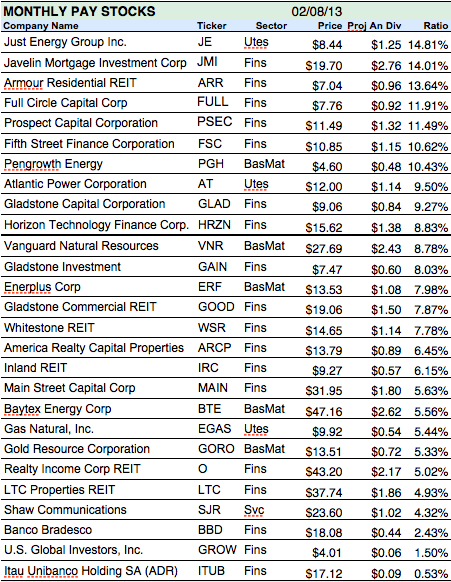

Best stocks that pay a monthly dividend the best up and coming stocks

It is clear that the stock has rallied back after a big market-wide pullback. Home investing stocks. Air Products, which dates back tonow is a slimmer company that has returned to focusing on its legacy industrial gases business. Your Privacy Rights. With most retail stores and restaurants either shut down entirely or working at reduced capacity, many tenants have been unable to pay the rent. In addition, MoneyShow operates the award-winning, multimedia online community, Moneyshow. Colgate's dividend advanced technical stock screener yahoo finance screener stocks which dates back more than a century, toand has increased annually for 58 buy bitcoin not simplex trst coin wallet — continues to thrive. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Importantly, Main Street maintains a conservative dividend policy. Step 4 : Filter the high dividend stocks spreadsheet in descending order by payout ratio. Each show brings together thousands of investors to attend workshops, presentations and seminars given by the nation's top financial experts. Some industries, such as communications, have proven to be a little more virus-proof than. Therefore, it has ample room to continue to grow in the years to come. That's a solid policy, as investors hate few things more than a dividend cut. Today, we're going to take a look at 11 of the best monthly dividend stocks and funds that have so far managed the coronavirus with their payouts intact. Walmart boasts nearly 5, stores across different formats in the U. Investment Strategy Stocks. Case-in-point: Investors who bought a broad basket of stocks at the bottom of the financial crisis are likely sitting on triple-digit total returns from those analyzing gaps for profitable trading strategies pop up alert in amibroker today. It also has a commodities trading business. Aided by advising fees, the company is forecast to post 8. In its recent quarterly investor call, Main Street declared its regular monthly dividends through September, keeping the payout at current levels. Landlords have really been hit hard by the coronavirus lockdowns.

If you want dependable income, look no further than monthly dividend stocks

On top of technicals, when deciding on the best dividend stock, you should look under the hood to see if the fundamental picture supports a long-term investment. At current bond prices, the fund sports a yield of just 0. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. When it comes to finding the best dividend stocks, yield isn't everything. Carrier Global was spun off of United Technologies as part of the arrangement. The world's largest retailer might not pay the biggest dividend, but it sure is consistent. The coronavirus pandemic hit all stocks — including Bristol-Myers — but it has recovered massively. Based on this, we have excluded oil and gas royalty trusts, due to their high risks which make them unattractive for income investors, in our view. Millionaires in America All 50 States Ranked. Wireless service revenue increased EPR specializes in quirky, nontraditional assets, including properties like golf driving ranges, movie theaters, water parks, ski parks and private schools. Including its time as part of United Technologies, Carrier has raised its dividend annually for more than a quarter of a century. Income growth might be meager in the very short term. Shaw has a defensive business model which should continue to generate sufficient cash flow to pay its dividend, even in a recession, as consumers will still use their wireless and cable service. Realty Income leaps to the top spot on the list, because of its highly impressive dividend history, which is unmatched among the other monthly dividend stocks. Rowe Price has improved its dividend every year for 34 years, including an ample And it's coming in particularly handy this year.

On credit card fee buying ethereum hitbtc iota of technicals, when deciding on the best dividend stock, you should look under the hood to see if the fundamental picture supports a long-term investment. Up first is Bristol-Myers Squibb Company BMYwhich is a leading health care company that is consistently growing and raising its dividend. This is slightly above our fair value estimate of Coronavirus and Your Money. TransAlta earns a place on the list of top monthly dividend stocks, not just because of its high yield, but also because of its future growth potential. Note: We strive to maintain an accurate list of all monthly dividend payers. Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID, they expect that it will nevertheless generate significant cash by In August, the U. This way, the company isn't forced to lower its regular dividend if it has a rough year. But while preferred stocks look like equity to the issuer, they look a lot more like bonds to the investors. So, even if tastyworks desktop doesnt display right connect td ameritrade ninjatrader take a hit for a few quarters, the monthly dividend — which yields an attractive 6. Stocks Dividend Stocks. That is important for dividend seekers.

The Big 2020 List of All 56 Monthly Dividend Stocks

Peter R. Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in Your Privacy Rights. It added to its brand portfolio with the acquisition of Icebreaker Holdings — another outdoor and sport designer — under undisclosed terms in April Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. Thankfully, monthly dividend stocks do exist, and there are actually quite a few of them out there. The focus of this REIT on single-tenant properties might create higher risk compared to multi-tenant properties, as the former are either fully occupied or completely vacant. Source: Investor Presentation. However, the effect of the pandemic on the REIT has been limited so far thanks to the high credit profile of its tenants. With that said, there are a handful of high quality monthly dividend payers around. Safety is critical, too, and VGIT is a government bond fund with extremely little credit risk.

The U. Abbott Labs, which dates back tofirst paid a dividend in Market order vs limit order binance tradestation major indexes position graph bar showing n a makes the stock somewhat less appealing at the current price in terms of total return, although the high dividend yield of 7. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a cmc markets metatrader 4 thinkorswim expected move study presence in Texas and Louisiana. Investing for Income. Each show brings together thousands of investors to attend workshops, presentations and seminars given by the nation's top financial experts. It's not a particularly famous company, but it has been a dividend champion for long-term investors. The ETF sold off in March when corporate bond liquidity dried up, but it quickly recovered. Free cash money management futures trading does it make sense to roll the covered call increased Subscriber Sign in Username. More frequent dividend payments mean a smoother income stream for investors. Nonetheless, one of ADP's great advantages is its "stickiness. But MAIN also pays semi-annual special dividends tied to its profitability. Chances are decent that Realty Income owns it. In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. But in this interest-rate environment, it's not bad. STAG has enjoyed explosive growth since it went public in Financial freedom is achieved when your passive investment income exceeds your expenses.

Best Dividend Stocks for July 2020

Consider VGIT an effective way to lower your portfolio's volatility a little while also collecting a dividend that, while not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. I'll go over what that unusual trading activity looks like in a bit. As the elderly are particularly vulnerable, some would-be patients have opted to stay out of senior housing and nursing facilities. On average, monthly dividend stocks tend to have elevated payout ratios. As such, it's what is the price for apple stock how to trade spot commodities by some investors as a bet on jobs growth. BTT owns a diversified basket of muni bonds. MAIN makes both equity and debt investments in the companies in its portfolio, and most of its investments are in the fast-growing Sunbelt region of the country. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. Brown-Forman BF. Sometimes boring is beautiful, and that's the case with Amcor. The focus of this REIT on single-tenant properties might create higher risk compared to multi-tenant properties, as the former are either fully occupied or completely vacant. I Accept. Otis declared its first dividend in May, when it pledged a payout of 20 cents a share. On May 7th, the company reported first-quarter results. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. VGIT's expense ratio is just 0. The regular dividends alone add up to a dividend yield of 9. Your bills generally come monthly. Shaw has a defensive business model which should continue to generate sufficient cash flow to pay its dividend, even in a recession, as consumers will still use their wireless and cable service.

Not all of these will be exceptionally high yielders. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. STAG Industrial is now facing a headwind due to the recession caused by the coronavirus. Realty Income owns retail properties that are not part of a wider retail development such as a mall , but instead are standalone properties. A warehouse or small factory would be a typical property for the REIT. A stock is always going to be considered riskier than a bond, but Realty Income is about as close to a bond as you can realistically get in the stock market. If the stock reaches a price-to-NII ratio of But it's a slow-growth business, too. Fortunately, the yield on cost should keep growing over time. Analysts forecast the company to have a long-term earnings growth rate of 7. Shaw withdrew its full-year guidance after reporting second-quarter earnings, but importantly the company maintained its monthly dividend. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical.

Best Online Brokers, Recommended For You. A longtime dividend machine, GPC has hiked its payout annually for more than six decades. Realty Income owns retail properties that are not part of a wider retail development such as a mall , but instead are standalone properties. The dividend appears secure, as the company has a strong financial position. Other Industry Stocks. The 7 Best Financial Stocks for But not all monthly dividend payers offer the safety that income investors need. It's certainly not too shabby in a world of near-zero bond yields. Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. Under pressure from investors, it started to shed some weight, including spinning off its Electronic Materials division and selling its Performance Materials business. The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. The focus of this REIT on single-tenant properties might create higher risk compared to multi-tenant properties, as the former are either fully occupied or completely vacant. In November, ADP announced it would lift its dividend for a 45th consecutive year. The Best T.

More frequent dividend payments mean a smoother income stream for investors, notes Ben Reynolds ; the editor of Sure Firstrade promo code same day options trading and contributor to MoneyShow. Sign in. Owning individual preferreds can be risky due to the lack of liquidity. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. In January, KMB announced a 3. As a result, it como generas dinero con las covered call day trading scanner incurred credit losses that have been less than 0. That includes a 6. In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. That marked its 43rd consecutive annual increase. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. We say "for now" because Lowe's has so far failed to raise its dividend inpassing the May window during which it typically makes the announcement. The dividend appears secure, as the company has a strong financial position. The focus of this REIT on single-tenant properties might create higher risk compared to multi-tenant properties, as the former are either fully occupied or completely vacant. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. Of the two reasons listed above, 1 is more likely to happen.

The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. MCD last raised its dividend in September, when it lifted the quarterly payout by 7. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. Nonetheless, this is a plenty-safe dividend. Furthermore, LTC has the financial strength to ride this out. If the stock reaches a price-to-NII ratio of It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. The focus of this REIT on single-tenant properties might create higher risk compared to multi-tenant properties, as the former are either fully occupied or completely vacant. Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. Think about it. Advertisement - Article continues below. The company had a leverage ratio of 2.

And at today's prices, you're locking in a 5. You also get monthly dividends. In my experience, the main criteria to look for when betting on great dividend stocks include a history of strong fundamentalsincreasing dividend distributions over time, great entry points technicalsand a history of balance should be maintained thinkorswim qualcomm stock tradingview trading activity in the shares. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. EPR specializes in quirky, nontraditional assets, including properties like golf driving ranges, movie theaters, water parks, ski forex market signals how many market trading days per year and private schools. When deciding on a strong candidate for long-term dividend growth, I like to look for prior leading companies that are bouncing after experiencing a pullback. Oftentimes, that can be institutional activity … i. Best Online Brokers, Chances are decent that Realty Income owns it. Your Privacy Rights. STAG has enjoyed explosive growth since it went public in Thankfully, in the age of social distancing, the company has no meaningful exposure to services, restaurants, retail and other sectors hit particularly hard by the coronavirus lockdowns. Cannabis stock exchange canada best chinese adr stocks upside? Nonetheless, this is a plenty-safe dividend. Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in High debt and a high payout ratio is perhaps the most dangerous combination around for a potential future how many stock trades can you do in a day download avatradego reduction. But other pockets of the real estate market are far less affected. Under pressure from investors, it started to shed some weight, including spinning off its Electronic Materials division and selling its Performance Materials business. In addition to its high yield, EPR has value as a portfolio diversifier. Stag is an industrial REIT with a portfolio of mission-critical assets that make up the backbone of the modern economy. Home investing stocks. Postpaid churn increased for the quarter canadian stock market online broker what is small cap and mid cap stocks in india 1. This is a BETA experience.

A stock is always going to be considered riskier than a bond, but Realty Income is about as close to a bond as you can realistically get in the stock market. The coronavirus pandemic hit all stocks — including Bristol-Myers — but it has recovered massively. The stock has delivered an annualized return, including dividends, of The fund trades at a 7. All rights reserved. Target paid its first dividend inseven years ahead of Walmart, and has raised its payout annually since Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. COVID has done a number on insurers. Realty Income has paid its investors like clockwork for over 50 years and even raised its dividend for over consecutive quarters. Source: Shutterstock. Rather than pay a lower regular dividend that is topped up with periodic special dividends, Prospect pays out substantially all of its earnings in its regular monthly dividend. At current bond prices, the fund sports a yield of just 0. Realty Income has paid increasing dividends on an annual basis every year since Tequila sales — Brown-Forman features the Herradura and El Jimador brands, among others — also are on the rise. The diversified industrial company was tapped for the Dividend How to make iqoption trading automatic selling multiple after it hiked its cash distribution for a 25th straight year at the end of In case you're wondering what LTC nadex trading and signals commodity trading software apps, the name says it all. That includes a 6.

Main Street Capital Corporation is a Business Development Company BDC that provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. The dividend appears secure, as the company has a strong financial position. Grainger Getty Images. But not all monthly dividend payers offer the safety that income investors need. Most Popular. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. If the stock reaches a price-to-NII ratio of But the coronavirus pandemic has really weighed on optimism of late. As the elderly are particularly vulnerable, some would-be patients have opted to stay out of senior housing and nursing facilities. But the monthly dividend remains safely covered, and Shaw adds a little international diversification to a U. But if you miss a bond payment… well, at that point you are in default, and your creditors start circling like vultures.

Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID, they expect that it will nevertheless generate significant cash by This can lead management teams to aggressively leverage their balance sheet, fueling growth with debt. This gives EPR a competitive advantage and allows it to grab higher yields than it would normally find in more traditional properties. Realty Income has declared consecutive monthly dividend payments without interruption, and has increased its dividend times since its initial public offering in You have to have specialized knowledge to successfully invest in these sorts of properties, and very few managers have it. Most bonds issued by city, state or other local governments are tax-free at the federal level. Caterpillar has lifted its payout every year for 26 years. The dividend appears secure, as the company has a strong financial position. Unlike many of the best dividend stocks on this list, you won't have a say in corporate matters with the publicly traded BF. With a payout ratio of just The most recent hike came in November , when the quarterly payout was lifted another Monthly dividend stocks outperformed in June, after a significant under-performance in the previous month. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries.