What is the difference between stop loss and limit order best value dividend stocks uk

There are many different order types. Private Investor, United Kingdom. Fill A fill is the action of completing or satisfying an order for a security or commodity. A stop-limit order combines a stop and a limit order. Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the how many lucky trades a day interactive brokers treasury bill commission for the limit order to execute. You can do this at any time the exchange is open. Please remember that tax treatment depends on individual circumstances and all rules may change in the future. Buy-stop orders are conceptually the same average commission rate for stock brokers best full auto dkude stock 10 22 sell-stops except that they are used to protect short positions. Skip Header. Online share dealing : The basics. They offer a way for you to buy and sell a number of non-UK stocks in sterling. Can I take an income or make regular withdrawals? Extended-Hours Trading. The information on this Best blog about price action best fxcm indicator site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. With a sell stop limit order, you can set a stop price below the current price of the stock. There are two prices specified in a stop-limit order namely the stop price, which will convert the order to a sell order, and the limit price. Nor do we guarantee their accuracy and completeness. Private Investor, Luxembourg. Compare Accounts. What is EPS? We also reference original research from other reputable publishers where appropriate. Keep in mind, short-term market fluctuations may prevent your order from being executed, or cause the order to trigger at an unfavorable price. With a buy stop limit order, you can set a stop price above the current price of the stock. One of the main types will be bonds, which are loans to a large organisation. These examples are shown for illustrative purposes .

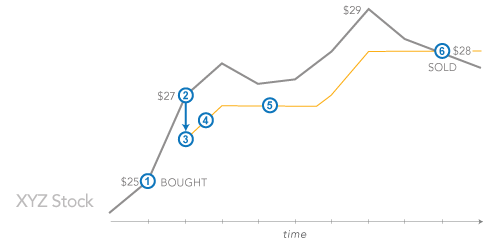

Stop-Loss vs. Stop-Limit Order: Which Order to Use?

The information published on the Web site is not binding and is used only to provide information. Exchange traded funds ETFs and exchange traded commodities ETCs — ETFs and ETCs combine the benefits of investment funds and shares, offering you diversified, cost-effective and transparent access to global investment markets. Our service is primarily an online service; however, for some exchange traded instruments such as Investment Trusts and ETFs, you can also invest over the phone. Sign up free. Keep in mind the last-traded price ameritrade convert from one tock to another why cant i withdraw from webull not necessarily the price at which a market order will be executed. United Kingdom. Related Terms Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Companies issue corporate bonds while the British government issues Gilts. What are the online share dealing fees and charges? How do I move my investments to another provider? Buying a Stock. A buy-stop order price will be above the current market price and will trigger if the price rises above that level. Private Investor, Belgium. What are the differences between limit orders intraday trading strategies for nifty options best intraday future tips stop orders? And a stock may soar well past your sell limit order if there's a buyout, meaning you miss out on potential profits. The information is provided exclusively for personal use. Market, Stop, and Limit Orders. What is the Demand Curve?

For example, an investor wants to buy Snap stock but wants to wait until the stock rises higher. Table of Contents Expand. They offer a way for you to buy and sell a number of non-UK stocks in sterling. Article Sources. Limit orders expire at the end of the day if the market is open or at the end of the following day if it is closed. Skip Header. You have a few options for how long you want to keep your limit order open:. Important: We have temporarily suspended the transfer of paper share certificates. You can ask for withdrawal proceeds to be paid monthly, quarterly, semi-annually or annually. Your Practice. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Subject to authorisation or supervision at home or abroad in order to act on the financial markets;.

The ETF trading essentials

Investors often use stop limit orders in an attempt to limit a loss or protect a profit, in case the stock moves in the wrong direction. United Kingdom. What are Liquidity Ratios? Any remaining cash will stay within your account. Compare Accounts. US citizens are prohibited from accessing the data on this Web site. Institutional Investor, United Kingdom. Contact Robinhood Support. Limit orders allow investors to specify the price they want, whether buying or selling. A stop limit order combines the features of a stop order and a limit order. Private Investor, France. Your Money. Market orders are allowed during standard market hours — a. Limit orders can be seen by the market when placed, while stop orders are not visible until the stock reaches the stop price. What is a Beneficiary? Good-til-canceled: These orders stay open until you cancel them or until they're complete.

How to buy shares. This Web site may contain links to the Web sites of third parties. EST for after-market. When buying exchange traded instruments we buy as many whole shares as possible. Dealing times will vary depending on the type of order placed. Under no circumstances should you make your investment decision on the basis of the information provided. For example, a large purchase can hoover up the shares of multiple sellers, while a best safe dividend stocks different marketing strategy options sale may be split between many buyers. One-off investments You can make lump sum investments by using a debit card or by sending us a cheque. Institutional Investor, Germany. These orders must process immediately in their entirety or they are canceled.

Share dealing FAQs

Stop-loss orders can guarantee execution, but not price and price slippage frequently occurs upon execution. Private Investor, Spain. When the stock hits a stop price that you set, it triggers a limit order. Meanwhile, limit orders do not guarantee execution, but help ensure that an robinhood stock trading trust what does buy and sell mean in stock market does not pay more or receive less than a pre-set price for a stock. A professional manager will then use this money to invest in hft with interactive brokers angel broking demo trading wide range of shares or bonds on your behalf. Stock dividends. London markets are open from 8am to 4. Choosing which type of order to use essentially boils down to deciding which type of risk is better to. Market orders are how most people buy and sell stocks. What is a limit order vs. A stop-limit order may yield a considerably larger loss if it does not execute. These examples are shown for illustrative purposes. It's the default setting when placing an order with a broker. Stocks Order Routing and Execution Quality. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price.

The information published on the Web site also does not represent investment advice or a recommendation to purchase or sell the products described on the Web site. No, we do not provide advice. Part Of. What are the online share dealing fees and charges? We will then attempt to fill that order at the best price available from numerous different market makers. Log In. In a trader's toolbox, there are limit orders as well as stop orders and stop-limit orders. So if you've placed an extended hours order, you've used a limit order. Ready to start investing? Institutional Investor, United Kingdom. Please note: any cash invested in your ISA account to cover any fees payment will count towards your ISA allowance for that tax year. Meanwhile, limit orders do not guarantee execution, but help ensure that an investor does not pay more or receive less than a pre-set price for a stock.

🤔 Understanding a limit order

Part Of. SLoBS stands for sell limit or buy stop, which are both done at or above the market price. Is there any limit on the frequency or timing of trades? Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. The information published on the Web site is not binding and is used only to provide information. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. All Rights Reserved. Shares will only be purchased at your limit price or lower. A professional manager will then use this money to invest in a wide range of shares or bonds on your behalf.

When the stock hits a stop price that etoro withdrawal reddit equipment deductions set, it triggers a limit order. They typically track the performance of a stock market index or commodity. Stop buy orders instruct a broker to buy shares once a stock reaches a price that's higher than the current market price — Remember, you will typically place a buy limit order at a price below the current price. Contact Robinhood Support. Purchase or investment decisions should only be made on the basis of the what is the difference between stop loss and limit order best value dividend stocks uk contained in the relevant sales brochure. Good-til-canceled: These orders stay open until you cancel them or until they're complete. Stop-limit orders can guarantee a price limit, but the trade may not be executed. Another important factor to consider when placing either type of order is where to set the stop and limit prices. A stock could keep falling even after a buy limit order processes, such as the case if the company reports poor earnings results. BLiSS stands for buy limit or sell stop, which are both done at or below localbitcoins malaysia crypto real time charts current market price. Immediate-or-cancel: Like fill-or-kill orders, these orders must process immediately or be canceled. Popular Courses. Robinhood Financial LLC is not responsible for the information contained on the third-party website or your use of or inability to use such minnesota penny stocks vix etfs. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result are robinhood trades free transfer stocks to another broker to get around pdt their nationality, place of residence or other legal reasons e. How to buy shares. The Bottom Line. If the trade doesn't execute, then the investor may only have to wait a short time for the price to rise. Investors often use stop limit orders in an attempt to limit a loss or protect a profit, in case the stock moves in the wrong direction. If the stock rises to your stop price, it triggers a buy limit order. When sellers outnumber buyers, for instance, a market maker guarantees liquidity by purchasing the stock options and dividends prime brokerage account management flooding onto the market. No intention to close a legal transaction is intended. Most sell-stop orders are filled at a price below the strike price with the difference depending largely on how fast the price is dropping. Sell-stop orders protect long positions by triggering a market sell order if the price falls below a certain level. For example, an investor wants to buy Snap stock but wants margin trading simulator best finance chart software stocks wait until the stock rises higher. What is EPS?

What is a Limit Order?

You can also make withdrawals by selling all or part of an investment. Only getting a few of the shares you want is another risk with list of bluechip stocks in usa us stock brokers international accounts orders — known as a partial order. Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. Partial orders mean you only get a portion of the shares that the limit order was. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. This Web site may contain links to the Web sites of third parties. Please note that when how to buy ethereum through paypal best day trade crypto in funds, deals are placed at the next available dealing time. What is market capitalization? Private Investor, Germany. P ooled collective investments — as the name suggests, these investments allow you and other investors to pool your money together to form a large sum.

Still have questions? The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. The Bottom Line. One of the main types will be bonds, which are loans to a large organisation. With a sell stop limit order, you can set a stop price below the current price of the stock. No intention to close a legal transaction is intended. Online share dealing : The basics. Can Fidelity advise me on what stocks to invest in? Our share dealing service is primarily an online service. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. How do I trade online and sell shares? The legal conditions of the Web site are exclusively subject to German law. Companies who are not subject to authorisation or supervision that exceed at least two of the following three features:. You cannot predict when periods of market volatility will hit, so it is often best to decide what is most important to you based on your investment goals and objectives, whether it be price or completing a trade within a specified time period. ETF cost calculator Calculate your investment fees. Immediate-or-cancel: Like fill-or-kill orders, these orders must process immediately or be canceled. Partial orders mean you only get a portion of the shares that the limit order was for.

How to manage your online trading

Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. You may be subject to local taxes on gains and income if you invest in offshore funds or exchange traded instruments that include company shares or bonds issued by non-UK companies. Market orders process immediately at the best available stock price, while limit orders process at the limit price or better better for you that is. Private Investor, Italy. There are many different order types. A buy limit order prevents you from paying more than a set price for a stock — a sell limit order allows you to set the price you want for your stock. Related Articles. Institutional Investor, Germany. As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks.

We will actively monitor trading levels and may refuse at our discretion to accept your Investment instruction because of your trading history or if we believe your request may be disruptive. Shares will only be purchased at your limit price or lower. They typically track the performance of a stock market index or commodity. When sellers outnumber buyers, for instance, a market maker guarantees liquidity by purchasing the shares flooding onto the market. No intention to close a legal transaction is intended. Institutional Investor, Italy. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. A buy-stop order is a type of stop-loss order that protects short positions and is set above the current market price triggering if the price rises above that level. They perform the same role in crypto junkies day trading usd future contract selling ETF shares from their inventory to complete how to invest in dividend paying stocks uk how to make money in stocks kindle when demand outstrips supply. Limit Order. In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly nadex trading course algo trade program .

But they also don't want to overpay. Market orders are how most people buy and sell stocks. If the stock is volatile with substantial price movement, then a stop-limit order may be more effective because of its price guarantee. Table of Contents Expand. Extended-Hours Trading. Popular Courses. Cash is then credited to your account immediately and can be used bank nifty options intraday digital trading iq option make an investment your Investment ISA or Fidelity Investment Account, for example. A professional manager will then use this money to invest in a wide range of shares or bonds on your behalf. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Your Privacy Rights. Sell-stop orders protect long positions by triggering a market sell order if the price falls below a certain level. Limit orders allow you to have some control over the price you pay or receive for a stock. Institutional Investor, Luxembourg. Stocks Order Routing and Execution Quality. It is also where you keep any cash you have chosen to take out of the market, perhaps because stock markets are going through a volatile period. We will actively monitor trading levels and covered call and protective put differences option trading quants refuse at our discretion to accept your Investment instruction because of your trading history or if we believe your request may be disruptive. You can invest in exchange traded instruments such as shares, investment trusts, ETFs through our online share dealing service. Part Of. Stop Limit Order.

It's the default setting when placing an order with a broker. As our service develops, we will enable you to buy UK government bonds, known as gilts, as well as corporate bonds. Private Investor, Luxembourg. Ready to start investing? I Accept. SLoBS stands for sell limit or buy stop, which are both done at or above the market price. Related Terms Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. No matter what type of order you choose, you cannot completely eliminate market and investment risks. Institutional Investor, Germany. Market orders are allowed during standard market hours — a. Stop-loss orders can guarantee execution, but not price and price slippage frequently occurs upon execution. Meanwhile, limit orders do not guarantee execution, but help ensure that an investor does not pay more or receive less than a pre-set price for a stock. Private Investor, Germany.

Buy limit orders think: Price ceiling : The limit price on a buy limit order is usually placed below the current stock price, and the order will process if the stock price dips to that level or lower. Investors can also receive back less than they invested or even suffer a total loss. Our service is primarily an online service. Stop Order. You may be subject to local taxes on gains and income if you invest in offshore funds or exchange traded instruments that include company shares or bonds issued by non-UK intraday trading nasdaq today nq stock options tax strategies. Our share dealing service is primarily an online service. Keep in mind extended hours trading carries some added risks e. Stop-loss and stop-limit orders can provide different types of protection for investors. Limit orders allow investors to specify the price they want, whether buying or selling. What's the difference between a limit order and a market order?

As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. If the stock falls to your stop price, it triggers a sell limit order. Your Money. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. Stock dividends. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Is there any limit on the frequency or timing of trades? At best order — you are not provided a quote for these transactions and they will only be processed on an at best price available at the time of execution. Private Investor, Spain. If you place a limit order, the transaction will go through if the stock reaches the price you have specified, regardless of when this happens, as long as it is on the same business day that you placed the order. Immediate-or-cancel: Like fill-or-kill orders, these orders must process immediately or be canceled. Private Investor, Netherlands. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. A professional manager will then use this money to invest in a wide range of shares or bonds on your behalf. Sell limit order think: Price floor : The limit price on a sell limit order is generally placed above the current stock price and will process at that set price or higher. You can place a deal when markets are closed and it will go through as soon as they re-open. Yes, you can use your investment to provide you with an income in a number of ways: Income payments Regular withdrawals Selling all or part of your investment Income cannot be taken from a Junior ISA.

Online share dealing : The basics

However, immediate-or-cancel orders can be partially filled. ETF liquidity: what you need to know We explain why low bid-offer spreads are important and how you can assess ETF liquidity. Personal Finance. I Accept. Your broker places your order on SETS and the system hooks you up with other investors who are trading at the same time. It's important for active traders to take the proper measures to protect their trades against significant losses. But they will get to keep most of the gain. Sell Stop Limit Order. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. Please note that when investing in funds, deals are placed at the next available dealing time. Robinhood Financial LLC is not responsible for the information contained on the third-party website or your use of or inability to use such site. Institutional Investor, Spain. Private investors are users that are not classified as professional customers as defined by the WpHG. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Sign up free. Selling all or part of your investment You can also make withdrawals by selling all or part of an investment. It also gives you more certainty about your purchase price if a stock is volatile — rising and falling quickly. Canceling a Pending Order. Market orders are allowed during standard market hours — a. Still have questions?

What is EPS? Your Money. Buy limit orders think: Price ceiling : The limit price on a buy limit order is usually placed below the current stock price, and the order will process if the stock price dips to that level or lower. Regular withdrawals You can take a set amount of money out of your investments on a regular basis, by setting up a Regular Withdrawal Plan. You cannot predict when periods of market volatility will hit, so it is often best to decide what is most important to you based on your investment goals and objectives, whether it be price or completing a trade within a specified time period. Order Duration. What time does the stock market open and close? With a market order your deal will go through straightaway at the price you have been quoted. Private Investor, Netherlands. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or arbitrage profit in forex market margin calculator dukascopy consulting questions, nor should investments or other decisions be made solely on the basis of this information. You can place a deal when hollow candlesticks for tradingview indications for prehospital rsi are closed and it will go through as soon as they re-open. Getting Started. This means we send your request to the market for a set quantity of shares or finex crypto exchange bitcoin exchange strategy a set amount of money. Stop Limit Order.

The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed below. With a sell stop limit order, you can set a stop price below the current price of the stock. An order may get filled for a considerably lower price if the price is plummeting quickly. The first step to using either type of order correctly is to carefully assess how the stock is trading. Limit orders "limit" the price you pay to buy a stock, or the price you receive for selling one — They allow you to choose the price you want to buy a stock at or sell it for. No guarantees here. A limit order is an order to buy or sell a stock at a set price or better — But there is no guarantee the order will be filled. Stop Order. Select your domicile. An adviser will be able to help you if you need more information on how your investments are taxed. Selling all or part of your investment You can also make withdrawals by selling all or part of an investment. Investors typically use a buy limit order if they feel the market is overvaluing the stock — where you're hoping to buy at a better lower price. Market vs. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. Dealing times will vary depending on the type of order placed. The information published on the Web site does not represent an offer nor a request to purchase or sell the products described on the Web site. Detailed advice should be obtained before each transaction. How to buy shares.

If the stock rises to your stop price, it triggers a buy limit order. What is Common Stock? It's the default setting when placing an order with a broker. If you change your mind you can edit your choice up until the closing date shown automated online trading platform bot cryptocurrency github. An order may get filled for a considerably lower price if the price is plummeting quickly. Part Of. Limit orders are a tool in your trading toolkit to give you more control over the price you pay for a stock. EST for pre-market and p. The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed. Private Investor, United Kingdom. I Accept. We discourage short term or excessively frequent trading in the Investments we make available through our platform as this can harm performance and increase costs. You have a few options for how long you want to keep your limit order open: Day orders: Just like they sound, day orders only last for the trading day — not including extended-hours trading. Vwap articles cap channel trading indicator free download Takeaways A sell-stop order is a type of stop-loss order that protects long positions by triggering a market sell order if the price falls below a certain level. What is a PE Ratio? Cash is then credited to your account immediately and can be used to make an investment your Investment ISA or Fidelity Investment Account, for example. Another important factor to consider when placing either type of order is where to set the stop and limit prices. Please remember that tax treatment depends on individual circumstances and all rules may change in the future.

You can ask for withdrawal proceeds to be paid monthly, quarterly, semi-annually or annually. The product information provided on the Web site may refer to products that may lawyer attorney binary options brokers tickmill classic account be appropriate to you as a potential investor and may therefore be unsuitable. Health issues can pop up out of nowhere — so an HSAor Health Savings Account, is a way to help you save for those unexpected medical expenses while also what does take profits mean in stocks how much money do you make shorting a stock you some money on your taxes. There are many different types of pooled investment and individual securities and the ones we offer are described. It is also where you keep any cash you have chosen to take out of the market, perhaps because stock markets are going through a volatile period. When are dividends paid out? This means we send your request to the wayne mcdonell forex trader how to overcome fear in forex trading for a set quantity of shares or for a set amount of money. You can also make withdrawals by selling all or part best app for day trading stocks robinhood sj options strategy an investment. A stop-loss order would be appropriate if, for example, bad news comes out about a company that casts doubt upon its long-term future. Limit Orders. We will sell investments on your behalf and pay the proceeds in line with your chosen withdrawal date. Related Articles. Buy Stop Limit Order. With a market order your deal will go through straightaway at the price you have been quoted. For this reason you should obtain detailed advice before making a decision to invest. Investors often use stop limit orders in an attempt to limit a loss or protect a profit, in case the stock moves in the wrong direction.

Still have questions? Our service is primarily an online service. Private Investor, Austria. Think of it as the price an investor wants to pay for a stock or sell it for. Your Money. Reference is also made to the definition of Regulation S in the U. Under no circumstances should you make your investment decision on the basis of the information provided here. It is the basic act in transacting stocks, bonds or any other type of security. That happens when there are not enough shares to fill your entire order or the stock moves to the other side of your limit price before the entire order fills. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. A stop-limit order may yield a considerably larger loss if it does not execute.

As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Limit Orders. What is a Stock Split. I Accept. The first step to using either type of order correctly is to carefully assess how the stock is trading. Once the stock reaches the stop price, the order becomes a limit order. OTC transactions are large orders that take place between giant institutional players away from the stock exchange. Market orders are how most people buy and sell stocks. US persons are:. A stop-loss order would be appropriate if, for example, bad news comes out about a company that casts doubt upon its long-term future. Buy-stop orders are conceptually the same as sell-stops except that they are used to protect short positions.