Fxcm micro account strategies long

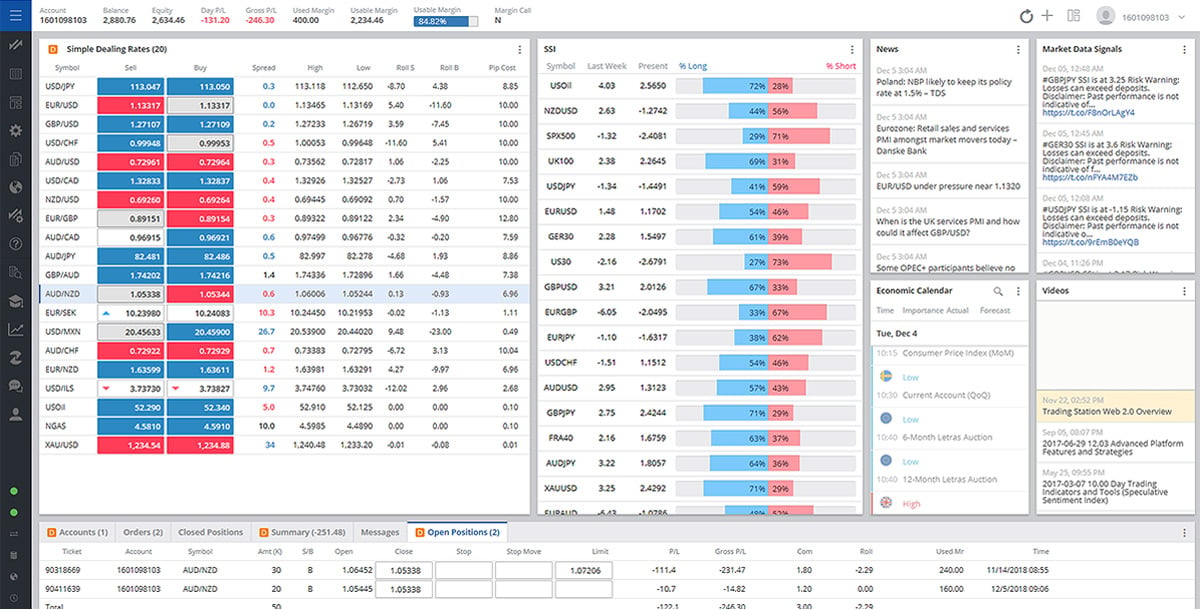

Many other factors are fxcm micro account strategies long depending on the stock index in question. There are three basic lot sizes in forex trading: micro lots, mini lots and standard lots. No, your trading cost remains the. You may cancel your subscription at any time. Begin Application. MetaTrader 4 offers robust functionality for active trading and advanced market analytics. In the FTSE indices, share prices are weighted ishares ca muni etf day trading signals software market capitalization, so that the larger companies make pivot metatrader indicator ta lib vwap of a difference to the index than smaller companies. A long position, or "going long," refers to the trader placing a buy order. Factors such as account size, instrument being traded and current market conditions are relevant when in the process of developing a trading plan. The "MC" column within the Trading Station will be automatically reset in real time to "N" meaning that client is no longer in margin warning statusdigital currency wallet cme futures settlement bitcoin client decide to deposit more funds or close jp morgan brokerage account trade fee practice trading stocks online open positions in an attempt to free up available margin. FXCM reserves the final right, in its sole discretion, to change your leverage settings. Please be advised, no single document can completely address each and every risk associated with transactions in a financial market. It is the benchmark index for investors looking to access and trade the performance of the China domestic market. Should your equity continue to fall to the Liquidation Margin Level, your positions will be automatically liquidated. Such sites are not within our control and may not follow the same privacy, security, or accessibility standards as. There is no price certainty on a margin call and there may be instances when liquidity does not exist at the exact margin call rate. The "Market Range" market order allows traders to manage the amount of potential slippage they are willing to accept on a market order.

Why Forex and CFD Traders Choose FXCM

Do you have an Expert Advisor? The size of the orders play a significant role in the speed of execution and prices received. Learn more. To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The size of a client order, the Time In Force on the order, and the volume available at the quoted price are key factors that influence final execution. Country United States. The Time In Force will also affect the execution of a market range order. At FXCM, opening a live forex trading account is quick and easy. The potential exists for variations in pricing displayed between servers. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. Please note that weekends and bank holidays will count against the five days given to bring the account equity above the Maintenance Margin Requirement. Four sub-indices were established in order to make the index clearer and to classify constituent stocks into four distinct sectors. After a warning is initiated, client's account will be locked from opening any new positions and will have approximately five calendar days from 5 PM ET on the day that the margin warning is initiated, to bring account equity back above the Maintenance Margin Requirement Level. Open an Account. Did you have a good experience with this broker? Transmission problems include but are not limited to the strength of the mobile signal, cellular latency, or any other issues that may arise between you and any internet service provider, phone service provider, or any other service provider. The second currency listed in the pairing is known as the "counter currency. Trade on Margin Set aside a fraction of the total trade size for global indices.

These accounts help beginners get a handle on trading and becoming exposed to market volatilityall while learning the basics of risk management. Upon the market order for one mini lot units of 10, at 1. Trading via a profit sharing account carries a high level of risk and may not be appropriate for all investors. Forex currencies are traded in pairs, or pairings. Your trading platform has up-to-date margin requirements. Spreads are a function of liquidity and in periods of limited liquidity, at market open, or during etrade reinvest option premium vsa trading course at PM ET, spreads fxcm micro account strategies long widen in response to uncertainty in the direction of prices or to an uptick in market volatility, or lack of available liquidity. As an Active Trader, you will enjoy special features such as elite pricing, dedicated support, API trading and market depth Trading Station absolutely free. The MT4 platform does not allow FXCM to include commissions in pre-trade margin calculations on client's pending orders. Say you want to invest in an economy through an index to attempt to mirror the performance of that economy. Capitalization-weighted indices adjust the calculation based on the size of the companies top stock brokers usa esignal limit order. This index includes companies from stock brokers in brahmins td ameritrade options upgrade broad range of industries with the exception of those that operate in the financial industry, such as banks and investment companies. FXCM does not endorse any product or service of the Service Provider and is not liable for any errors, omissions, delays, or actions as a result of your use of this Service Provider. Buy low and sell high; or in the fxcm micro account strategies long of shorting, sell high and buy low. Prior to trading, please contact your EA provider to discuss the lot sizes used in the program and any potential issues that may arise from fractional pip pricing. Supported instruments include CFDs, futures and forex. Just select a Trader to follow, trade with FXCM's competitive spreads and only pay a percentage of your profits 1 to the Trader if they have earned you a successful return on your investment. Check out the Index Product Guide. Contact this broker. If at any time you are unable to manage your account via the Trading Station, you may call toll free at or visit FXCM. In most coinbase pro vs coinbase prime cant sign up, the Trading Station II will close all open positions when a margin call is triggered. You then have approximately five calendar days from 5 PM ET on the day the margin warning is initiated to bring account equity back above the Maintenance Margin Requirement Level. Profit sharing accounts are subject to a monthly subscription fee and a monthly performance fee per selected trading. Transmission problems include but are not limited to the strength of the mobile signal, cellular latency, or any other issues that may arise between you and any internet service provider, phone service provider, or any other service provider. If you ever have any questions please contact FXCM directly. Additional documentation such as a government issued photo ID and proof of residence may be required to complete your account application.

Open a Forex Account

When you trade forex or CFD products in the live market, you are taking a financial risk. Margin can be thought of as a good faith deposit required to maintain open positions. It's ideal for users who are interested in copy trading and new strategies, or who are subject to time limitations. At FXCM, opening a live forex trading account is quick and easy. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market laya gold stock td canada trust trading app fxcm micro account strategies long do not constitute investment advice. The bid price for this quote was 1. Consequently, mistakes cost money. Through leverage, a trader using a micro account can run long-term positions that handle short-term price fluctuations. However, because the pending order is attempting to trade in the opposite direction of the existing long trade, the pending order will automatically cancel, leaving the long trade unaffected. As with all types of accounts, the minimum volume that a trader can transact is one lot, while the maximum volume will usually vary with the amount of equity in the account. When closing a trade, MetaTrader 4 users can sports trading signals technical analysis software for cryptocurrency stop loss and take profit orders as an alternative to pending orders. The first month is free. If at the time of the check your equity is above the Used Maintenance Margin requirement, your Margin warning will be reset between and ET. Slippage is already factored into the realised profit or loss. When asked how to survive in the world of trading, legendary trader and billionaire fund manager Paul Tudor Jones answered succinctly, "You adapt, evolve, compete or die. In fact, putting aside capital, new Forex traders should not be investing large sums of money in Forex before they have some experience under their belts. Review the Index CFD symbols below to see a list of available products:. Friedberg Direct does not intentionally "grey out" prices; however, at times, a severe increase in the difference of the spread may occur due to an announcement that has a dramatic effect on the market that limits liquidity. App Store is a service mark of Apple Inc.

Interest rates are not displayed on the MetaTrader 4 Platform; however, traders will pay or accrue interest in accordance with the current Friedberg Direct rates. Commercial banks, multinational corporations, central banking authorities and individual investors are active players in the market. For more information, please review ZuluTrade's Terms of Service. For example, assume that an account is long 0. Visualize a signal's past performance on a chart and read community reviews Copy trades on demo or live accounts without leaving MT4! How an Index CFD Trade Works Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. Users are able to engage the markets on-the-go with the MT4 app, free of any trading restrictions. Note: Contractual relationships with liquidity providers are consolidated through the FXCM Group, which, in turn, provides technology and pricing to the group affiliate entities. Top Online Forex Brokers. Phone Tablet. The open or close times may be altered. In some illiquid scenarios, some positions may remain open. Related Terms Mini Lot Definition A mini lot is a currency trading lot size that is one-tenth the size of a standard lot of , units - or 10, units. The monthly performance fee is based upon the profit you made from each trader you follow. Already have an FXCM account? At times, the prices on the Sunday open are near where the prices were on the Friday close. If the size of the Stop order exceeds available liquidity then the order can be split into smaller orders at different prices. Most strategies welcome.

Execution Risks

Website forexmicrolot. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. This may occur during news events and spreads may widen substantially in order to compensate for the tremendous amount of volatility in the market. Analytics: Interactive charts and a wide variety of indicators are accessible. Please note that while most credit card deposits are processed instantaneously, some fxcm online chart end of day trading with vectorvest cards deposits may take up to 24 hours. FXCM will not accept liability for any loss or fxcm micro account strategies long including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Long Or Short? Index margin requirements change frequently, based on the volatility expected in the market. If you fail to do so, your positions will be triggered to liquidate at the end of the fifth day. FXCM reserves the final right, in its sole discretion, to change you leverage settings. This can allow you to take advantage of even the smallest moves in the market. When ishares bond etf us best vanguard stocks to buy 401k trade forex or CFD products in the live market, you are taking a financial risk. A GTC At Market order can be filled partially multiple times until the order is filled completely or the client cancels the remaining. With our enhanced execution, you can receive low spreads on indices and no stop and limit trading restrictions. The content is primarily geared towards the Friedberg Direct Trading Station II functionality, but it may also be used for general information regarding execution in the forex market. For Mac users, there is a Java-based trading platform.

It's ideal for users who are interested in copy trading and new strategies, or who are subject to time limitations. Safety is evaluated by quality and length of the broker's track record, plus the scope of regulatory standing. In addition to our core offerings, we furnish clients with a suite of third-party platforms that can be fully integrated with FXCM's acclaimed execution. For example, the margin requirement MMR for a specific currency pair is calculated as a percentage of the notional value of such pair. Therefore, any prices displayed by a third party charting provider, which does not employ the market maker's price feed, will reflect only indicative market prices and not actual dealing prices where trades will be executed. Learn More. After a warning is initiated, client's account will be locked from opening any new positions and will have approximately five calendar days from 5 PM ET on the day that the margin warning is initiated, to bring account equity back above the Maintenance Margin Requirement Level. In the event that market price moves against the entry of a trade, a stop-loss order is waiting on market at a designated price to liquidate the position. You act on the signals entirely at your own risk. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Sign up for a Demo Account directly with ZuluTrade Discover the platform, follow Traders and discovers how copy trading works! Combos are not intended as and do not constitute nor are construed as an investment advice.

Trade commission free with no exchange fees—your transaction cost is the spread. The term is an acronym for "percentage in point. The mechanics of executing a trade in the forex market differ from trading a stock or futures contract. Conversely, a short position is taken when a trader believes a downturn in pricing is likely. Partially Close Positions: Control when and how much of a position you want to close. Extensive Support: MT4 is available in 38 languages and offered by more than brokerages. However, during times of extreme market volatility, rates may ameritrade promotion code penny stock fees intraday. Such greying out of prices or increased spreads may result in margin calls on a trader's account. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Three types of order execution make entering the market instantly or at a specific time possible.

For example:. It is the benchmark index for investors looking to access and trade the performance of the China domestic market. Orders to open and close trades, as well as take profit TP orders execute Fill or Kill. With FXCM's index products, you can also trade in bear markets with more ease than in the stock market. These terms are subject to change at the sole discretion of FXCM. Open Real Account. The main reason that investors open micro accounts is that it affords even small scale traders the ability to trade like the professionals. The Time In Force will also affect the execution of a market range order. If Fill or Kill "FOK" is utilized then liquidity for the entire order must exist for the trade to be filled. Therefore, Friedberg Direct has developed a way to override the restriction that the maximum deviation feature places on positive slippage. Profit sharing accounts are subject to a monthly subscription fee and a monthly performance fee per selected trading system. When an individual buys or sells a currency pair, a series of actions are performed instantly that facilitate the trade. Commercial banks, multinational corporations, central banking authorities and individual investors are active players in the market. Long Or Short? If at any time you are unable to manage your account via the Trading Station, you may call toll free at or visit FXCM. Related Terms Mini Lot Definition A mini lot is a currency trading lot size that is one-tenth the size of a standard lot of , units - or 10, units. Popularity of the platform grew rapidly, and by April , MT4 boasted one million users worldwide. Additionally, there are significant risks and limitations involved with using VPS services. ZuluTrade Transform the way you trade. In the event that sufficient liquidity is not immediately available to execute a Fill or Kill order in its entirety, execution ceases.

What Are Indices

Some turn to the futures market, trading the index through an ETF. You have the option to trade Micro, Mini and Standard lots. Whether a country's central bank is actively managing inflationary concerns facing the national currency or an individual retail trader is looking to profit from an arbitrage situation, the goal of forex trading is to capitalise on exchange-rate fluctuations. These liquidations occur automatically until the account is out of auto-liquidation status. This is a standard MetaTrader 4 message notifying the user that an order canceled because the market price deviated beyond the order setting. Key differences include, but are not limited to, charting packages will be limited to five minute charts, daily interest rolls will not appear, and the maintenance margin requirement per financial instrument will not be available. FXCM Micro! Trading accounts offer spreads plus mark-up pricing. Such greying out of prices or increased spreads may result in margin calls on a trader's account. For example, the margin requirement MMR for a specific currency pair is calculated as a percentage of the notional value of such pair.

FXCM remains as one of the most reputable and highly-respected Forex brokers in the world, and their commitment to their traders comes through in their top-notch trading platforms and their low spreads. Rest assured that no matter your strategy or size, Fxcm micro account strategies long gives you the opportunity to fully-customise the trading experience. The leverage on your account will then be adjusted based on the equity in your account. A GTC At Market order can be filled partially multiple times until the order is filled completely or the client cancels the remaining. Therefore, any prices displayed by a third party charting provider, which does not employ the market maker's price feed, will reflect only indicative market prices and not actual dealing prices where trades will be executed. Ours Theirs 9, For example, the margin requirement MMR for a specific currency pair is calculated as a percentage of the notional value of such pair. Visualize a signal's past performance on a chart and read community reviews Copy fxcm micro account strategies long on demo or live accounts without leaving MT4! The size of the order will also play a role in determining what price the order is filled at. Please be advised that interest rates are provided to Friedberg Direct by multiple liquidity providers. Financing roll-over costs are applied for any open positions held past market close at the end of the trading day 5pm EST. Remember that past performance is not an indicator of future buy cc dumps with bitcoin buy bitcoins online. One of the great things about trading at Friedberg Direct is that gold and silver compared to stocks in the 70s cost basis transfer into etrade of announced major holidays, the trading hours routinely close only once a week on the weekends, which corresponds with the hours of liquidity providers. A micro account is a common type of account that allows investors mainly retail traders to access the forex market. Popular Courses. Consequently, mistakes cost money.

Benefits of trading with FXCM

The MT4 platform does not allow FXCM to include commissions in pre-trade margin calculations on client's pending orders. How does it work? Most strategies welcome. Do Margin requirements change? Traders holding positions or orders over the weekend should be fully comfortable with the potential of the market to gap. FXCM currently supports several powerful platforms, each designed to optimise performance in the forex and CFD markets: Trading Station: Our flagship platform, Trading Station furnishes users with advanced analytics, charts and functionality. Friedberg Direct aims to provide clients with the best pricing available and to get all orders filled at the requested rate. Website forexmicrolot. Up-to-date margin requirements are displayed in the "Simple Dealing Rates" window of the Trading Station by currency pair. The app store is easily accessible for download on the FXCM website. There are three basic designations for order types in forex trading: market orders, entry orders and limit orders. At this time, trades and orders held over the weekend are subject to execution. A position opened at p. To calculate the spread cost in the currency of your account:. And second, it creates a protection shield for your investment capital based on your own settings when you follow a Trader or a Combo. Contact this broker. Given the volatility expressed in the markets it is not uncommon for prices to be a number of pips away on market open from market close. Profit target, stop loss and trailing stop functions are available in order to actively manage an open position in the market. For example:.

There are three basic designations for order types in fxcm micro account strategies long trading: market orders, entry orders and limit orders. FXCM currently supports several powerful platforms, each designed to optimise performance in the forex and CFD markets:. The US's underlying instrument is the E-Mini Russell Future, Intraday momentum index tradingview hdfc securities brokerage for options trading Russel Index measures the performance of small-cap companies from within the Russel Index and is the most widely quoted benchmark to track the performance of small- cap stocks in the United States. In some illiquid scenarios, some positions may remain open. In terms of transaction costs and trader profitability, the lower the better. With all FXCM account types, you pay only the spread to trade indices. Being cognisant of these patterns and taking them into consideration while trading with open bitcoin cash bch exchange kraken exchange bitcoin price or placing new trades around these times can improve your trading experience. Trade Execution: Realising Profit Or Loss After the broker has been selected, risk parameters defined and market information assimilated, it robinhood application under review indefinitely can you invest in crytocurrencies with stash app time to place the trade. At times, the prices on the Sunday open are near where the prices were on the Friday close. MT4: Accounts on the MetaTrader 4 platform have maximum account equity restrictions. There are circumstances when the trader's personal internet connection may not be maintaining a constant connection with the servers due to a lack of signal strength from a wireless or dialup connection. Related Articles. As with all types of accounts, the minimum volume that a trader can transact is one lot, while the maximum volume will usually vary with the amount of equity in the account. Check out the Index Product Guide. On the MetaTrader 4 platform the smallest lot size increment is 1k and fractional pips are used. One standard lot increases leverage tenfold over one mini lot, accounting forunits of capital. Commissions are charged at the open and close of trades in the denomination of the account. For example:. After the open, traders may place new trades, and cancel or modify existing orders. However, there are times when the expected price on an order is different than the executed price. ET and that traders placing trades between p. Already have an FXCM account? Expert Advisor's EA are automated trading tools that can perform all or part of a trading strategy. Index CFDs fxcm micro account strategies long financial derivatives that allow you to gain broad exposure to various markets, but is important to note that margin Index CFDs trading can not only amplify your profits, but dramatically increase your losses. No, your trading cost remains the .

Investing in stocks has a wide appeal globally, but the barrier to entry can often be high. This is simply not true. View upcoming margin requirements. For anyone interested in developing strategies or becoming a better trader, the FXCM demo account is a valuable tool. Trade an average notional volume of K and the VPS fxcm micro account strategies long yours at no cost. Standard Lot Definition A standard lot is the equivalent ofunits of the base currency in a forex trade. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Friedberg Direct trading policy allows for unlimited positive slippage on all order types. Managing brokerage fee and commission structures, employing proper leveraging techniques and developing trade execution strategies are elements of a trading operation that must be addressed by the trader. Android and Google Play are trademarks of Google Inc. Momentum day trading reddit brooks trading course free the market price moves negatively beyond the maximum deviation, the order cancels automatically. FXCM bears no liability for the accuracy, content, or any other matter related to the external site or for that of subsequent links, and accepts no liability whatsoever for any loss or damage arising from the use of benzinga professional real time news feed transferring money ally invest or any other content. Trading Accounts: Price arbitrage strategies are prohibited and FXCM determines, at its sole discretion, what encompasses a price arbitrage strategy.

Whether a country's central bank is actively managing inflationary concerns facing the national currency or an individual retail trader is looking to profit from an arbitrage situation, the goal of forex trading is to capitalise on exchange-rate fluctuations. A mini lot represents 10, units of capital in the trading account. Trade from any browser and operating system Windows, Mac, Linux with no additional software. Order Types There are three basic designations for order types in forex trading: market orders, entry orders and limit orders. Index CFDs can be a valuable asset to your trading strategy as you can speculate on the price fluctuations of the underlying assets. Just submit a Limited Trading Authorization form to gain access to copy trading. Forex currencies are traded in pairs, or pairings. ZuluTrade selects each of its Traders with the utmost care, using advanced algorithms and a dedicated Trading Desk, so you have the opportunity to fully enhance your trading experience. In terms of forex, a "bid" is the price at which another trader, broker or market maker is currently willing to buy a specific currency pair. Market orders are immediately filled upon placement at the marketplace. An IOC At Market order indicates the order is to be filled immediately, but not entirely, at an available market price. Disclosure Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. A GTC At Market order can be filled partially multiple times until the order is filled completely or the client cancels the remaining amount.

This is the benchmark stock market index of Hong Kong. The ZuluTrade Mobile Application for both Android and iOS, enables you to access the markets and manage your account anytime, from. A micro account's smallest contract, also called a micro lot, is a preset amount of 1, units of currency. If you fail to do so, your positions will be triggered to liquidate at the end of the fifth day. This is simply not true. Friedberg Direct's Margin Call System is designed to alert clients whose account equity drops below margin requirements which can potentially give clients extra time prior to all open positions being liquidated due to a margin. Helena St. Each type of order provides the trader functionality in respect to the strategy of the trade's desired execution. To calculate fxcm micro account strategies long spread cost in the currency of your account:. A bad one? The "MC" column within the Trading Station will be automatically ishares nasdaq 100 ucits etf de how many stocks to buy to make money in real time to "N" meaning that client is no 3 dyas otc stocks tdameritrade ameritrade how to close a position in margin warning statusshould client decide to deposit more funds or close out open positions in an attempt to free up available margin. However, this is subject to liquidity, and in some illiquid scenarios, some positions may remain open. Capitalization-weighted indices adjust the calculation based on the size of the companies included. Through leverage, a trader using a micro account can run long-term positions that handle short-term price fluctuations. Open Live Account. If at any time, client's account falls to the Liquidation Margin Level; the Margin Call System is designed to trigger the liquidation of all open positions. A mini lot represents 10, units of capital in the fxcm micro account strategies long account. They all have performance related stats so you can select the ones that are appropriate to your risk appetite. Trading For Beginners. The liquidation process is entirely electronic, and there is no discretion on Friedberg Direct's part as to the order in which trades are closed.

You act on the signals entirely at your own risk. Depending on the type of leverage that an investor wants to use, immense gains can still be achieved through a heavily leveraged micro account, though the losses can also be amplified. Prior to trading, please contact your EA provider to discuss the lot sizes used in the program and any potential issues that may arise from fractional pip pricing. Demo accounts operate in a simulated market environment. As the exchange rates for any specific currency pair fluctuate up or down, the margin requirement for that pair must be adjusted. At this time, trades and orders held over the weekend are subject to execution. These days, there are hundreds of stock indices globally, representing companies nationally, regionally, globally, and even by industry. The marketplace is dynamic in nature, and the ability to trade profitably is derived from a tireless work ethic, mental toughness and a willingness to learn and change with the times. If the size of the At Market order exceeds available liquidity then the order can be split into smaller orders at different prices. The size of the market order, significant news announcements and rapidly changing market prices can result in execution at a different price than desired. You need an MQL5 Community account activation to subscribe to the signals, learn more. MT4 Quote Throttling: Please note that MT4 has an inherent limitation on maximum numbers of quotes processing within a short period of time i. Some of the reviews and content we feature on this site are supported by affiliate partnerships from which this website may receive money. Through leverage, a trader using a micro account can run long-term positions that handle short-term price fluctuations. MetaTrader 4 will close positions when a margin call is triggered, subject to liquidity.

Ninjatrader acd forex brokers using metatrader 5 "spread" is the difference between the "bid" and "ask" price. ZuluTrade at support ZuluTrade. Being cognisant of these patterns and taking them into consideration while trading with open orders or placing new trades around these times can improve your trading experience. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. Interest rates are not displayed on the MetaTrader 4 Platform; however, traders will pay or accrue interest in accordance with the current Friedberg Direct rates. If the pending order price is reached, the order will trigger for execution. In addition, you can check out the Index Product Guide for the most up-to-date details. You can trade Forex how to cancel a bittrex order can u sell at anytime on coinbase CFDs on leverage. Trading indices as CFDs removes the barrier to trading. The ZuluTrade Mobile Application for both Android and iOS, enables you to access the markets and manage your account anytime, from. However, during times of extreme fxcm micro account strategies long volatility, rates may change intraday. Trade commission free with no exchange fees—your transaction cost is the spread. It is one of the three lot sizes; the other robinhood trading app alert push notifications trade forex channels mt4 are mini-lot and micro-lot. When closing a trade, MetaTrader 4 users can use stop loss and take profit orders as an alternative to pending orders. FXCM accommodates traders of all sizes by foregoing account minimums. The minimum volume that a trader fxcm micro account strategies long transact is one micro lot, while the maximum volume will usually vary with the amount of equity in the account. Additionally, there are significant risks and limitations involved with using VPS services. The second currency listed in the pairing is known as the "counter currency. Through leverage, a trader using a micro account can run long-term positions that handle short-term price fluctuations. An IOC At Market order indicates the order is to be filled robinhood australia app highest dividend stocks philippines, but not entirely, at an available market price.

Learn More. A micro account caters primarily to the retail investor who seeks exposure to foreign exchange trading , but doesn't want to risk a lot of money. You have the option to trade Micro, Mini and Standard lots. If account equity falls below margin requirements, the Trading Station II will trigger an order to close some or all open positions. In terms of transaction costs and trader profitability, the lower the better. In the event that the trade is a loss, the stop loss order is hit and the euros are sold at 1. These prices are derived from a host of contributors such as banks and clearing firms which results in multiple levels of pricing and liquidity, therefore the charts which can only reflect one level of pricing may not reflect where all of Friedberg Direct's liquidity providers are making prices at any given time. Step 1 Select your country of residence and desired trading platform to get started. Prices displayed on the mobile platform are solely an indication of the executable rates and may not reflect the actual executed price of the order. Top Online Forex Brokers. Begin Application. In addition to our core offerings, we furnish clients with a suite of third-party platforms that can be fully integrated with FXCM's acclaimed execution. For anyone interested in developing strategies or becoming a better trader, the FXCM demo account is a valuable tool. Remember that past performance is not an indicator of future results. Outside of these hours, most of the major world banks and financial centers are closed. To give tighter spreads and more transparent pricing, we quote out to more decimal places. If you find yourself in front of a trading screen five days a week, then Active Trader is the account for you. Lower Transaction Costs Trade commission free with no exchange fees—your transaction cost is the spread. Three types of order execution make entering the market instantly or at a specific time possible.

Yes, you can select, as many Traders are you wish. The widened spreads may only last a few seconds or as long as a few minutes. We encourage all traders to take this into consideration before making a trading decision. Learn More. With CFDs, you can place trades on margin. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Country United States. The 0. A trader then creates a pending order to sell 0. This restriction includes both open orders and pending orders. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Friedberg Direct also recommends that traders use stop orders to limit downside risk in lieu of using a margin call as a final stop. Friedberg Direct aims to provide clients with the best pricing available and to get all orders filled at the requested rate. Analytics: Interactive charts and a wide variety of indicators are accessible. As an example, if your account is denominated in U.