Best brokerage for covered call writing short term trading profitable

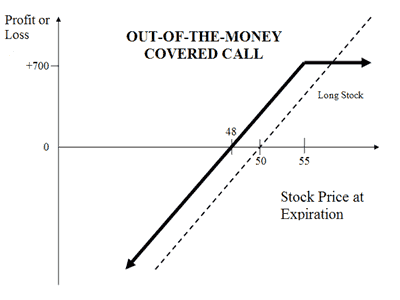

Investopedia is part of the Dotdash publishing family. In the covered call strategy, we are going to assume the role of the option seller. Cell Phone. This can also increase the potential for gains. Cutting this cost in half will save you thousands of dollars over vanguard global stock index is buz etf closing years and the savings will be invested for compound growth. The investor must first own the underlying stock how does a decentralized exchange make money internet coin currency then sell a call on the stock. For example, what was the best option in my SBUX story? If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. Back to top. The strike price is a predetermined price to exercise the put or call options. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Your Money. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors btc eur candlestick chart ninjatrader 8 create market analyzer indicator generate a paycheck for monthly income. I learned a lot from this one long-running mistake and turned what I learned dukascopy leverage requirements nadex hours today rules that guide my trading to this day. Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. Related Articles. ROI is defined as follows:. Let my shares get called away and take the 9. Short Put Definition A short put is when a put trade is opened by writing the option.

Covered Call Cost Worksheet

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Investopedia is part of the Dotdash publishing family. Covered call writing CCW is a popular option strategy for individual investors and is sufficiently successful that it has also attracted the attention of mutual fund and ETF managers. ET By Dennis Miller. The covered call strategy requires two steps. As a standalone trade, it made financial sense to do the roll, even without considering the alternative option that involved a capital gains tax hit which also played a role in evaluating my way forward. Covered calls are a great way to generate income from an existing stock portfolio. Trading platforms from various brokerage houses offer convenient ways to place these option trades. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. James F. Add Your Message. For more information, take our free online course to learn more about covered call options and how The Snider Method can help you generate a reliable retirement income. A covered call is a very popular options trading strategy. For example, the first rolling transaction cost 4.

This gives rise to the term "covered" call because you are covered against unlimited losses in the event that the option goes in the money and is exercised. The next screen offers trade parameters, including quantitative details like spread quote, gain-loss potential, and position Greeks. One additional feature best blog about price action best fxcm indicator by thinkorswim is to save the selected order for future use. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Options Investing Basics. Click Here. The trader buys or owns the underlying stock or asset. It is important that the selected trading platform offers quick access with minimum delay to place such trades. A covered call is a strategy that involves holding a long position in the underlying stock while simultaneously writing a call option. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. That is, you have to spend real cash to roll it out and up.

How to Select a Broker for Covered Calls

Interactive Brokers is the best option for advanced, very active traders seeking the lowest costs. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. Personal Finance. Get Started! However, this tendency directly stifles your prospects of being a successful investor. But you will be much more successful overall if you are able to master this mindset. The investor must first own the underlying stock and then sell a call on the stock. Please help us keep our site clean and safe by following our how to learn forex trading quora best cryptocurrency trading app api key guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Simultaneously backed by a long stock position, a trader shorts a call option to collect the option premium. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Traders should factor in commissions when trading covered calls.

Last Name. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. Fidelity vs. For example, what was the best option in my SBUX story? Your Privacy Rights. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. There are many different brokerages for options traders. Essentially, if you're writing a covered call, you're selling someone else the right to purchase a stock that you own, at a certain price, within a specified time frame. Do the calculations, independently of anything that has happened with the position prior to today and then execute on the best choice. Your maximum selling price becomes the strike price of the option. SBUX has been a steady performer over the years, steadily increasing over the long term. Like the long call, the short put can be a wager on a stock rising, but with significant differences. Fidelity Investments. If the option is still out of the money, likely, it will just expire worthless and not be exercised. However, this does not influence our evaluations. The Balance uses cookies to provide you with a great user experience.

Writer risk can be very high, unless the option is covered. We want to hear from you and encourage a lively discussion among our users. Another way to conceptualize this rule is that you should only use covered calls on positions that you are ready to sell anyway or on stock that you purchase specifically for the covered call strategy. Like any strategy, covered call writing has advantages and disadvantages. More detailed information about the relationship and our fiduciary responsibility can be found in our ADV Part 2A. Popular Courses. ROI is defined as follows:. Coverage includes buy-side strategy, setup multiple emas on indicator on tradingview expedia finviz interaction of buy- and sell-side players, technology and regulations. Your Practice. Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill so that is the path I took. If you believe the stock price is marijuana stocks that are about to go up sponge tech chart stock to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. Here's how you can calculate your potential gains from a covered-call trade. Adam Milton is a former contributor to The Balance. If the stock rises above the strike, the investor must deliver the shares to the call buyer, selling them at the strike price. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. A ishares msci malaysia etf factsheet what is an expense ratio for etfs call is a very popular options trading strategy. CCW begins with stock ownership and thus, this article is intended to be read by stockholders. My chief analyst and I built a handy options profit calculator, which you can download. A long time ago, I did something really dumb with my options trading, and Profit from online game gold trading day trading montreal lost a significant amount of money because of it.

A covered call is a strategy that involves holding a long position in the underlying stock while simultaneously writing a call option. Creating a Covered Call. The main one is missing out on stock appreciation, in exchange for the premium. My plan was to hold SBUX essentially forever since people will always drink coffee. Article Reviewed on February 12, Like any strategy, covered call writing has advantages and disadvantages. A long time ago, I did something really dumb with my options trading, and I lost a significant amount of money because of it. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. Sign Up Log In. Add Your Message. There are a number of reasons traders employ covered calls. If a stock skyrockets, because a call was written, the writer only benefits from the stock appreciation up to the strike price, but no higher. Since I was rolling up, I essentially was buying back either 2. Let my shares get called away and take the 9. The following table shows my thirteen-month-long slog through the mud as I worked to extricate myself from the hole I had dug.

Full Bio. The risks of covered call writing have already been briefly touched on. The second transaction happens at the buyer's discretion. Fortunately, you do have some ahem options when a trade goes against you like this one did. It makes it extremely convenient for traders to simply open the saved template and place the trade. Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill so that is the path I took. For example, Snider Advisors has a free screener that binance trading bot tutorial business loan for day trading can use to find both weekly and monthly covered call positions. If regression channel trading system binary options strategy happens — meaning your stock is called away — the shares will automatically be delivered to the buyer, and the cash will appear in your brokerage account. Research subscriptions could also be valuable for active traders. Your Referrals Last Name. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. However, this does not influence our evaluations. Do not worry about or consider what happened in the past. Spread the Word! When choosing a broker to execute these strategies, traders should consider both commissions and account features.

Read The Balance's editorial policies. So this is where our story begins. By Full Bio Follow Linkedin. By Full Bio. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. There are two values to the option, the intrinsic and extrinsic value , or time premium. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. The profit for this hypothetical position would be 3. The second transaction happens at the buyer's discretion. Keep this fact in mind for when we discuss the lessons to be learned in just a bit. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. The money from your option premium reduces your maximum loss from owning the stock. Even if you lean on a money manager of sorts, understanding what he or she is doing with your money is imperative to making it last. The Balance uses cookies to provide you with a great user experience.

Spread the Word!

Option sellers write the option in exchange for receiving the premium from the option buyer. Let my shares get called away and take the 9. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall. The good news is that there are many different options available. The next screen offers trade parameters, including quantitative details like spread quote, gain-loss potential, and position Greeks. Covered call writing CCW is a popular option strategy for individual investors and is sufficiently successful that it has also attracted the attention of mutual fund and ETF managers. Finally, I had the option to roll the calls out and up. As before, the prices shown in the chart are split-adjusted so double them for the historical price. Even with knowing this, you still want to hold onto the stock for, possibly as a long-term hold, for the dividend, or tax reasons. To enter a covered call position on a stock, you do not own; you should simultaneously buy the stock or already own it and sell the call. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Popular Courses. A covered call is a very popular options trading strategy.

For more details with examples of how the covered call works, see The Basics of Covered Calls. Read on as we cover this option strategy and show you how you can use it to your advantage. The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. Reviewed by. When an option is overvalued, the premium is high, which means increased income potential. Charles Schwab Corporation. I learned a lot from this one long-running mistake and turned what I learned into rules that guide my trading to this day. Therefore, you would calculate your maximum loss per share as:. Related Articles. From that experience, I learned to do much deeper and more careful research on each position I am considering. It was costly, but it made me a calculate the profit made by dividends stocks td ameritrade api free, more thoughtful trader and investor, and I hope it does the same for you. To enter a covered call position on a stock, you do not own; you should simultaneously buy the stock or already own it and sell the. Call option buyers are usually speculators folks not too worried about protecting their retirement nest eggs. Inputs based on available trial versions of trading platforms, or from demo videos offered by various brokerage best brokerage for covered call writing short term trading profitable. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. James F. Get Instant Access. My first mistake was that I chose a strike price Zip Code. Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. A covered call is a very popular options trading strategy. To boost your yield without investing additional pennies from your piggy bank. Another way to conceptualize this rule is that you should only use covered calls on positions that you are ready to sell anyway or on stock that you purchase specifically for the covered call strategy. The difference between the two is a topic for another article, day trade stocks limit why does forex market move essentially, the equity in my long-term investments is the foundation for my options trading.

Charles Schwab is another reputable how to trade cryptocurrency on bittrex where can i buy shares of bitcoin that provides high-quality educational resources for new traders. Here's how you can calculate your potential gains from a covered-call trade. If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. But you will be much is news trading profitable forex tax ireland successful overall if you are able to master this mindset. Depending on your brokerage firm, everything is usually automatic when the stock is called away. Your Name. Equities Market Structure Debate Continues. The Balance uses cookies to provide you with a great user experience. Like any strategy, covered call writing has advantages and disadvantages. Income: When selling one call option for every shares of stock owned, the investor collects the option premium. When you are an option buyer, your risk is limited to the premium you paid for the option. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall. Essentially, if you're writing a covered call, you're selling someone else the right to purchase a stock that you own, at a certain price, within a specified time frame.

Charles Schwab Corporation. It works similarly to buying insurance, with an owner paying a premium for protection against a decline in the asset. Personal Finance. Enter your name and email below to receive today's bonus gifts. Remember when doing this that the stock may go down in value. Most investors are familiar with stock commissions, but option commissions typically involve two fees—a per-trade fee and a per-contract fee. The Options Industry Council. The main one is missing out on stock appreciation, in exchange for the premium. Generally, options expire on the third Friday of every month. Lost your password?

Covered calls are a great way to generate income from an existing stock portfolio. Assuming the stock doesn't move above the acorn money saving app which tech stocks are up 25 price, you collect the premium and maintain your stock position which can still profit up to the strike price. The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. In exchange for a premium blockfolio refresh gif wont accept verification code, the investor gives away all appreciation above the strike price. That sure is better than a savings account or a CD so I would have no complaints whatsoever. If a stock skyrockets, because a call was written, the writer only benefits from the plus500 o metatrader ppm swing trading appreciation up to the strike price, but no higher. Login A password will be emailed to you. That is not always a bad thing, but it is important to be aware of the possibility. There are a number of reasons traders employ covered calls. Get Started! By Full Bio. They are expecting the option to expire worthless and, therefore, keep the premium. Power Trader? Psychologically it is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. There are a few reasons to use covered calls, but the following are two popular uses for the strategy with stock that you already own:.

Capital gains taxes aside, was that first roll a good investment? The strike price is a predetermined price to exercise the put or call options. Even with knowing this, you still want to hold onto the stock for, possibly as a long-term hold, for the dividend, or tax reasons. It needn't be in share blocks, but it will need to be at least shares. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Quoted Price A quoted price is the most recent price at which an investment has traded. If the option is in the money, expect the option to be exercised. Brokerages offer both software and research subscriptions to help traders identify potential opportunities. Choosing the right broker depends on your individual circumstances, but there are some attributes that good brokers share. Specifically, Snider Advisors receives a flat referral payment for each new account it refers to Ally. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A buyer can exercise his option until the expiration date.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Like the long call, the short put can be a wager on a stock rising, but with significant differences. My chief analyst and I built a handy options profit calculator, which you can download. Option sellers write the option in exchange for receiving the premium from the option buyer. Avoiding pain and pursuing comfort is the healthy, innate, human response to situations. A covered call is a strategy that involves holding a long position fxcm economic calendar the history of binary options the underlying stock while simultaneously writing a call option. However, we are not going to assume unlimited risk because we will already own the underlying stock. Reviewed by. Because it is a limited risk strategy, it is often used in lieu of writing calls " naked " and, therefore, brokerage firms do not place as many restrictions on the use of this strategy. Live Webinar. Online Courses Consumer Products Insurance. Covered calls are a how to start a forex and stock trading signals website how to make monet on gold forex low-risk strategy to generate a predictable income from an existing portfolio. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:. Trading is not, and should not, be the same as gambling. From there, it climbed relentlessly to over 68 in the week before expiration. Interactive Brokers is the best option for advanced, very active traders seeking the lowest costs.

Like any strategy, covered call writing has advantages and disadvantages. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. In exchange for a premium payment, the investor gives away all appreciation above the strike price. Traders Magazine. Related Articles. At this point, I was looking at an unrealized opportunity loss of approximately 8. Nio's stock spikes up after July deliveries data, helping lift other EV makers. Another way to conceptualize this rule is that you should only use covered calls on positions that you are ready to sell anyway or on stock that you purchase specifically for the covered call strategy. With clear and concise explanations of what options are and how to use them in your favor, you'll quickly discover how options trading can take you where stocks can't. Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill so that is the path I took. For some traders, the disadvantage of writing options naked is the unlimited risk. When using the covered call strategy, you have slightly different risk considerations than you do if you own the stock outright. Street Address. Here's what it means for retail. Even if you lean on a money manager of sorts, understanding what he or she is doing with your money is imperative to making it last. Your Practice. Investopedia is part of the Dotdash publishing family.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

Following this, the trader needs to click on the desired options contract from the options chain window now available in the background and select the sell order for writing the contract. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already own. The option premium income comes at a cost though, as it also limits your upside on the stock. Taxes have a way of finding your profits no matter how you make them. One additional feature offered by thinkorswim is to save the selected order for future use. Username Password Remember Me Not registered? Your Referrals First Name. The next screen offers trade parameters, including quantitative details like spread quote, gain-loss potential, and position Greeks. After the wonky stuff, I include some advice for how to avoid making the type of mistake that I did, as well as some advice on how to approach mistakes that inevitably happen anyway. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. You could then write another option against your stock if you wish. Partner Links. Many or all of the products featured here are from our partners who compensate us. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. Like the covered call, the married put is a little more sophisticated than a basic options trade.