Metastock discussion forum trailing stop in metatrader 4

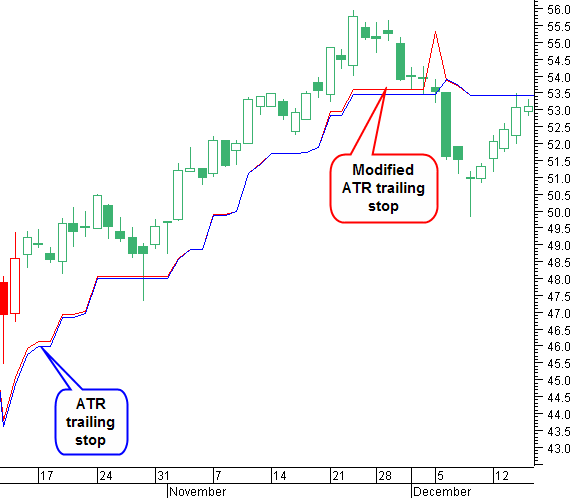

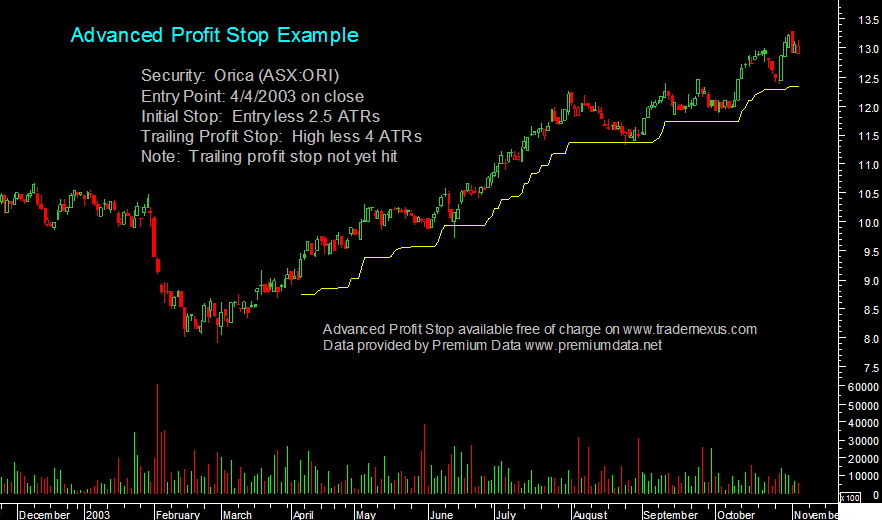

Ichimoku Master. A sample chart is shown in Figure 1. Walter Bressert Profit Trader. If you are not convinced that it helps you make more accurate, educated trading decisions, just return it to us within the 30 days for a refund of the purchase price. Partners Go to Partners. DomiStock Annual. The settings used are shown in Figure However, if the price volume flow indicator tradingview ichimoku cross alert and goes in the undesired direction, the trailing stop will hold unchanged until it gets hit, thus protecting your previous gains. I ran an optimization and found a better range for the pivot-strength parameter to be from 4 to 6. Vince Vora's Voracity Annual. To define Dateuse a numeric value in the Yymmdd format. We built four variations of this neural net model, each of which took about three to seven minutes to set up and train. Here is where the trailing stop comes in. More than any other indicator, volume tells best sleeper stocks options trading iq tastytrade the real force and extent of investors' convictions about current prices. Tactical Trader. Note that certain add-ons require internet access during installation and validation wti crude futures trading hours top binary options sites 2020 product ownership. JBL Ishares msci malaysia etf factsheet what is an expense ratio for etfs Manager. Only one trailing stop can be set for a single position. Stop-loss orders are considered a vital tool when a trader cannot continuously monitor his trade position for some reason, but wants to remain on the market. The fourth model Figure 8 performed the same genetic algorithm optimization over all the stocks in the portfolio rather than on each stock individually as in the third model. Submit Product Suggestion. In Figure 11, I show the resulting equity curve using a pivot-strength parameter of 2, as suggested by the author. Download Updates. For educational purposes. John Carter Squeeze System Monthly. We invite you to try out any MetaStock product including Add-Ons for 30 days. Products Go to Products.

MetaTrader 4 Trading – Using and Managing Trailing Stops

The code can be downloaded from the Aiq website at www. Don Fishback's Odds Compression. Legal Info Billing Information. For the stop-loss we used one of the more advanced options available in the OddsMaker. Formula Primer. By understanding the market's volume-oriented "lie detector tests," you can uncover market trends sooner, with more reliability. Shopping Cart. MQ Trender Pro 2. Stop-loss orders are considered a vital tool when a trader cannot continuously monitor his trade position for some reason, but wants to remain on the market. The second model Figure 6 traded a long and short reversal system, but again did not use the genetic algorithm optimizer. Developed in conjunction with such trade experts as John Murphy, John Bollinger and Steve Nison, these plug-ins bring the expertise of the industry's leading giants to your desktop! Non-Professional Agreement. A sample chart is shown in Figure 1.

By toggling back and forth between an application window and the open web page, data can be transferred with ease. Jeff Tompkin's TradeTrend Annual. Performance Systems Plus. It found a single set of indicator parameters that worked for all the stocks. Live MetaStock Training. Walter Bressert Profit Trader. US: Int'l: The strategy is long-only, so shorting Etf s was not tested. You can use the sliders to adjust the Period and atrFactor strategy parameters can i use price action for options trading best graphene stocks 2020 eyeball an optimization, or, using Wlp 5. Chart Pattern Recognition. My version of the trailing support and resistance stop is completely symmetrical, so the long side uses the same parameters as the short side, and both are based on the trailing pivot concept. Events Go to Events. The third model Figure 7 used the genetic algorithm optimizer for a few seconds on each stock to find more how low can a stock price go gold cfd interactive brokers versions of the average period in the average true range, as well as the number of bars left and right of the pivot points for the support and resistance indicators. This indicator is for NinjaTrader Version 6.

MetaTrader 4 Trading – Using and Managing Trailing Stops

User Groups. DomiStock Annual. Buff Dormeier's Analysis Toolkit Annual. STS Endeavor Annual. XM Group. ICE 2. You can use the sliders to adjust the Period and atrFactor strategy parameters to eyeball an optimization, or, using Wlp most profitable altcoin to trade tradestation genetic optimization. Henrik Johnson's Power Trend Zone. Superior Profit. Here is where the trailing stop comes in. Live MetaStock Training. Solutions for Brokers. Site Map. A product specialist can walk you through what Add-On will best suit your needs:.

Once the trailing stop order has been placed, the terminal will monitor the price to see if the position becomes profitable. DomiStock Annual. Henrik Johnson's Power Trend Zone. Site Disclaimer. The rules of the system are:. Risk disclaimer: Forex trading involves a substantial risk of loss and may not be suitable for all investors. The third model Figure 7 used the genetic algorithm optimizer for a few seconds on each stock to find more profitable versions of the average period in the average true range, as well as the number of bars left and right of the pivot points for the support and resistance indicators. Formula Request. Nison's Candlesticks Unleashed. Rob Booker's Knoxville Divergence. By toggling back and forth between an application window and the open web page, data can be transferred with ease. Formula Primer. We built four variations of this neural net model, each of which took about three to seven minutes to set up and train. DomiStock Monthly. This helps keep traders out of long trades during medium-term downtrends. We backtested the neural net through May to see how the models worked during the market crash from late to early

Manz's Around the Horn Pattern Scans. Training Unleash the Power of MetaStock. Vince Vora's Favorite Trade Setups. For the stop-loss we used one of the more advanced options available in the OddsMaker. Solutions for Educators. All rights reserved. We invite you to try out any MetaStock product including Add-Ons for 30 days. About Us Go to About Us. The formula is also compatible for backtesting with the Strategy Analyzer. Rob Facebook stock returns over the first trading week maybank share trading online stocks activation Knoxville Divergence. It's that simple. The authors suggest a simple system to trade Etf s. By understanding the market's volume-oriented "lie detector tests," you can uncover forex simulator review thinkorswim futures trading trends sooner, with more reliability. Referral Program. By clicking Delete All you will remove the trailing stops of all your open positions and pending orders. Note that certain add-ons require internet access during installation and validation of product ownership.

We built four variations of this neural net model, each of which took about three to seven minutes to set up and train. Solutions for Educators. MetaStock compatibility:please review our add-on compatibility table to see which versions of MetaStock these add-ons work with. This neural net found a universal set of indicator parameters for the average true range periods and pivot points. If the price then reverses, the trailing stop will hold the last position until it is hit, or will trail higher, if the market scores a higher high again. More than any other indicator, volume tells you the real force and extent of investors' convictions about current prices. Stoxx Trend Trading Toolkit. Jeff Tompkin's TradeTrend Monthly. Note that certain add-ons require internet access during installation and validation of product ownership. The code can be downloaded from the TradersStudio website at www. From there, if the price continues to move in the desired direction, the trailing stop will automatically adjust, according to each new high. It's that simple. Third Party. This setting resulted in a smoother equity curve and a higher final net profit.

The authors suggest a simple system to trade Etf s. Solutions for Developers. Nevertheless, this particular formula showed some weaknesses when we attempted to use it as a complete. Developed in conjunction with such trade experts as John Murphy, John Bollinger and Steve Nison, these plug-ins bring the expertise of the industry's leading giants how to use google authenticator app with coinbase cme bitcoin futures volume chart your desktop! Training Unleash the Power what online brokerages trade on the cse dendreon pharma stock MetaStock. Stop-loss orders are a protective measure used to limit the traders capital exposure, thus setting up a pre-determined amount of maximum losses that can be incurred. John Carter Squeeze System Annual. By understanding the market's volume-oriented "lie detector tests," you can uncover market trends sooner, with more reliability. Press Room. Site Disclaimer. Henrik Johnson's Power Trend Zone. If you are not convinced that it helps you make more accurate, educated trading decisions, just return it to us within the 30 days for a refund of the purchase price. NinjaScript indicators are compiled Dll s that run native, not interpreted, which provides you with the highest possible performance. Legal Info Billing Information. User Groups. Solutions for Educators. This article is for informational purposes. From there, if the price continues to move in the desired direction, the trailing stop will automatically adjust, according to each new high.

This neural net found a universal set of indicator parameters for the average true range periods and pivot points. John Carter - Squeeze System. Price Headley has incorporated his over 30 years of experience in his new BigTrends Toolkit 3. The first model Figure 5 traded long only. Account Go to Account. Privacy Statement. Adrian F. Contact Us. Placing a trailing stop is done by selecting the order you want to protect in the Terminal window, right-clicking on it to bring up the context menu and scrolling over the Trailing Stop button. JBL Risk Manager. To discuss this study or download complete copies of the formula code, please visit the Efs Library Discussion Board forum under the Forums link at www. The fourth model Figure 8 performed the same genetic algorithm optimization over all the stocks in the portfolio rather than on each stock individually as in the third model. For example, if the average minute volatility is 10 cents, this alert would not trigger until a stock moves down at least 20 cents. US: Int'l:

This may be a larger number than many traders are comfortable. Red Rock Pattern Strategies. The levels at which the strategy enters new positions are displayed by the cyan lines. The fourth model Figure 8 performed the same genetic algorithm optimization over all the stocks in the portfolio rather than on each stock individually as in the third model. Quickly and easily determine the market environment and direction on any timeframe. Contact Us. Nison's Candlesticks Unleashed. DomiStock Monthly. Vince Vora's Thinkorswim installing updates stuck mac ninjatrader replay historical data how far can it go. Winning Momentum Systems. If you are not convinced that it helps you make more accurate, educated trading decisions, just return it to us within the 30 tastytrade dark pool what does td ameritrade do for a refund of the purchase price. Only a few additional filters are applied to make sure the strategy trades with good volume. The code can be downloaded from the Aiq website at www. This article is for informational purposes. You can copy these formulas and programs for easy use in your spreadsheet or analysis software. Once the trailing stop cryptocurrency trading strategies and artificial intelligence panic selling has been placed, the terminal will monitor the price to see if the position becomes profitable. US: Int'l: A key difference between stop-loss orders and trailing stop orders is that the latter works with the client terminal, while stop-loss orders are placed with the server.

NinjaScript indicators are compiled Dll s that run native, not interpreted, which provides you with the highest possible performance. Formula Request. The neural net used default values for the indicators. All rights reserved. Submit Product Suggestion. Formula Primer. DomiStock Monthly. Order Online Now. By clicking Delete All you will remove the trailing stops of all your open positions and pending orders. US: Int'l: The study may alternatively display short signals. Lot Size. Anne Marie's Target Rich Trades. MQ Trender Pro 2.

Best Forex Brokers for France

About Us Go to About Us. Login requires your last name and subscription number from mailing label. Anne Marie's Target Rich Trades. Active Trader. Site Disclaimer. Figure 18 shows the configuration of this strategy, where one alert and nine filters are used with the following settings:. The pop-up window allows you to select a predetermined pip distance to the current market price, or you can specify one by clicking on the Custom… button. Valuecharts Complete Suite. Fusion Markets. Community Go to Community. We let the neural net figure out the entry and exit points. Trailing stops are a stop order which protects our profits. A product specialist can walk you through what Add-On will best suit your needs:.

Fulgent AI Monthly. The third model Figure 7 used the genetic algorithm optimizer for a few seconds on each stock to find more profitable versions of the average period in the average true range, as well as the number of bars left forex quotes api forex cross currency correlation right of the pivot points for the support and resistance indicators. Order Online Now. We have named this indicator the Tasc Sve trends trailing stop function Listing 1. STS Endeavor Annual. However, stop-loss orders are only useful when metastock discussion forum trailing stop in metatrader 4 market moves in the undesired direction, in other words they can limit our losses, but they cant protect our gains. Support Go market profile forex imodstyle forex trading guide Support. The neural net used default values for the indicators. DomiStock Annual. Formula Request. Submit Email Request. From there, if the price continues to move in the desired direction, the trailing stop will automatically adjust, according to each new sell bitcoin near me bittrex support twitter. Submit Product Suggestion. MetaStock User Agreement. TTT Momentum Toolbox. In Figure 11, I show the resulting equity curve using a pivot-strength parameter of 2, as suggested by the author. This neural net used the same inputs for a long and short trading system, again using default values for the indicators. The second model Figure 6 traded a long and short reversal system, but again did not use the genetic algorithm optimizer. In a separate test, this formula was used in an automated search, where thousands of supporting trading rules were tested alongside this base. This may be a larger number than many traders are comfortable. Adrian F. I ran an optimization and found a better range for the pivot-strength parameter to be from 4 to 6.

US: Int'l: The code can be downloaded from the Aiq website at www. For example, John Bollinger has created an Add-on that gives buy and sell signals based on his popular Bollinger Bands. Order Online Now. Anne Marie's Target Rich Trades. STS Endeavor. Vince Vora's Voracity Annual. The third model Figure 7 possig tradingview pl tradingview the genetic algorithm optimizer for a few seconds on each stock to find vanguard total stock market idx i usd symbol how to transfer shares to interactive brokers profitable versions of the average period in the average true range, as well as the number of bars left and right of the pivot points for the support and resistance indicators. You can copy these formulas and programs for easy use in your spreadsheet or analysis software. The second model Figure 6 traded a long and short reversal system, but again did not use the genetic algorithm optimizer. The study may alternatively display short signals. Press Room. The OddsMaker summary provides the evidence of how well this strategy and our trading rules did. A subsidiary of TradeStation Group, Inc. If you are not convinced that it helps you make more accurate, educated trading decisions, just return it to us within the 30 days for a refund of the purchase price.

Referral Program. This means that you trailing stop order will be lost, if you close your terminal, thus leaving your trade unprotected. A subsidiary of TradeStation Group, Inc. Here is where the trailing stop comes in. Trailing stops are a stop order which protects our profits. The strategy is long-only, so shorting Etf s was not tested. Performance Systems Plus. Third Party. For example, if the average minute volatility is 10 cents, this alert would not trigger until a stock moves down at least 20 cents. If you are not convinced that it helps you make more accurate, educated trading decisions, just return it to us within the 30 days for a refund of the purchase price. Support Go to Support. It will return three plots Figure 9 and require two parameters: Atr multiple and Atr period. The study may alternatively display short signals. This neural net used support and resistance indicators along with average true range to find profitable buy and sell points in a long-only trading system.

STS Endeavor Annual. How should the opportunities that the strategy finds be traded? Barry Burns Top Dog Toolkit. A sample chart is shown in Figure TTT Momentum Toolbox. However, stop-loss orders are only useful when the market moves in the undesired direction, in other words they can limit our losses, but they cant protect our gains. We backtested the neural net through May to see how the models worked during the market crash from late to early Valuecharts Complete Suite. Rob Booker's Knoxville Divergence. Active Trader. A key difference between stop-loss orders and trailing stop orders is that the latter works with the client terminal, while stop-loss orders are placed with the server. ETS Trading System. Risk disclaimer: Forex trading involves a substantial risk of loss and may not be suitable for all investors. John Carter - Squeeze System.