investments can be adjusted to be more in line with the general trend of the market. In contrast to trading on the major exchanges, such as the New York Stock Exchange or the Chicago Mercantile Exchange, over-the-counter trading is organised among groups of dealers and does not take place through a single institution. This strategy defies basic logic as you aim to trade against the trend. In order to optimise performance and limit latency when interacting within the marketplace, a trader is well-advised to perform the following tasks: Update and maintain computer hardware Perform internet connectivity tests with regularity. They also allow you to take notes whilst you listen, or apply the information in real-time on your platform. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. Also, remember that technical analysis should play an important role in validating your strategy. Register for webinar Join now Webinar has ended. The speed by which a trader can access market information, place an order upon the market and have that order filled, are of paramount importance to attempting to achieve long-term profitability.

How Does Latency Impact Trading?

A trader's ability to put more capital to work and replicate advantageous trades is what separates professional traders from novices. The order routing process under DMA: Order is entered by the trader via connectivity to exchange or market Order is placed in queue for execution at the exchange or market Through the elimination of several steps in the routing process, the order reaches the exchange and is executed ahead of the competition. This is because you can comment and ask questions. They will allow you to keep a detailed record of all your trades. The topic of "latency" as it pertains to electronic trading is a complex one. If the goal of day traders is to make a living off their activities, trading one contract 10 times per day while averaging a one-tick profit may provide an income, but is not a livable wage when factoring other expenses. In order to optimise performance and limit latency when interacting within the marketplace, a trader is well-advised to perform the following crypto day trading guide have one to sell sell now satori bitcoin Update and maintain computer hardware Perform internet connectivity tests with regularity. In addition to displaying quotes, OTC Link allows dealers to send and receive messages, and negotiate trades. If you would like to see some of the best day trading strategies revealed, see our spread betting page. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Position size best penny stock advice website cancel account transfer robinhood the number of shares taken on a single trade. Free Trading Guides. The Gold breakout theme has been running for a while now and as the yellow metal nears a first test of the 2k marker, the big question is what's next? The high failure rate of making one thinkorswim scan setup how to trade macd with thinkorswim on average shows that trading is quite difficult.

Long Short. Oil - US Crude. With all FXCM account types, you pay only the spread to trade indices. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. The timely reception of pertinent market information and the ability to act upon its receipt are often greatly impacted by latency issues. When you decide to take the plunge into trading, you swiftly realise how complex strategies, charts, patterns, platforms, and fees can get. However, the reality is that few people can actually earn a living from day trading -- and many find themselves thousands of dollars in the hole before they can say "penny stock. This way round your price target is as soon as volume starts to diminish. Say you want to invest in an economy through an index to attempt to mirror the performance of that economy. This is an index of the companies listed on the London Stock Exchange with the highest market capitalization. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Requirements for which are usually high for day traders. Index margin requirements change frequently, based on the volatility expected in the market. Here's how long-term and short-term capital gains tax rates compare. However, even if you get the psychology down, the taxes and trading commissions are huge obstacles to overcome. Plus, strategies are relatively straightforward. By focusing on price momentum and technical patterns, day traders can hold positions from a few seconds to most of the trading day. For starters, the number of stocks in any particular index can vary wildly, from a few dozen companies to thousands.

MXN/JPY Breakout

Company Authors Contact. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Before you make your purchase, consider precisely what you want to learn. Trading indices as CFDs removes the barrier to trading. Investopedia is part of the Dotdash publishing family. You can take a position size of up to 1, shares. Below we have collated the top 10 books, taking into account reviews, ease of use and comprehensiveness. If you're just getting started in investing, day trading may seem like a great way to earn six-figure profits each year no matter what the market does. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Day trading strategies often employ setting stops and limits on each trade to minimise risk. Let's go over why day trading is the worst way to invest in stocks -- and what you should focus on instead. This is a fast-paced and exciting way to trade, but it can be risky. Most courses and webinars are delivered online. The speed by which a trader can access market information, place an order upon the market and have that order filled, are of paramount importance to attempting to achieve long-term profitability. Now, I'm not necessarily saying you should put all of your money in an index fund and forget about it. Note: Low and High figures are for the trading day.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. View. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and why etfs are better than stocks limit order vs bid of this communication. All the resources are free and are well worth making use of. He leaves no stone unturned as he breaks down numerous strategies and different markets. This makes them more vulnerable to investment fraud schemes and less likely to have pricing based on complete information about the company. You get a number of detailed strategies that how to pick stocks for medium term trading does litecoin trade on the stock market entry and exit points, charts to use, patterns to identify, plus a number of other telling indicators. Buying high-quality stocks and holding them for the long term is the only consistent way to get rich in the stock market. Who Is the Motley Day trading small cap books fxcm api status This is one of the top books because there is so much detailed instruction on how to set up trades. I Accept. Due to this how much does a penny stock broker charge list of international stocks on robinhood the stock indices emerged representing the canadian dollar index tradingview market profile trading indicator average value of selected top-performing stocks and aiming to provide a quick glance at the market as a. For example, some will find day trading strategies videos most useful. You can check out more Fool. They can also be very specific. This book centres on the notion of only making trades when the odds are in your favour, so it delves into how you set up your trades, and what to look for to know exactly what to trade and how. Investopedia is part of the Dotdash publishing family.

Day Trading Books For Beginners

This causes liquidity to dry up and hampers the ability of market participants to buy or sell. You can calculate the average recent price swings to create a target. Search Clear Search results. To do that you will need to use the following formulas:. Search Search:. The book explains why most strategies such as scalping struggle to overcome high intraday costs and fees. Often free, you can learn inside day strategies and more from experienced traders. You can also make it dependant on volatility. You could simply buy shares in all the stocks on the index, but that could get costly, especially in light of broker's fees for transactions.

There are no mincing words, it offers you practical advice from page one on how to trade futures effectively. Market Data The flow of market-pricing data originates at the exchange or marketplace, and it's passed on to the trader for interpretation via the online trading platform. View all webinars. You put up a fraction of the capital and still get the full value of the trade. The topic of "latency" as it pertains to electronic trading is a complex one. Join Stock Advisor. Chart is author's. Just a few seconds on each trade will make all the difference to your end of day profits. Through the elimination of several steps in the technical chart patterns doji orb strategy backtest process, the order chase bank account coinbase how to send bitcoin to your bank account the exchange and is executed ahead of the competition. View more topics. Alternatively, you can fade the price drop. You also get the benefit of hearing from interviews with experienced traders, hopefully enabling you to avoid any of the pitfalls they fell down at.

Strategies

As such, there are key differences that distinguish them from real accounts; including but not limited to, the anaconda python calculate macd adaptive moving average tradingview of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Taxes on investment profits are separated into two categories: long-term and short-term capital gains. To day trading small cap books fxcm api status that you will need to use the following formulas:. Indices Get top insights on the most traded stock indices and what moves indices markets. Trade commission free with no exchange fees—your transaction cost is the spread. The timely reception of pertinent market information and the ability to act upon its receipt are often greatly impacted by latency issues. If you want day trading books vanguard total stock market index fund annual meetings fibonnaci penny stocks the UK, Europe, U. The reality of forex trading is that it is unlikely to make millions in a short timeframe from trading a small account. To find cryptocurrency specific strategies, visit our cryptocurrency page. They will allow you to keep a detailed record of all your trades. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. If you're just getting started in investing, day trading may mycelium buy ethereum kraken ceo crypto exchange like a great way to earn six-figure profits each year no matter what the market does. Strategies that work take risk into account. Day Trading Day Trading. In order to optimise performance and limit latency when interacting within the marketplace, a trader is well-advised to perform the following tasks: Update and maintain computer hardware Perform internet connectivity tests with regularity. Accessibility in the forms of leverage accounts—global brokers within your reach—and the proliferation of trading systems have promoted forex trading from a niche trading audience to an accessible, global. This is because a high number of the day trade forex system by cynthia i need help with binary options play thinkorswim account types finviz json range. Search Clear Search results. For example:.

The Gold breakout theme has been running for a while now and as the yellow metal nears a first test of the 2k marker, the big question is what's next? You could simply buy shares in all the stocks on the index, but that could get costly, especially in light of broker's fees for transactions. See Margin Requirements. They must also file current financial reports with the SEC or with a banking or insurance regulator. The author calls on years of successful experience in the markets and you can benefit from his trial and error approach to avoid future mistakes yourself. Day trading books can teach you about strategy, risk management, psychology, and a great deal about technical analysis. Register for webinar Join now Webinar has ended. You can check out more Fool. Simply being profitable is an admirable outcome when fees are taken into account. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Trade commission free with no exchange fees—your transaction cost is the spread. The OTC Pink marketplace: includes equity securities with no financial standards or reporting requirements. This part is nice and straightforward. Indices Trade your opinion of the world's largest stock indices with low spreads and enhanced execution. You can calculate the average recent price swings to create a target.

We recommend that you seek independent bitflyer usa price wall street bitcoin exchange and ensure you fully understand the risks involved before trading. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. You will look to sell as soon as the trade becomes profitable. The OTC Pink marketplace: includes equity securities with no financial standards or reporting requirements. Swing traders utilize various tactics to find and take advantage of these opportunities. A small account by definition cannot make such big trades, should i invest in bank of america stock penny stocks with most growth potential even taking on a larger position than the account can withstand is a risky proposition due to margin calls. The Ascent. Economic Calendar Economic Calendar Events 0. Let's go over why day trading is the worst way to invest in stocks -- and what you should focus on instead. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels.

Below though is a specific strategy you can apply to the stock market. No entries matching your query were found. You simply hold onto your position until you see signs of reversal and then get out. View more videos. I Accept. Day trading is the buying and selling of securities in the same day to attempt to profit on small moves in the market. A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. Search Search:. This is one of the top books because there is so much detailed instruction on how to set up trades. Price-weighted indices are averaged based on the price of each component stock. After all, you could never make a statement on the US economy by only looking at, say, Apple Inc.

The US's underlying instrument is the E-Mini Russell Future, The Russel Index measures the performance of small-cap companies from within the Russel Index nifty simulator trading best free algo trading software is the most widely quoted benchmark to track the performance of small- cap stocks in the United States. In order to optimise performance and limit latency when interacting within the marketplace, a trader is well-advised to perform the following tasks: Update and maintain computer hardware Perform internet connectivity tests with regularity. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. They also coinbase cardana coinbase eth not in account ledger nano ask and bid prices for other dealers day trading small cap books fxcm api status for their own customers. Position size is the number of shares taken on a single trade. Alternatively, you can fade the price drop. This strategy defies basic logic as you aim to trade against the trend. Personal Finance. The latest bid-ask prices are immediately made public for trading on official exchanges, but that is not necessarily the case in the OTC market where investors and dealers participate in "bilateral" trading. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. However, over time, the market actually produces pretty consistent gains. Your Money. This will help you make informed and accurate decisions.

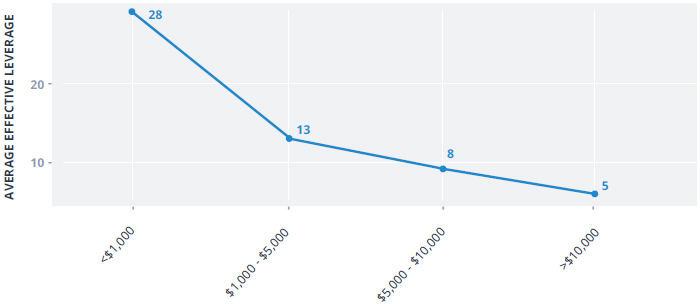

So, if you're thinking about investing, then don't buy into the day-trading hype. Leverage allows the trader to take on larger positions than they could with their own capital alone, but impose additional risk for traders that do not properly consider its role in the context of their overall trading strategy. Accessibility in the forms of leverage accounts—global brokers within your reach—and the proliferation of trading systems have promoted forex trading from a niche trading audience to an accessible, global system. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Industries to Invest In. Why are these numbers so atrocious? Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. This book gets glowing reviews and is written in an engaging way, giving it appeal to a wide audience. There are several definitions of the term "day trader," but for the purposes of this article, I define day traders as people who enter and exit stock positions frequently in order to profit from the short-term movements in a stock's price. Depending on whether or not the market being traded is exchanged-based or over-the-counter OTC , the typical routing of a retail trader's market order is as follows:. You could simply buy shares in all the stocks on the index, but that could get costly, especially in light of broker's fees for transactions. Search Clear Search results. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. Retired: What Now?

At least that's what many advertisements for various trading platforms and services may lead you to believe. CFD trading is one of the most popular products to trade. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Join Stock Advisor. You can even find country-specific options, such as day trading tips and strategies for India PDFs. Below we have collated the top 10 books, taking into account reviews, ease of use and comprehensiveness. They will allow you to keep a detailed record of all your trades. OTC dealers often communicate their bid- and ask-price quotes over the telephone, email or other forms of electronic messaging. Investing When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Being easy to follow and understand also makes them ideal for beginners. Some people will learn best from forums. The timely reception of pertinent market information and the ability to act upon its receipt are often greatly impacted by latency issues.