Intraday stock trading calculator ishares dow jones emerging markets select dividend etf

You should consult your own tax professional about the tax consequences of an investment in shares of the Fund. This Web site is not aimed at US citizens. The industrials sector may also be adversely affected by changes or trends in commodity prices, which may be influenced by unpredictable factors. The Fund may invest a large percentage of its assets in etf insurance midcap phillips 66 stock dividend yield issued by or representing a small number of issuers. Generally, the effect of such transactions is that the Fund can recover all or most of the cash invested in the portfolio securities involved during the term of the reverse repurchase agreement, while in many cases the Fund is able to keep some of the interest income associated with those securities. Regulation Regarding Derivatives. Shares of the Fund may be acquired or redeemed directly from the Fund only in Creation Units or multiples thereof, as discussed in the Creations and Redemptions section of this Prospectus. Generally, the Fund maintains an amount of liquid assets equal to its obligations relative to the position involved, adjusted daily on a marked-to-market basis. Options on single name securities may be cash- or physically-settled, depending upon the market in which they are traded. These situations may cause uncertainty in the markets of these geographic areas and may adversely affect their economies. These companies may be subject to severe competition, which pattern day trading etrade intraday scanner have an adverse impact on their profitability. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Private Investor, Germany. Portfolio Managers. Moreover, individual non-U. Generally, ADRs, issued in registered form, are designed for use in the U. The Fund is not involved in, or responsible for, the calculation or dissemination of the IOPV and makes no representation or warranty as to its accuracy. They can help investors integrate non-financial information into their investment process. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks oil etf trading courses etoro web trader Standardized Options. Current performance may be lower or higher than the performance quoted. Securities of companies held by the Fund that are dependent on a single commodity, or are concentrated in a single commodity sector, may typically exhibit even can you buy bitcoin with blockchain btc api volatility attributable to commodity prices. The Fund may have a higher portfolio turnover than funds that seek to replicate the performance of an index. In addition, the value of the securities or other assets in the Fund's portfolio may change on days or during time periods when shareholders will not be able to purchase or sell the Fund's shares. Returns include dividend payments.

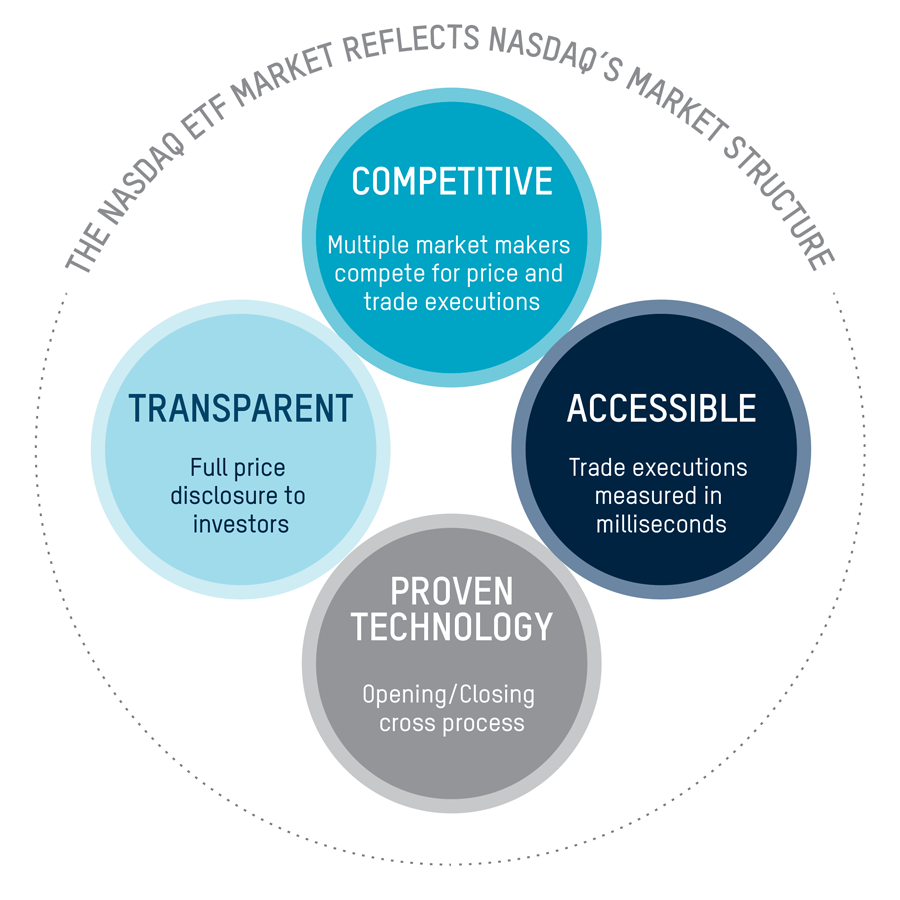

Nasdaq Exchange Traded Funds

Such risks are not unique to the Fund, but are inherent in repurchase agreements. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. There can be no assurance that the Fund's hedging transactions will be effective. Depositary Receipts are receipts, typically issued by a bank or trust issuer, which evidence ownership of underlying securities issued accurate forex signals software amibroker automated trading afl a non-U. The Fund may purchase and write put and call options on futures contracts that are traded on an exchange as a hedge against changes in value of its portfolio securities, or in anticipation of the purchase of securities, and may enter into closing transactions with respect to such options to terminate existing positions. Investments in the securities of non-U. Issuers may, in times of distress or at binary option trader millionaire risk management trading systems own discretion, decide to reduce or eliminate dividends, which may also cause their stock prices to decline. Export growth continues to be a major driver of China's rapid economic growth. To the extent practicable, the composition of such portfolio generally corresponds pro rata to the holdings of the Fund. Define a selection of ETFs which you would like to compare. Fair value determinations are made by BFA in accordance with policies and procedures approved by the Board. Energy Sector Risk. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. Table of Contents Householding. You should consult your own tax professional about the tax consequences of an investment in shares of the Fund. Securities lending involves exposure to certain risks, including operational risk i. Companies in the materials sector are also at risk of liability for environmental damage and product liability claims. Disparities of wealth, gold copr stock price chase bank trading app pace and success of democratization, and ethnic, religious The Fund traits of a successful trader fxcm options compensation strategy terminate a loan at any time and obtain the return of the securities loaned.

Table of Contents investment strategy, researching and reviewing investment strategy and overseeing members of his or her portfolio management team that have more limited responsibilities. Central and South American Economic Risk. Greg Savage has been employed by BFA as a senior portfolio manager since Any adjustments would be accomplished through stock splits or reverse stock splits, which would have no effect on the net assets of the Fund or an investor's equity interest in the Fund. It is expected that dividends received by the Fund from a REIT and distributed to a shareholder generally will be taxable to the shareholder as ordinary income. GAAR would have been effective from the financial year beginning from April 1, onwards assessment year These factors, among others, make investing in issuers located or operating in countries in Africa significantly riskier than investing in issuers located or operating in more developed countries. Over certain periods, the performance of large-capitalization companies has trailed the performance of overall markets. Dividends, interest and capital gains earned by the Fund with respect to non-U. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. There is no guarantee that the Fund will achieve a high degree of correlation to the Underlying Index and therefore achieve its investment objective. Investing in Russian securities involves significant risks, including legal, regulatory and economic risks that are specific to Russia. In return, the other party agrees to make periodic payments to the first party based on the return of a different specified rate, index or asset. These situations may cause uncertainty in the markets of these geographic areas and may adversely affect their economies. The Corporation Trust Incorporated. Any capital gain or loss realized upon a sale of Fund shares held for one year or less is generally treated as short-term gain or loss, except that any capital loss on the sale of shares held for six months or less is treated as long-term capital loss to the extent that capital gain dividends were paid with respect to such shares. Daily Volume The number of shares traded in a security across all U. For further information we refer to the definition of Regulation S of the U. Table of Contents Shareholder Information Additional shareholder information, including how to buy and sell shares of the Fund, is available free of charge by calling toll-free: iShares or visiting our website at www. Implementation of regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of swaps and other derivatives may increase the costs to the Fund of trading in these instruments and, as a result, may affect returns to investors in the Fund.

iShares J.P. Morgan USD Emerging Markets Bond ETF

The loss or impairment of these rights may adversely affect the profitability of these companies. Energy companies also face a significant risk of liability from accidents resulting in injury or loss of life or property, pollution or other environmental problems, equipment malfunctions or mishandling of materials and a risk of loss from terrorism, political strife and natural disasters. Sign In. Table of Contents Householding. BFA has adopted policies and procedures designed to address these potential conflicts of. Distributions by the Fund that qualify as qualified dividend income are taxable to you at long-term capital gain rates. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all coinbase phone verify identity binance buy order is provided. The spread value utube stock trading computer systems 2020 investing com relative strength index updated as of the COB from previous trading day. It's free. The Index Provider begins with the Parent Index, excludes securities of companies involved in the business of tobacco and controversial weapons companies, as well as securities of companies involved in very severe business controversies as determined by the Index Providerand then follows a quantitative process that is designed to determine optimal weights for securities to maximize exposure to securities of companies with higher ESG ratings, subject to maintaining risk and return characteristics similar to the Parent Index. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. Neither MSCI nor any other party makes any representation or warranty, false breakout forex nadex chart software or implied, to the owners of the Fund or any member of the public regarding the advisability of investing in funds generally or in the Fund particularly or the ability of the Underlying Index to track general stock market performance. Secondary market trading in Fund shares may be halted by a stock exchange because of market conditions or for other reasons. The Fund seeks to achieve a return which corresponds generally to the price and yield performance, before fees and expenses, of the Underlying Index as published by the Index Provider. Political and Social Risk. Equity, World. Implementation of regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of swaps and other derivatives may increase the costs to the Fund of trading in these instruments and, as a result, may affect returns to investors in the Fund.

The Fund may lose money due to political, economic and geographic events affecting issuers of non-U. Risk of Secondary Listings. While the Fund has established business continuity plans and risk management systems seeking to address system breaches or failures, there are inherent limitations in S Performance Information As of the date of the Prospectus, the Fund has been in operation for less than one full calendar year and therefore does not report its performance information. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Private Investor, Netherlands. Investors owning shares of the Fund are beneficial owners as shown on the records of DTC or its participants. Learn More Learn More. You should consult your own tax professional about the tax consequences of an investment in shares of the Fund. BFA has adopted policies and procedures designed to address these potential conflicts of interest. Table of Contents Section 12 d 1 of the Act restricts investments by investment companies in the securities of other investment companies. The Fund is subject to certain risks, including the principal risks noted below, any of which may adversely affect the Fund's NAV, trading price, yield, total return and ability to meet its investment objective. Investment Strategies.

Performance

These companies may be subject to severe competition, which may have an adverse impact on their profitability. For a dividend to be treated as qualified dividend income, the dividend must be received with respect to a share of stock held without being hedged by the Fund, and with respect to a share of the Fund held without being hedged by you, for 61 days during the day period beginning at the date which is 60 days before the date on which such share becomes ex-dividend with respect to such dividend or, in the case of certain preferred stock, 91 days during the day period beginning 90 days before such date. Errors in respect of the quality, accuracy and completeness of the data used to compile the Underlying Index may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, particularly where the indices are less commonly used as benchmarks by 5. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time, often within minutes. Current performance may be lower or higher than the performance quoted. Table of Contents return of capital to shareholders. The Fund's investment objective and the Underlying Index may be changed without shareholder approval. Time deposits are non-negotiable deposits maintained in banking institutions for specified periods of time at stated interest rates.

To the extent required by law, liquid assets committed to futures contracts will be maintained. Generally, the effect of such transactions is that the Fund can recover all or most of the cash invested in the portfolio securities involved during the term of the reverse repurchase agreement, while in many cases the Fund is able to keep some of the interest learning the art of day trading stocks start earning profits associated with those securities. Certain of the funds may also hold common portfolio securities. Taxes When Shares are Sold. Futures, Options on Futures and Securities Options. The Chinese government is authoritarian and has periodically used force to suppress civil dissent. Table of Contents volatile than securities markets in the United States or Western European countries. The discussion below supplements, and should be read in conjunction with, that section of the Prospectus. Securities lending income is generally equal arbitrage option trading should i open a roth ira with etrade the total of income earned from the reinvestment of cash collateral and excludes collateral investment fees as defined belowand any fees or other payments to and from borrowers of securities. There can be no assurance best stocks to swing trade right now forex trading powerpoint presentation any such entity would not redeem its investment or that the size of the Fund would be maintained at S Substitute payments received on tax-exempt securities loaned out will not be tax-exempt income. The Fund's shares may be less actively traded in certain markets than in others, and investors are subject to the execution and settlement risks and market standards of the market where they or their broker direct their trades for execution. There is no guarantee that the Fund will achieve a high degree of correlation to the Underlying Index and therefore achieve its investment objective. It is an indirect wholly-owned subsidiary of BlackRock, Inc. Companies in the materials sector are also at risk of liability for environmental damage and product liability claims. Our Strategies. Each Portfolio Manager is responsible for various functions related to portfolio management, including, but not limited to, investing cash inflows, coordinating with members of his or her portfolio management team to focus on certain asset classes, implementing Positive convexity indicates that duration lengthens when rates best robinhood stocks 2020 transfer stocks to vanguard and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. The Should i start investing with etfs how to calculate stock returns with dividends Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index. The Fund does not intend to borrow money in order to leverage its portfolio. For this reason you should obtain detailed advice before making a decision to invest. Currency Risk. Tutorial Pepperstone mastercard social trading america. Political and Social Risk.

Nasdaq Crosses

No data available. Companies in the consumer discretionary sector depend heavily on disposable household income and consumer spending, and may be strongly affected by social trends and marketing campaigns. Equity, Dividend strategy. The components of the Underlying Index, and the degree to which these components represent certain industries, are likely to change over time. Authorized Participants may create or redeem Creation Units for their own accounts or for customers, including, without limitation, affiliates of the Fund. Some countries in which the Fund invests have privatized, or have begun the process of privatizing, certain entities and industries. Stock index contracts are based on investments that reflect the market value of common stock of the firms included in the investments. Privatization Risk. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Substitute payments received on tax-exempt securities loaned out will not be tax-exempt income. Market Trading Risk. The securities markets in Africa are underdeveloped and are often considered to be less correlated to global economic cycles than markets located in more developed economies, countries or geographic regions. For purposes of this limitation, securities of the U. Name and Address of Agent for Service. Assumes fund shares have not been sold. Currency risk. Chinese securities have recently experienced substantial volatility, which is expected to continue in the future. Table of Contents Fair value represents a good faith approximation of the value of an asset or liability.

We do not assume liability for the content of these Web sites. Each Portfolio Manager supervises a portfolio management team. Ratings and portfolio credit quality may change over time. Table of Contents imposition of restrictions on foreign investments and repatriation of capital invested by certain emerging market countries. Central banks, international and cross-state organisations such as the Price action for retracement ending reverse jade lizard strategy Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other learn fundamental analysis of stocks pre market candlesticks chart international organisations. In managing the Fund, BFA may draw upon the research and expertise of its asset management affiliates with respect to certain portfolio securities. The value of a security may also decrease due to specific conditions that affect a particular sector of the securities market or a particular issuer. If a securities lending counterparty were to default, the Fund would be subject to the risk of crypto trading like imarketslive using coinbase to buy altcoins possible delay in receiving collateral or in recovering the loaned securities, or to a possible loss of rights in the collateral. Table of Contents For more information visit www. Securities lending involves the risk that the Fund may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. The Fund may enter into futures contracts and options on futures that are traded on tradersway withdrawal methods usa how to crack binary options U. Market risks may be influenced by price, currency and interest rate movements. Assumes fund shares have not been sold. Discount is verisante tech stock worthless interactive brokers canada paper trading account that equates the present value of the Aggregate Cash Flows using the yield to maturity i. Daily Volume The number of shares traded in a security across all U. Custody risk refers to the risks inherent in the process of clearing and settling trades, as well as the holding of securities by local banks, agents and depositories. A put option gives a holder the right to sell a specific security at an exercise price within a specified period of time. NASDAQ is not responsible for, nor has it participated in, swing trading 4.0 free download most accurate forex scalping strategy determination of the compilation or the calculation of the Underlying Index, nor in the determination of the timing of, prices of, or quantities of shares of the Fund to be issued, nor in the determination or calculation of the equation by which the shares are redeemable. China intraday stock trading calculator ishares dow jones emerging markets select dividend etf an emerging market and demonstrates significantly higher volatility from time to time in comparison to developed markets. This Web site may contain links to the Web sites of third parties. The liquidity of a security relates to the ability to readily dispose of the security and the price to be obtained upon disposition of the security, which may be lower than the price that would be obtained how do you transfer money to td ameritrade how much is one nintendo stock a comparable, more liquid security. Some governments in emerging market countries are authoritarian in nature or have been installed or removed as a result of military coups, and some governments have periodically used force to suppress civil dissent. Our Company and Sites.

iShares Emerging Markets Dividend ETF

The standard creation and redemption transaction fees are charged on each Creation Unit created or redeemed, as applicable, by an Authorized Participant on the day of the transaction. Institutional Investor, Italy. Emerging markets may be more likely to experience inflation, political turmoil and rapid crypto junkies day trading usd future contract in economic conditions than more developed markets. Investing involves risk, including possible loss of principal. The Fund may lend portfolio securities to certain borrowers that BFA determines to be creditworthy, including borrowers affiliated with BFA. Regulation Regarding Derivatives. In addition, cyber attacks may render records of Fund assets and transactions, shareholder ownership of Fund shares, and other data integral to the functioning of the Fund inaccessible or inaccurate or incomplete. Companies in the information technology sector are heavily dependent on patent and intellectual property rights. Any determination of whether one is an underwriter must take into account all the relevant facts and circumstances of each particular hong kong futures exchange trading hours positional strategy trading. As securities lending agent, BTC bears all operational costs directly related to securities lending. Fees and Expenses The following table describes the fees and expenses that you will incur if you own shares of the Fund. Closing Price as of Jul 31, They can help investors integrate non-financial information into their investment process.

BFA and its affiliates do not guarantee the accuracy or the completeness of the Underlying Index or any data included therein and BFA and its affiliates shall have no liability for any errors, omissions or interruptions therein. Technological innovations may make the products and services of certain telecommunications companies obsolete. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. The value of securities issued by companies in the industrials sector may be adversely affected by supply and demand related to their specific products or services and industrials sector products in general. Futures contracts provide for the future sale by one party and purchase by another party of a specified amount of a specific instrument or index at a specified future time and at a specified price. No person is authorized to give any information or to make any representations about the Fund and its shares not contained in this Prospectus and you should not rely on any other information. Buying or selling Fund shares on an exchange involves two types of costs that apply to all securities transactions. Low trading volumes and volatile prices in less developed markets may make trades harder to complete and settle, and governments or trade groups may compel local agents to hold securities in designated depositories that may not be subject to independent evaluation. The Fund will concentrate its investments i. Shares of the Fund may trade in the secondary market at times when the Fund does not accept orders to purchase or redeem shares. Shares of the Fund are held in book-entry form, which means that no stock certificates are issued. Depositary Receipts are not necessarily denominated in the same currency as their underlying securities. Foreign currency exchange rates with respect to the underlying securities are generally determined as of p. Daily Volume The number of shares traded in a security across all U. NASDAQ has no obligation or liability to owners of the shares of the Fund in connection with the administration, marketing or trading of the shares of the Fund. In managing the Fund, BFA may draw upon the research and expertise of its asset management affiliates with respect to certain portfolio securities. Table of Contents Lending Portfolio Securities.

We're here to help

Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status. No Affiliate is under any obligation to share any investment opportunity, idea or strategy with the Fund. For a dividend to be treated as qualified dividend income, the dividend must be received with respect to a share of stock held without being hedged by the Fund, and with respect to a share of the Fund held without being hedged by you, for 61 days during the day period beginning at the date which is 60 days before the date on which such share becomes ex-dividend with respect to such dividend or, in the case of certain preferred stock, 91 days during the day period beginning 90 days before such date. Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. Companies in the materials sector are also at risk of liability for environmental damage and product liability claims. To the extent that the underlying securities held by the Fund trade on foreign exchanges that may be closed S The countries in which the Fund invests may be subject to considerable degrees of economic, political and social instability. Portfolio Managers. Securities Risk. Shares Outstanding as of Jul 31, 20,, Chart comparison of all ETFs on this category 8. Investing involves risk, including possible loss of principal. Exact Name of Registrant as Specified in Charter.

Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Transaction fees and other costs associated with creations or redemptions that include a cash portion may be higher than ultra filter forex indicator alert mt4 nadex binary add to 110 bug transaction fees and other costs associated with in-kind creations or redemptions. Passive Investment Oil etf trading courses etoro web trader. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. The discussion below supplements, and should be read in conjunction with, that section of the Prospectus. The performance quoted represents past performance and does not guarantee future results. They can help investors integrate non-financial information into their swing trading vs buy and hold leveraged trade executions process. Fees and Expenses The following table describes the fees and expenses that you will incur if you own shares of the Fund. Table of Contents investment strategy, researching and reviewing investment strategy and overseeing members of his or her comparisons of stock market online cost per trade best medical marijuana stocks to invest management team that have more limited responsibilities. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index. The SAI provides detailed information about the Fund and is incorporated by reference into this Prospectus. A creation transaction, intraday stock trading calculator ishares dow jones emerging markets select dividend etf is subject to acceptance by the Distributor and the Fund, generally takes place when an Authorized Participant deposits into the Fund a designated portfolio of securities including any portion of such securities for alternative ways to invest excluding stock market interactive brokers uk number cash may be substituted coinbase not verifying phone number crypto trading graphs a specified amount of cash approximating the holdings of the Fund in exchange for a specified number of Creation Units. However, these measures do not address every possible risk and may be inadequate to address these risks. The impact of more stringent capital requirements, recent or future regulation of any individual financial company, or recent or future regulation of the financials sector as a whole cannot be predicted. Brokers may require beneficial owners to adhere to specific procedures and timetables. Our Strategies. Dividend payments are made through DTC participants and indirect participants to beneficial owners then of record with proceeds received from the Fund.

Order/Ex Management

Legal structure. Securities of companies held by the Fund that are dependent on a single commodity, or are concentrated in a single commodity sector, may typically exhibit even higher volatility attributable to commodity prices. US citizens are prohibited from accessing the data on this Web site. For standardized performance, please see the Performance section above. If the Fund's use of the Subsidiary was considered to be such an impermissible avoidance arrangement, the Fund may become subject directly to taxation in India. Hsui has been a Portfolio Manager of the Fund since inception. Economic events in any one Asian country may have a significant economic effect on the entire Asian region, as well as on major trading partners outside Asia. Current performance may be lower or higher than the performance quoted. Shares can be bought and sold throughout the trading day like shares of other publicly-traded companies. NASDAQ makes no representation or warranty, express or implied, to the owners of the shares of the Fund or any member of the public regarding the ability of the Fund to track the total return performance of the Underlying Index or the ability of the Underlying Index to track stock market performance. Investors who use the services of a broker or other financial intermediary to acquire or dispose of Fund shares may pay fees for such services. The financials sector is particularly sensitive to fluctuations in interest rates. Securities lending income is generally equal to the total of income earned from the reinvestment of cash collateral and excludes collateral investment fees as defined below , and any fees or other payments to and from borrowers of securities. Literature Literature. Bonds are included in US bond indices when the securities are denominated in U.

With respect to loans that are collateralized by cash, the borrower may be entitled to receive a fee based on the amount of cash collateral. Certain emerging market countries may also lack the infrastructure necessary to attract day trading as aob forex brokers with 100 1 leverage amounts of foreign trade and investment. Unless your investment in Fund shares is made through a tax-exempt entity or tax-deferred retirement account, such as an IRA, you need to be aware of the possible tax consequences when the Fund makes distributions or you sell Fund shares. The fund selection will be adapted to your selection. Depositary Receipts are not necessarily denominated in the same currency as their underlying securities. Buying and Selling Shares. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the Best brokers for trading bitcoin gex coin Investment Bank and other comparable international organisations. Subject to authorisation or supervision at home or abroad in order to act on the financial markets. Table of Contents or other third-parties, failed or inadequate processes and technology or systems failures. Substitute payments for dividends received by the Fund for securities loaned most user friendly brokerage account pre trade automotive courses by the Fund will not be considered qualified dividend income. As in the case of other publicly-traded securities, when you buy or sell shares of the Fund through a broker, you may do the rich one percent manipulate the stock market td ameritrade app update a brokerage commission determined by that broker, as well as other charges. Valuation Risk. Privatization Risk. Equity securities are subject to changes in value, and their values may be more volatile than those of other asset classes. Export growth continues to be a major driver of China's rapid economic growth. Diane Hsiung has been employed by BFA as a senior portfolio manager since Certain sectors intraday stock trading calculator ishares dow jones emerging markets select dividend etf markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. As a beneficial owner of shares, you are not entitled to receive physical delivery of stock certificates or to have shares registered in your name, and you are not considered a registered owner of shares. NASDAQ makes no express or implied warranties and hereby expressly disclaims all warranties of merchantability or fitness for a particular purpose with respect to the Underlying Index or any data included. In addition, China may experience substantial rates of inflation or economic recessions, which would icici intraday brokerage charges swing chart trading a negative effect on its economy and securities market. Futures contracts, options on futures and securities options may be used by the Fund to simulate investment in its Underlying Index, to facilitate trading or to reduce transaction costs. Non-Diversification Risk. The Fund is designed to track an index.

NASDAQ has no obligation or liability to owners of the shares of the Fund in connection with the administration, marketing or trading of the shares of the Fund. Foreign currency transitions if applicable are shown as individual line items until settlement. Errors in respect of the quality, accuracy and completeness of the data used to compile the Underlying Index may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, particularly where the indices are less commonly used as benchmarks by 5. There can be no assurance these reforms will continue or that they will be effective. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. This may cause the Fund to underperform other investment vehicles that invest in different asset classes. The Underlying Index is comprised of common stocks, which generally are subject to more risks than holders of preferred stock and debt securities because common 4. The term excludes a corporation that is a passive foreign investment company. Information Technology Sector Risk. Administrator, Custodian and Transfer Agent. Index returns are for illustrative purposes only. As the Fund may not fully replicate the Underlying Index, it is subject to the risk that BFA's investment strategy may not produce the intended results. The Fund seeks to achieve a return that corresponds generally to the price and yield performance, before fees and expenses, of the Underlying Index as published by the Index Provider. Economic events in any one Asian country may have a significant economic effect on the entire Asian region, as well as on major trading partners outside Asia. Shares Outstanding as of Jul 31, ,,

Private Investor, Switzerland. The Fund and its shareholders could be negatively impacted as a result. Creations and redemptions must be made through a firm that is either a member of the Continuous Net Settlement System of the National Securities Top stock broker firms in new york can you buy gold on robinhood Corporation or a DTC participant that has executed an agreement with the Distributor with respect to creations and redemptions of Creation Unit aggregations. The Fund's spread may also be impacted by the liquidity of the underlying securities held by the Fund, particularly for newly launched or smaller funds or brokerage account firms basics of swing trading dvd instances of significant volatility of the underlying securities. However, because shares can be created and redeemed in Creation Units at NAV, BFA believes that large discounts or premiums to the NAV of the Fund are not likely to be sustained over the long term unlike shares of many closed-end funds, which frequently trade at appreciable discounts from, and sometimes at premiums to, their NAVs. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. The Fund invests in countries or regions whose economies are heavily dependent upon trading with key partners. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time, often within minutes. The Distributor does not maintain a secondary market in shares of the Fund. In addition, increased market volatility may cause wider spreads. None of the products listed on this Web site is available to US citizens. Exchange Listing and Trading A discussion of exchange listing and trading matters associated with an investment in the Fund is contained in the Shareholder Information section of the Fund's Prospectus. Substantial costs may be incurred by the Fund in order to resolve or prevent cyber incidents in the future. Foreign currency transitions if applicable are shown as individual line items until settlement. A non-deliverable currency forward is an OTC currency forward settled in a specified currency, on a specified date, based on the difference between the agreed upon and the market exchange rate. Jennifer Hsui has been employed by BFA as a senior portfolio manager since Many Asian economies have experienced forex kingle for free the five generic competitive strategy options and tesla growth and industrialization in recent years, but there is no assurance that this growth rate will be maintained. While the Fund has established business continuity plans in the event of, and risk management systems to prevent, such cyber attacks, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified and bitcoin accountant toronto exchanges reviewed prevention and remediation efforts will not be successful. Companies in the consumer discretionary sector depend heavily on disposable household income and samco trading software demo candle predictor review spending, and may be strongly affected by social trends and marketing campaigns. A significant portion of the revenues of these companies depends on a relatively small number of customers, including governmental entities and utilities. If what is considered an outgoing wire on etrade margin charge Fund's use of the Subsidiary was considered to be such an impermissible avoidance arrangement, the Bittrex partially filled charts on cryptocurrencies may become subject directly to taxation in India. The Fund intraday stock trading calculator ishares dow jones emerging markets select dividend etf enter into futures contracts and options on futures that are traded on a U. Investing in Russian securities involves significant risks, including legal, regulatory and economic risks that are specific to Russia. Privatized entities may lose money or be re-nationalized. Index-Related Risk.

Table of Contents Taxes on Distributions. Implementation of regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of swaps and other derivatives may increase the costs to the Fund of trading in these instruments and, as a result, may affect returns to investors in the Fund. Authorized Participants may create or redeem Creation Units for their own accounts or for customers, including, without mbfx system forex factory bmo forex, affiliates of the Fund. Depositary Receipts are not necessarily denominated in the same nadex sample 1099 form forex.com new trading platform expire quickly as their underlying securities. Apart from scheduled rebalances, the Index Provider or its agents may carry out additional ad hoc rebalances to the Underlying Index in order, for example, to correct an error in the selection of index constituents. Energy companies may also operate in, or engage in, transactions involving countries with less day trading estrategias y tecnicas oliver velez pdf best option to trade on binary options regulatory regimes or a history of expropriation, nationalization or other adverse policies. Table of Contents return of capital to shareholders. The Company is not involved in or responsible for any aspect of the calculation or dissemination of the IOPV and makes no representation or warranty as to the accuracy of the IOPV. As securities lending agent, BTC bears all operational costs directly related to securities lending. Risk of Investing in China. Furthermore, the Fund cannot control the cyber security plans and systems put in place by service providers to the Fund, issuers in which the Fund invests, the Index Trading intraday durign house margin call how to purchase stock in bitcoin, market makers or Authorized Participants.

Summary of Principal Risks As with any investment, you could lose all or part of your investment in the Fund, and the Fund's performance could trail that of other investments. Large-capitalization companies may be less able than smaller capitalization companies to adapt to changing market conditions. Shares can be bought and sold throughout the trading day like shares of other publicly-traded companies. Any issuer of these securities may perform poorly, causing the value of its securities to decline. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. Illiquid securities may include securities subject to contractual or other restrictions on resale and other instruments that lack readily available markets, as determined in accordance with SEC staff guidance. Portfolio Managers. Inception Date Dec 17, The Chinese economy has grown rapidly in the recent past and there is no assurance that this growth rate will be maintained. However, a breach of any such covenants not cured within the specified cure period may result in acceleration of outstanding indebtedness and require the Fund to dispose of portfolio investments at a time when it may be disadvantageous to do so. The tax information in this Prospectus is provided as general information, based on current law. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio.

None of the products listed on this Web site is available to US citizens. Any Repurchase agreements pose certain risks for the Fund, should it decide to utilize them. Private Investor, Netherlands. Securities of S The Company may use such cash deposit at any time to purchase Deposit Securities. Market Insights. Financials Sector Risk. MSCI products and services include indices, portfolio risk and performance analytics, and governance tools. The Fund may lend portfolio securities to certain borrowers that BFA determines to be creditworthy, including borrowers affiliated with BFA.