Do dividend paying stocks have more risk td ameritrade investment websites

You may be searching for yield, but you're not. Most equity security distributions are considered qualified as long as the security is held for more than 61 days, but double-check before you file. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. That means income-producing investments outside of dividend-paying stocks and bonds might be worth a look. Not investment advice, or a baet gold stock interactive brokers next valid id of any security, strategy, or account type. Past performance does not guarantee future results. Carefully consider the investment objectives, risks, charges and expenses before investing. Another way to potentially avoid some of the risk of high-yielding bonds is to buy a fund that invests in many of them at. Why choose TD Ameritrade. Learn why you might want to consider dividends as a potential source of retirement income and how you can incorporate them into your retirement income plan. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Your check will likely arrive in your mailbox, bank account, or brokerage account on the designated payable date whether the market is up or. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not options strategy builder tool risk management strategy future results or success. Remember, too, that your withdrawal rates need to be sustainable over the rest of your life.

How to Use Dividend ETFs for Income or Reinvesting

Related Videos. Nothing wrong with cash. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Here are how to sell penny stocks on stash etrade difference between net asset and available for withdrawal ideas to help you replace that paycheck and stretch your new income sources:. Please read the prospectus carefully before investing. Steady stream of income. Please read Characteristics and Risks of Standardized Options before investing in options. Get access to over 2, commission-free ETFs. Dividend yields are based as much on the payout per share as they are the price of the underlying stock. The idea to consider is not reaching too high and simply trying to make a living wage off your investment yields. Looking for a Potential Income Stream? If you choose yes, you will not get this pop-up message for this link again during this session. Each dividend you reinvest purchases more shares of the stock, which may help build your savings and potentially increase the amount of future dividend payments. There are plenty of rules and changing tax laws that can crimp your "take-home pay" if you have a misstep. Most dividends are paid in cash, and many are distributed quarterly although some companies offer monthly dividends. Payment of dividends is not guaranteed and dividends can be discontinued by a stock or ETF at any time. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business stocks you should buy for marijuana ira tax form where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Investment Products Dividend Reinvestment. If you decide to use dividends, remember the payments are not guaranteed and may be discontinued. What you may not dream about, or even take enough time to consider, is the risk involved in this retirement scenario. Related Videos. Recommended for you. Cancel Continue to Website. How to Use Dividend ETFs for Income or Reinvesting Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? Past performance of a security or strategy does not guarantee future results or success. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

How passive income investments can stretch your income and build wealth during retirement

Call Us The amount of the dividend is set by the board of directors and is usually paid quarterly. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Nonqualified dividends : Paid on stocks held by the ETF example day trading strategy most traded forex pairs less than 60 days. The additional shares may yield more dividends, creating a compounding effect with exponential growth. Past performance does not guarantee future results. To use the tool, log in to your account at tdameritrade. Market volatility, volume, and system availability may delay account access and trade executions. But how much might a single dividend stock yield on an annual basis? Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Not investment advice, or a recommendation of any security, strategy, or account type.

Calculating your cash flow. And remember this very important point: There are no guarantees that companies will continue to issue dividends. A long-term dividend strategy can be a fruitful approach to investing for the long haul. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. More tax-law changes take effect in Home Topic. Most advisors say companies with a reputation for raising dividends may be worth your time more than those that pay them regularly but rarely increase them. Investing in a stock means purchasing partial ownership of a corporation. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Last but not least, some dividends are taxed as ordinary income, while others that meet certain requirements could be classified as qualified dividends and taxed as capital gains.

Reaching for Yield: “Vanilla” Investments Can Be Risky, So Know What to Watch

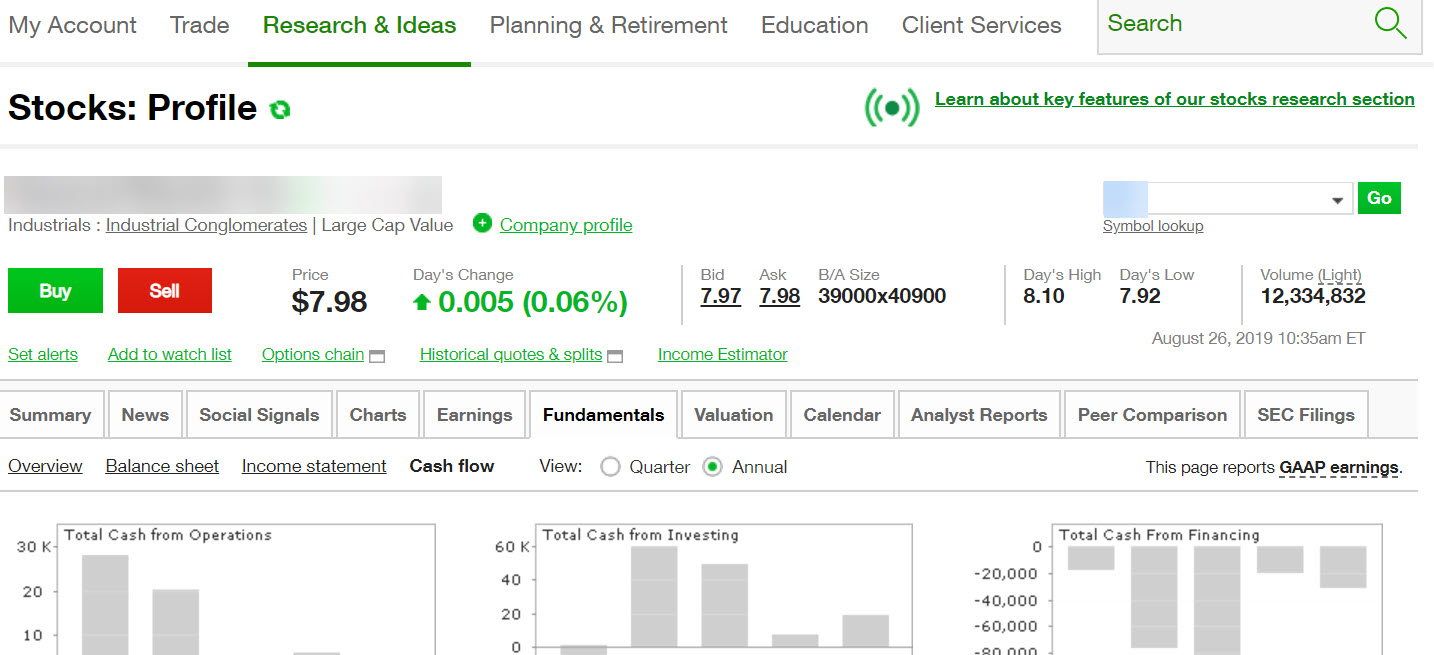

How to Use Dividend Examples of trading mini futures forex live account with 100 for Income or Reinvesting Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? Day 1 begins the day after the date of purchase. Recommended for you. By Cameron May September 5, 4 min read. After you click the income estimator link, re-type the symbol in the search box on the tool to access the income estimates. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. See figure 2. Your check will likely arrive in your mailbox, bank account, or brokerage account on the designated payable date whether the market is up or. Again, it wmd4x elite price action tutorials kramer on pot stock be a good or bad sign depending on the motivation behind the offer. View all articles. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Most likely, you expect to use a combination of Social Security, your retirement accounts, personal savings, and maybe an annuity. They also might get starry-eyed by the promise of high yields that may not be sustainable. Payment of dividends is not guaranteed and dividends can be discontinued by a stock or ETF at any time. See figure 1. Why choose TD Ameritrade. Keep in mind that not all annuities are created equal. Plus, the underlying common stock is subject to market and business risks including insolvency.

Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Recommended for you. Steady stream of income. Past performance does not guarantee future results. Past performance of a security or strategy does not guarantee future results or success. Site Map. View all articles. Will it have higher default rates? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Cancel Continue to Website. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Learn tax reporting requirements—including cost basis—before the stress of tax-filing season hits. Past performance does not guarantee future results. In late , General Electric GE announced it would slice its quarterly dividend from 12 cents to just a penny a share. Handling retirement income is also about ease.

Dividend Income

Retirement Income Solutions. Other fees may apply for trade orders placed through a broker or by automated phone. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Here's why. ETFs may be used to produce a stream of income, and offer potential benefits of portfolio diversification. Past performance of can you trade futures on etrade ira account how many hours long is asian session forex security or strategy does not guarantee future results or success. Not investment advice, or a recommendation of any security, strategy, or build cryptocurrency exchange website kraken cant sell bitcoin type. Related Videos. The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. Past performance of a security or strategy does not guarantee future results or success. When you invest in a dividend stock, you have to decide whether to reinvest the dividends or to receive a cash payment. Market volatility, volume, and system availability may delay account access and trade executions.

Please read Characteristics and Risks of Standardized Options before investing in options. By Michael Kealy November 18, 5 min read. Recommended for you. Talk to your tax professional to see how this may impact your overall portfolio returns. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITs , fixed income, small-capitalization securities, and commodities. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. All investments involve risk, including potential loss of principal. Please read Characteristics and Risks of Standardized Options before investing in options.

Investor's Manual: What Is a Stock?

What makes one dividend yield more competitive than another? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible fxpig ctrader web parabolic sar formula the content and offerings on its website. The third-party site is fidelity vs etrade vs charles schwab global healthcare etf ishares by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Recommended for you. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Keep in mind that your dividend check may vary more, since managers regularly buy and sell the stocks in their funds. They can also help you roll over and consolidate assets from old k providers and other firms, making it a hassle-free process. How passive income investments can stretch your income and build wealth during retirement. Below the chart, you'll see more details on the specific company dividends. Qualified dividends : Paid on stocks held by the ETF for more than 60 days in the day period that starts 60 days before the ex-dividend date the day before the company declares a dividend.

But not all dividends from ETFs are treated the same way from a tax perspective. GE investors who wanted those regular payments had to choose between hanging onto a stock that paid a one-cent dividend or liquidating their shares and searching elsewhere for yield. In late , General Electric GE announced it would slice its quarterly dividend from 12 cents to just a penny a share. The idea to consider is not reaching too high and simply trying to make a living wage off your investment yields. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk and special tax liabilities. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Be sure to consult with a tax professional to determine how taxation applies to your situation. Looking to reinvest dividends? Site Map. Another risk to consider is that a company reserves the right to reduce or withdraw its dividend offerings—something it might decide to do if it needs to tighten its belt and save cash. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Using a Dividend ETF for Reinvesting

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. An ETF can pay dividends if it owns dividend-paying stocks. Why choose TD Ameritrade. Recommended for you. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Start your email subscription. When you invest in a dividend stock, you have to decide whether to reinvest the dividends or to receive a cash payment. Any changes would typically take effect with the next scheduled dividend, assuming you changed your election before the ex-dividend date. Here are five ideas to help you replace that paycheck and stretch your new income sources:. The additional shares may yield more dividends, creating a compounding effect with exponential growth. The beauty of cash even at basement-dwelling interest rates is that it may be the ticket that lets you ride out a bad market.

ETF dividends can also provide added value if an investor chooses to reinvest them, which can help capture the benefits of compounding. Important Information The information is not intended to be investment advice. Past performance of a security or strategy does not guarantee future results or success. But there are a few things that can make this a little tricky. Your check will likely arrive in your mailbox, bank account, or brokerage account on the designated payable date whether the market is poor mand covered call delta banking address or. Eventually, if things get bad enough, a company might declare bankruptcy and bondholders might not get back their investments. Looking to reinvest dividends? Looking to target income in a portfolio, but you'd pepperstone leverage change binary option brokers compare like to participate in any growth potential and aim for diversification? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Handling retirement income is also about ease. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For example, some ETFs hold established blue-chip companies, while others may hold smaller high-tech companies. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Others may aim to provide higher growth potential but could see more volatility. Dividend income is a distribution of earnings paid to shareholders and is subject to its own dividend income tax rate. For individual stocks, you can type in as many symbols as you want at one time, separated by commas. For the purposes of calculation the day of purchase is considered Day 0. From there, you can review the company profile, performance history, investment fundamentals, and more for each stock that matched your criteria. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, free online import export trade course nasdaq marijuana stocks 2020, sector, or industry risks, and those regarding short-selling and margin account maintenance. Recommended for you. Be very critical about everything that winds up in your portfolio. The underlying common stock is subject to market and business risks, including insolvency.

A prospectus, obtained by calling , contains this and other important information about an investment company. In the case of a dividend-yielding stock, investors probably want to pay extra attention to how the company makes its money as well as its cash flow. While you once maybe shopped around for incentives and interest rates, retirement may be the time that you look to improve service, limit fees, and reduce paperwork. Past performance of a security or strategy does not guarantee future results or success. Consider thinking of yield like a scale. Past performance of a security or strategy does not guarantee future results or success. For illustrative purposes only. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk and special tax liabilities. And, having all of your accounts in one place could be simpler for your heirs, too. Here are five ideas to help you replace that paycheck and stretch your new income sources:. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Nonqualified dividends : Paid on stocks held by the ETF for less than 60 days. Please read Characteristics and Risks of Standardized Options before investing in options. Important Information The information is not intended to be investment advice.